These 3 NASDAQ stocks have great earnings forecasts, yet their valuations are still reasonable given the growth rates. This makes them worth accumulating even as their prices are rising.

Most of these stocks are high-tech stocks that have been beaten down on a year-to-date basis. If the recession does not come in as severe as the market fears, which seems increasingly likely, their stocks will likely rebound quickly.

The 3 stocks are SiTime (SITM), Silicon Labs (SLAB), and Analog Devices (ADI).

SiTime (SITM)

SiTime Corporation (SITM) makes resonators and clock integrated circuits (ICs), and various types of oscillators used in ICs. These are key ingredients for computers, servers, GPUs, etc.

Given the high demand for its products, revenue is soaring. Sales are forecast to rise 50% this year to $327.6 million from $218.8 million in 2021.

For 2023 analysts surveyed by Refinitiv see sales up 22% to almost $400 million. This puts the stock on a price-to-sales (P/S) multiple of almost 10x for 2022 and 8x for 2023.

Moreover, EPS is seen growing over 16% in 2023 to $5.06. Its forward P/E multiple is over 34x earnings, down from 39x for 2022.

The stock is up 45% over the past year, but YTD it’s down over 37%. That makes this one of the top undervalued NASDAQ stocks to buy before Wall Street catches on.

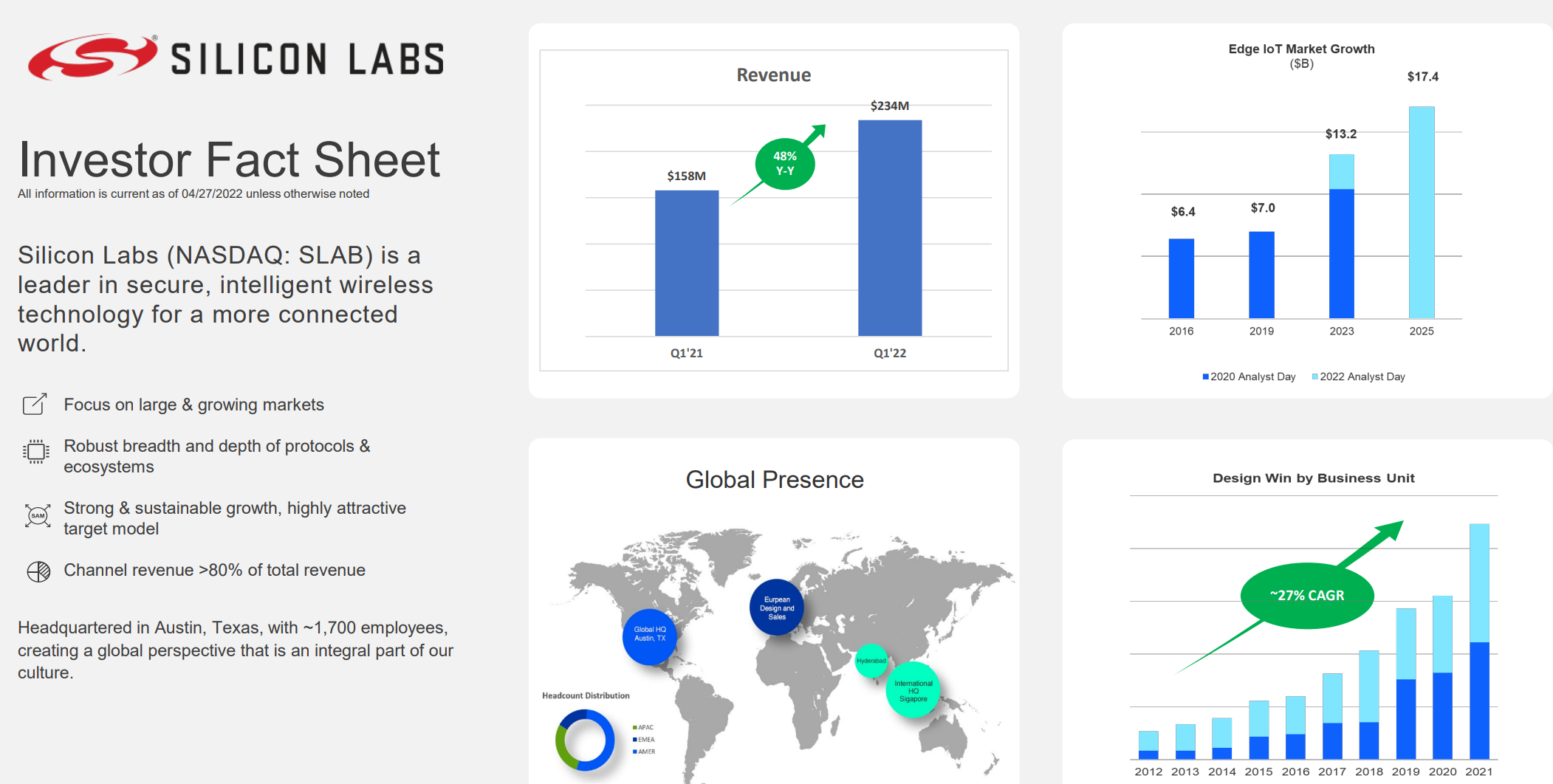

Silicon Labs (SLAB)

Silicon Laboratories (SLAB) is a fabless semiconductor maker that specializes in wireless microcontrollers and sensor products.

These are used in the Internet of Things (IoT), including connected home and security, industrial automation and control, smart metering, smart lighting, commercial building automation, and consumer electronics.

Silicon Labs’ sales are forecast to grow 41% this year to $1.02 billion and 16% next year to $1.18 billion. That puts SLAB stock on a price-to-sales multiple of 5.1x this year and 4.3x in the year to 2023.

Moreover, earnings are forecast to hit $3.64 per share this year. Its P/E multiple is high at 37.2x. However, with earnings growth, its forward P/E multiple falls to 34.5x.

Analog Devices (ADI)

Analog Devices (ADI) is an integrated circuit manufacturer. It specializes in digital signal processing technologies and related areas. The company is in a high-growth field. Given the lack of chips in many industries, demand is high.

Sales are forecast to rise over 61% this year to $11.8 billion. By 2023 they are set to rise 4% to $12.31 billion. That puts ADI stock on a forward P/S multiple of over 6.8x revenue.

Moreover, analysts also forecast earnings will hit $9.26 this year. That represents 43% growth over last year’s $6.46 EPS.

As a rest, ADI stock is on a forward 16x earnings multiple and a lower multiple at 17.5x for 2023. That is probably too low a valuation for this high-growth company. Expect to see the market rerate it once fears of recession abate.

More Stock Market News from Barchart

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Server%20racks%20by%20dotshock%20via%20Shutterstock.jpg)