ChargePoint (CHPT), the EV battery charging company, which has yet to produce any profits, is experiencing 2 of the 3 top unusual options activity today, May 23. The reason is it is due to report its earnings on May 31, after the market closes next Tuesday.

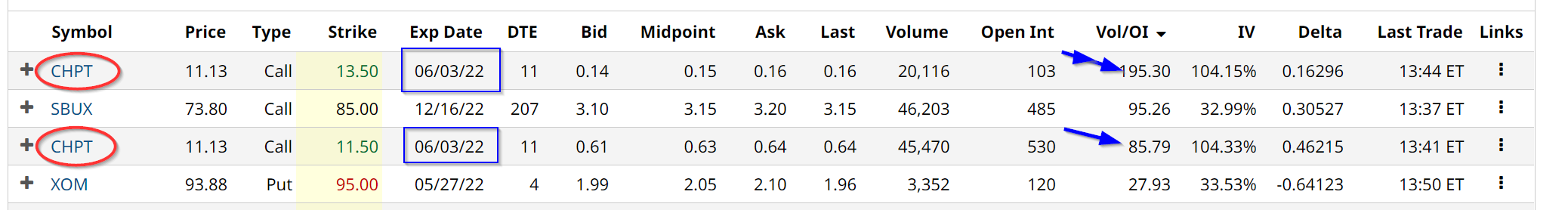

This can be seen on Barchart's Unusual Stock Options Activity tab:

This is seen in the fact that the options that expire on June 3 (the Friday after the COB Tuesday earnings release) has had 20,116 call options contracts for the $13.50 strike price. This implies that a good number of people who bought those call options expect the price to shoot over $13.50 per share. That is a potential gain of 19.5%. At the time it only has 103 options held ("Open Interest"). So this will boost the open interest by 195x for the $13.50 strike.

In other words, whoever bought these call options expect the price to move much higher than 20% from here. The reason is they will have to liquidate many of these options so they hope the price will be much higher by June 3, just 2 days after the earnings release.

The same is true for the $11.50 strike price buyers. This call option has 85.79 x more call options traded compared to its existing open interest.

So what is going on here?

ChargePoint's Prospects

ChargePoint has a growing number of EV charging stations and the company is in a huge ramp-up phase. So far it is not profitable and is bleeding cash. For example, last quarter its free cash flow was negative $52 million.

But the market is not that concerned about this cash burn since the company has $315 million in cash on its balance sheet. That said, at some point, it has to become cash flow positive in order to not blow through its cash and have to raise more equity.

Right now analysts expect the company to produce $75.66 million in revenue (15 analysts surveyed by Refinitiv) for the quarter ending April 30. That is roughly on par with the $75.9 million in made in the Jan. 2022 quarter. So any revenue number higher than this will significantly boost CHPT stock. It could lead to less negative net income and less negative FCF burn.

Obviously, that is what the investors in the two large tranches of CHPT call options are hoping for. The $11.50 and $13.50 strike prices are close to the existing price and the investors hope that the results will produce a blowout revenue number.

That could make these options extremely profitable. The $13.50 ask price is only 16 cents as of the time of this writing. If it rises to $1.00 with any kind of positive number from Chargepoint, the investors will have a multibagger.

/AI%20(artificial%20intelligence)/Businessman%20touching%20the%20brain%20working%20of%20Artificial%20Intelligence%20(AI)%20Automation%20by%20Suttiphong%20Chandaeng%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)