Amazon (AMZN) stock is now up over 15% since July 28, when it released its Q2 results after the market closed. It was at $122.28 then but now is over $141 per share as of Friday, Aug. 5.

Its gains are mainly due to Amazon's positive revenue growth for the quarter and its projections for strong Q3 results. This could still leave room for the stock to move higher and leaves some attractive covered call play opportunities in the stock now.

For Q2, Amazon posted revenue growth of over 7% compared to last year and around 4% higher than Q1. In addition, the company expects Q3 revenue to grow between 13% and 17% compared with the third quarter of 2021.

This essentially will allow Amazon's free cash flow (FCF) growth to turn positive, as it was negative this past quarter, as I explained recently in my prior article. In fact, for the past three quarters, Amazon has had a negative trailing 12 month (TTM) FCF. That means that it experienced an outflow of cash over the last 12 months for the past 3 quarters.

As a result, with higher revenue going forward, this could help the company to start generating positive free cash flow. That could help the stock move higher over the next several quarters. This also provides covered call income opportunities.

Covered Call Income Plays

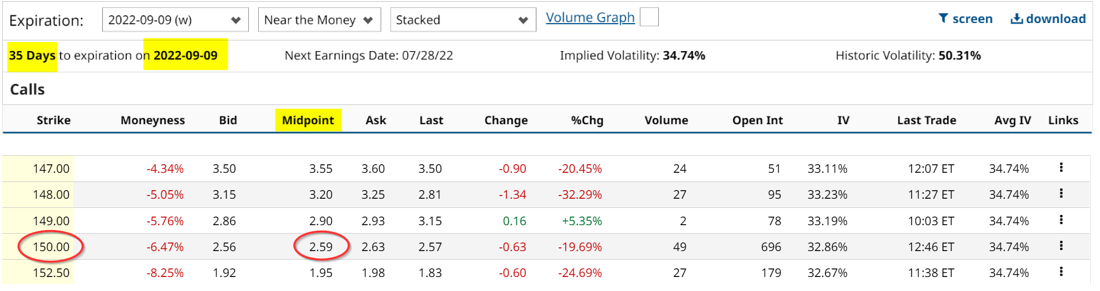

The chart below shows that Sept. 9, 2022 options chain has an interesting out-of-the-money covered call income opportunity.

The $150 strike price, which is 6.1% over today's price of $141.32, offers a $2.59 premium to covered call sellers. That represents a very juicy 1.83% income opportunity (i.e., $2.59/$141.32), and yet is still 6.1% higher. So theoretically, if the stock does not rise to $150 by the end of Sept. 9, 35 days from now, the investor makes 1.83%.

Moreover, even if it does rise to $150 or higher by Sept. 9, the investor keeps the 6.1% gain plus the 1.83% income, for a total return of 7.93% or almost 8% in a little over one month. That is a very good return for most investors.

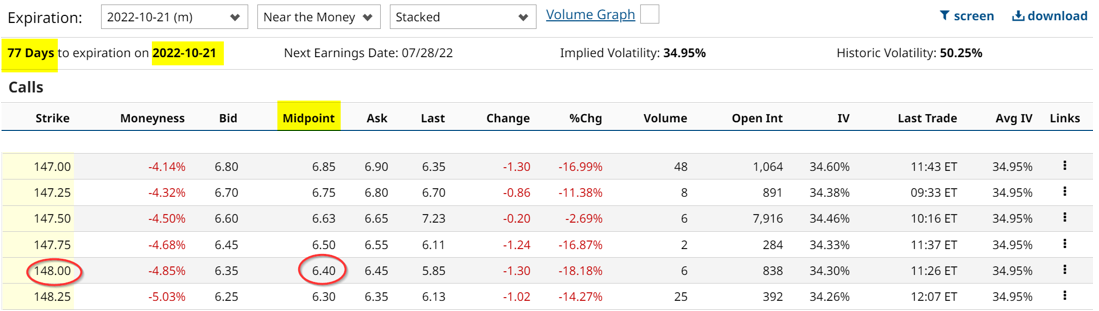

Another play below is longer dated - for Oct. 21. It shows that the $148 strike price calls are priced in the midpoint at $6.40 per contract.

That represents 4.53% income over today's price. One reason an investor might do this is if they thought the stock was at a recent peak. This would be more defensive in nature and allow the investor to make a higher return, albeit with a higher risk that the stock could rise to $148 by Oct. 21 or sooner.

Nevertheless, these two examples show that the call premiums for AMZN stock are at a high level and investors should take advantage of this to gain extra income.

More Stock Market News from Barchart

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)

/Quantum%20Computing/A%20concept%20image%20of%20a%20green%20and%20yellow%20motherboard_%20Image%20by%20Gorodenkoff%20via%20Shutterstock_.jpg)