Ford Motor Company (F) stock is very cheap now at just 6 times earnings forecasts for 2003 with a 3.29% dividend yield. In addition, short-term out-of-the-money calls can provide an additional 12.9% in annualized income. Let's look at this.

Ford is in the midst of making a transition to become a significant electric vehicle (EV) manufacturer. In fact, it has already announced it will split its auto business into two units: Ford Blue, for traditional gas- and diesel-powered vehicles, and Ford Model E, for new electric models. As a result, it says it will be able to produce 2 million EVs by 2026.

This compares with Tesla (T), the premier EV maker with over 70% market share in the U.S., which already is projected to make roughly 1.4 million EVs this year alone.

Analysts now forecast that Ford will make $1.92 per share this year and up to $2.06 in 2023. So, at today's price of $12.11, Ford stock trades for 6.31x 2022 earnings and 5.9x for 2023.

Moreover, Ford pays a dividend of 40 cents annually. That gives the stock an annual yield of 3.30%. In addition, investors can make good money with covered call income plays.

Covered Call Income

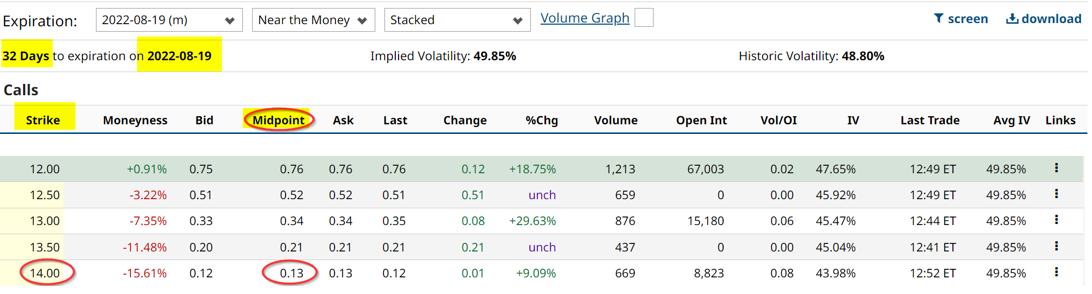

Right now, the Aug. 19 call options offer a good covered call opportunity, as the table below shows.

For example, the $14 strike price calls about one month out (Aug. 19) are priced at 13 cents at the midpoint. So, since the stock trades at $12.11, this provides over 1% in additional income (i.e., 1.073%).

Moreover, on an annualized basis, that results in an annual yield of 12.9% to the patient investor (i.e., 12.876%), assuming it can be replicated each month.

So, if you add the 3.30% dividend to the 12.9% covered call income potential, Ford stock offers an attractive total yield possibility of over 16% (16.20%) annually. This assumes that the out-of-the-money calls are not exercised if the stock were to rise to $14 by Aug. 19.

But, even if it does, the investor gets to keep the capital gain of almost $2.00 (i.e., $14.00/$12.11), or 15.6%. Including the 1.073% covered call income the one-month potential gain will be 17.34%. That is a very good return for most investors, especially since it would be in one month.

More Stock Market News from Barchart

/Tesla%20dealership%20with%20cars%20in%20lot%20by%20Jetcityimage%20via%20iStock.jpg)