Peloton Interactive (PTON) stock is up almost 40% at $11.79 on Aug. 5, from $8.40 on July 15. But that spike did not prevent an astute investor to buy 34,899 call options at 30 cents for the $13.00 strike price on Aug. 5 for over $1 million ($0.30 x 34,899 x100 = $1.04697 million).

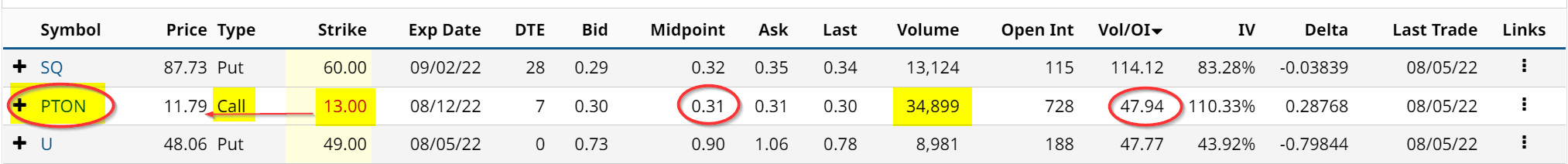

This unusual trading volume is almost 48 times the open interest prior to the purchase, according to Barchart. The open interest is the number of contracts that were still being held by investors. You can see this in the Unusual Stock Options Activity report by Barchart below.

The open interest by the end of the day on Aug. 5 was 1,584 contracts, so a large portion of those call option contracts has been sold already. Nevertheless, this short-dated activity in the PTON calls at the $13.00 strike for expiration on Aug. 12 indicates that investors still think there is room for PTON stock to spike higher.

You can see in the Barchart option chain that the PTON calls at the $13.00 strike price expiring this coming Friday, Aug. 12 still trade for 31 cents at the midpoint. Let's think about this for a moment.

The investor who bought the calls, paying over $1 million, clearly believes that PTON stock will rise at least 10% from $11.79 where PTON closed on Aug. 5 to over $13.00 within 7 days. They were willing to pay a premium of 2.63% over today's price ($0.31/$11.79).

On the other hand, the sellers of the calls got a very good premium. Even if the stock rises over $13.00 by Friday they will make a quick gain of almost 13% (12.89%) in 7 days (i.e., 2.63% covered call premium plus 10.26% in the stock price gain.

Why the Rush?

Why would the investor in these short-dated calls believe that PTON stock is so undervalued that it will gain over 10% in one week? This is even after the stock is up 40% in the past several weeks. Moreover, the announcement on Aug. 4 from Peloton that it will announce its Q2 earnings on Aug. 25 seems to imply the call option purchase may be too early.

Or is it?

For one, PTON stock trades for just a little over 1 times sales for its fiscal year ending June 30, 2022, according to Seeking Alpha. In addition, the average of 31 analysts' sales forecasts shows an expected 3.3% gain in sales this coming year to $3.71 billion from $3.59 billion forecast for the year ending June 2022. But is that really worth a stock rising 10% in one week even before earnings come out?

In fact, analysts still project negative earnings of $4.25 for the year ending June 30. Indeed, the company is burning through huge amounts of cash. In the last 12 months ending March 31, its free cash flow was over negative $2.5 billion. The only ray of hope here is that they project much lower negative earnings per share for the June 2023 year. That is not much to hang your hat on.

The most likely scenario is this. The call option buyer expects other investors to push up the stock prior to the earnings announcement. This is a sort of refined greater fool theory method of investing. Its core is speculation.

That is not a great way to invest. On the other hand, covered call investors are getting a good price here. I suggest that investors consider selling this call on a covered call basis especially if it rises higher this week. The 2.63% potential income is very attractive.

More Stock Market News from Barchart

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)

/Quantum%20Computing/A%20concept%20image%20of%20a%20green%20and%20yellow%20motherboard_%20Image%20by%20Gorodenkoff%20via%20Shutterstock_.jpg)