These two Dow Jones Industrial Average stocks have good earnings prospects, low P/E multiples, and attractive dividend yields. Moreover, I specifically chose these two stocks as they also have very high out-of-the-money covered call yields on an annualized basis.

This is because investors will likely have the opportunity to repeat these covered call plays numerous times over the coming year.

Covered call plays are a way to generate income with stable income stocks that don't tend to gyrate that much. That way the investor can buy 100 shares of the underlying stock. Next, the investor sells one call option per 100 shares that he or she owns at a higher strike price (i.e., one that is out-of-the-money). The investors immediately collect the income from that sale.

Here is the opportunity: if the stock does not rise to the level of that strike price, the call option will not be triggered and exercised by the buyer. This is why it makes sense to generally sell at strike prices that are at least 10% over the existing price.

And even if it does rise to the strike price or higher, thereby triggering the sale of the underlying “covered” shares per option, the investor books a capital gain. This is based on how far above the strike price is from when the covered shares were bought.

Let's dive in and look at these two covered call income plays.

Dow, Inc. (DOW)

This chemical company trades for 6.3x earnings and has a dividend yield of 5.6%. Its earnings are forecast to fall from $7.98 in 2022 to $7.17 per share in 2023. It raises the P/E to 7x for 2023.

And it also makes this one of the most cyclical stocks of the DJIA.

However, consider this. Dow, Inc. still generates large amounts of free cash flow (FCF). For example, in Q1 Dow, Inc. produced $1.249 billion in FCF.

As a result, Dow was able to use this FCF to spend $513 million in dividends during the quarter. It now has a 5.6% dividend yield as a result.

It also bought back $635 million in common stock shares. As a result, on an annualized basis, buybacks now are 4.16% of its revenue. If sales top $59.7 billion in 2022, it could spend $2.5 billion in buybacks.

That amount represents 6.8% of its total market value.

So, in effect, Dow Inc is a stock with a 5.6% dividend yield and a 6.8% buyback yield. That brings its total shareholder yield to 12.4%.

Dow stock has fallen 20% in the last 30 days. That makes Dow stock one of the most undervalued Dow stocks worth buying now. It also has a very attractive covered call income opportunity. Look at the table below.

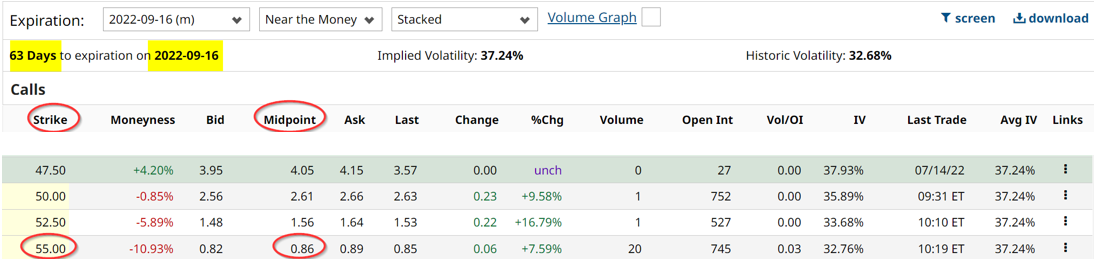

This shows that the call options which expire on Sept. 16 (63 days forward) for DOW Inc offer a $55 strike price at the mid-price of 86 cents. Here is what that means for the covered call investor. The investor buys 100 shares of DOW stock for $49.70 per share at a cost of $4,970. Next, the investor sells one contract of the Sept. 16 $55 call option and immediately receives $86 in his account.

That represents a gain or yield of 1.73% (i.e., $86/$,4,970). Since there are 5.8 periods of 63 days in a year, this income yield can theoretically be copied 5.8 times, giving a total rate of return of 10% annually. Now, this assumes that the stock price does not rise to the point where it is exercised. But even if it does, the investor will gain an extra 10.66% (i.e., $55/$49.7-1).

Honeywell International (HON)

Aerospace and engineering and communications company Honeywell International’s earnings are forecast to rise almost 12% from $8.70 per share to $9.71 next year. That lowers its P/E multiple from 19.9x this year to 17.9x for 2023. That is not cheap, but not super expensive given its growth outlook.

However, Honeywell generates large amounts of free cash flow (FCF) as well. This allows it to pay a generous dividend per share of $3.92 per share. Based on its price at the close of July 12 of $173.61, that gives the stock a yield of 2.3%.

In addition, there is an interesting covered play for HON stock. This can be seen below.

This shows that the $185 strike price calls can be sold for $2.58. That represents an income yield of 1.50% over today's price of $172.10 for HON stock. Since that could theoretically be repeated 5.8x, the annualized return opportunity is 8.7%. Combined with the 2.3% dividend yield, the investor can make 11.0% on this stock repeating this covered call play.

More Stock Market News from Barchart

/Intel%20Corp_%20badge%20holder-by%20hasrul_rais%20via%20Shutterstock.jpg)

/AI%20(artificial%20intelligence)/Artificial%20intelligence%20and%20machine%20learning%20concept%20-%20by%20amgun%20via%20iStock.jpg)

/AI%20(artificial%20intelligence)/Data%20Center%20by%20Caureem%20via%20Shutterstock%20(2).jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)