Last week we highlighted two unusual call options at ChargePoint (CHPT) that expire on June 3. A week later investors in those 2 call options tranches have made massive gains. But if those investors keep holding their calls, things could change once earnings are released after the market closes on May 31.

First, look at this article we wrote on May 23, “ChargePoint is Experiencing Unusual Options Activity Today.” It shows that there was huge volume in the calls for the $11.50 and $13.50 strike prices on the June 3 option chain. I wrote that that much will depend on the company's earnings release after the market on May 31.

You could have bought the $13.50 calls at 16 cents, or $16 per call option contract, and 64 cents ($64 per call contract) for the $11.50 exercise price on June 3. For example, buying 10 calls at the $11.50 price would have cost $640 before commissions, and 10 calls at the $13.50 strike price calls would have cost $160.

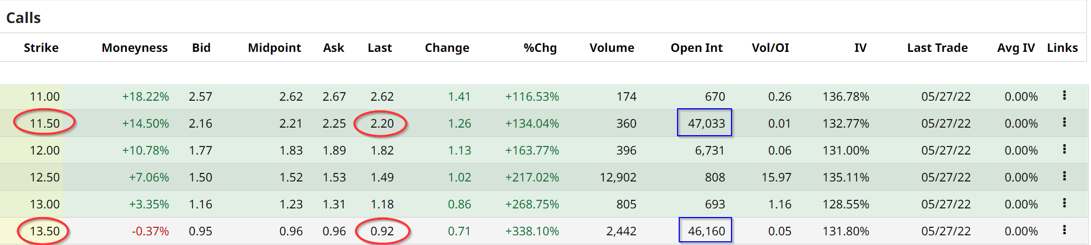

But, now, as of Friday, both of these option tranches are highly profitable, even though the company has still not released its earnings. For example, look at the options table below:

This shows that the $11.50 calls (strike price) are worth $2.20, or $220 per call contract. The $13.50 calls are worth $92 per call.

The CHPT stock price closed Friday, May 27, at $13.45, so the $11.50 calls are in-the-money and have $1.95 of intrinsic value (compared to their $2.20 price). The $13.50 calls are slightly out of the money by 5 cents, so all of the 92-cent price calls represent extrinsic value.

But the bottom line is that if you bought 10 calls at the $11.50 strike price for $640, your contracts are now worth $2,200, or a gain of $1,560, +243.75%. The owners of the $13.50 strike price calls, having bought 10 calls at $160, now have a profit of $760, as their 10 calls are worth $920. This represents a gain of 475%.

What Could Happen After Earnings Release

As of May 30, analysts expect ChargePoint will report $76 million in revenue and a loss of 16 cents per share. So any major deviation from these numbers will cause the stock to move significantly higher or lower.

But what should the owners of these calls now do? Let's look at the forces at play here. For one, they have huge profits, and the sellers of the calls have huge losses. There could be a great deal of pressure exerted by the sellers of the calls, especially if they are hedge funds, to force the stock down, no matter what the company reports.

That is why often earnings reports result in a stock falling since there is a “sell on the news” type of pressure.

But on the other hand, most of the sellers of the calls will also have to “buy to cover” their loss-making positions. This will put a large amount of upward pressure on the call prices.

Therefore, it seems clear, that since the $13.50 call prices have no intrinsic value, owners of these calls should try and take some or all of their holdings profits. The owners of the $11.50 calls have more intrinsic value and can possibly wait out the earnings report.

One thing is for sure. There will be three days of trading in these calls after the COB May 31 earnings report, before they expire on June 3. That should produce huge volatility.

/AI%20(artificial%20intelligence)/Businessman%20touching%20the%20brain%20working%20of%20Artificial%20Intelligence%20(AI)%20Automation%20by%20Suttiphong%20Chandaeng%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)