Copper, aluminum, nickel, lead, zinc, and tin are nonferrous metals traded on the London Metals exchange. In Q2, all the metals fell by over 20%, and only nickel’s price moved higher over the first six months of 2022. The sector fell 27.24% in Q2 and 13.07% over the first half of this year, making it the worst performer for both periods.

Meanwhile, iron ore, the primary ingredient in steel, and the Baltic Dry Index that measures bulk shipping rates declined in Q2.

Tin leads the way to the downside in Q2, with aluminum and nickel posting nearly 30% declines

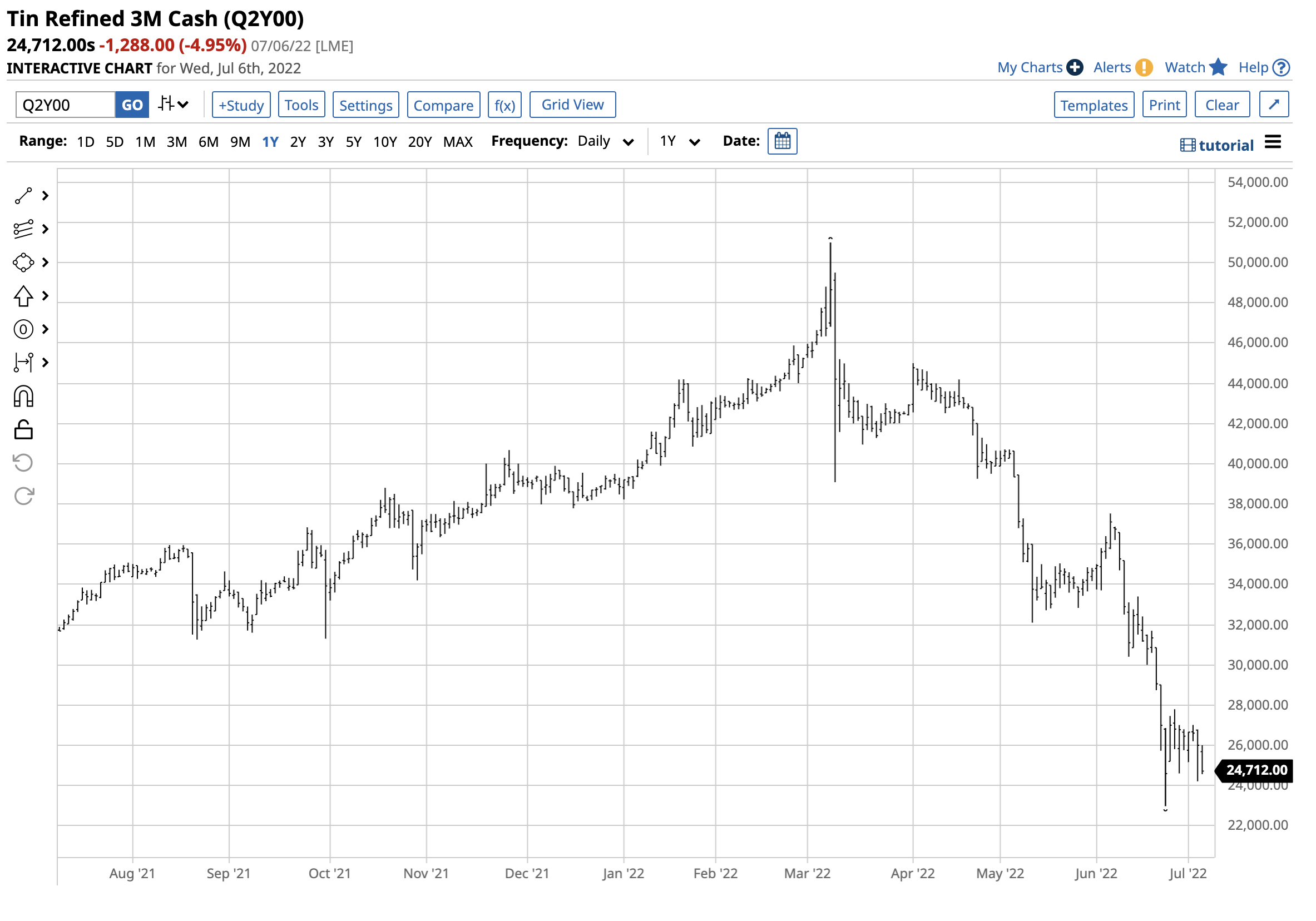

Tin is the least liquid base metal on the LME, and it suffered the most substantial decline in Q2 and so far in 2022. Three-month tin forwards declined 38.36% in Q2, closing at the $26,451 per ton level on June 30.

The chart highlights that despite reaching a record $51,000 per ton high in March 2022, tin forwards posted a 31.93% loss over the first half of 2022. On June 6, the price was still moving lower and was sitting at the $24,712 per ton level.

LME aluminum forwards also reached a record peak when they traded at $4,073.50 per ton in March 2022. The most liquidly traded LME nonferrous metal fell 29.95% in Q2, erasing the Q1 gain, and was 15.05% lower at the $2,445.50 level than the closing price at the end of 2021. Aluminum forwards were slightly lower at $2409.50 per ton on July 6.

LME nickel forwards also traded to an all-time high in March when a Chinese nickel company got caught short, pushing the price to an explosive peak of $101,365 per ton and disrupting trading. Meanwhile, the price dropped to the $22,698 per ton level at the end of Q2, and nickel forwards posted a 29.31% loss. Over the first six months of 2022, nickel was still 9.35% higher than at the end of 2021, making it the only LME metal to move higher over the six-month period. Nickel was lower at the $21,849 level on July 6.

Lead and Zinc prices decline

LME zinc closed Q2 at $3,157 per ton, 24.35% lower for the quarter. Zinc fell 10.67% over the first half of this year. Zinc exploded to a high of $4,460 in early March before the price imploded with the rest of the base metals. Zinc was lower at the $3,048 level on July 6.

Three-month LME lead forwards reached a high of $2,533 per ton in March and closed Q2 at the $1,907.50 level. Lead posted a 17.21% loss over the first six months of 2022 and was slightly higher at $1,969 per ton on July 6.

COMEX and LME copper fall over 20%- The Doctor says a recession has begun

Doctor copper has a knack for forecasting economic trends, and it was screaming that the global economy was heading for a recession at the end of Q2.

COMEX copper futures traded to a record $5.01 per pound high in March 2022 before turning lower. In late Q2, the red nonferrous metal fell below critical technical support at the August 2021 low at just under $4 per pound. COMEX copper futures closed at $3.7145 on June 30, down 21.82% in Q2 and 16.78% lower over the first half of 2022. Copper futures continued to descend in early Q3, reaching a low of $3.2730 on the September contract on July 6 before recovering to over $3.50 on July 7.

The chart highlights the price action in LME three-month copper forwards that reached a record $10,845 per ton high in March 2022 before turning lower and closing Q2 at $8,258 on June 30. LME copper declined 20.40% in Q2 and was 15.05% lower over the first six months of this year. At the $7,520.50 level on July 6, the selling in the copper market continued in early Q3.

Iron ore and freight rates drop

Iron ore is the primary ingredient in steel manufacturing. Iron ore prices fell 23.25% in Q2, closing at the $121.88 per ton level on June 30. At that price, iron ore was only 1.4% higher than the closing level on December 31, 2021. Nearby iron ore futures were slightly lower at the $115 per ton level on July 7.

The Baltic Dry Index is a barometer of global shipping rates. In Q2, the BDI dropped 7.72% and was 1.40% lower over the first half of this year at the 2186 level. The BDI was lower at the 2043 level on July 7.

The outlook for Q3 and the second half of 2022 is cloudy

Q2 was an ugly period for the nonferrous metals trading on the LME and COMEX and most industrial metal and mineral prices. Rising interest rates, a strong dollar, Chinese lockdowns because of COVID-19, the increasing odds of a global recession, and uncertainty caused by the war in Ukraine and geopolitical turmoil create a potent bearish cocktail for the metals and minerals that are infrastructure building blocks. China is the demand side of the fundamental equation for these commodities, and weakness in the Chinese economy was very bearish over the past months and at the beginning of Q3.

The outlook for metal and mineral prices will depend on China. When the world’s most populous country and second-leading economy emerges from lockdowns and economic activity picks up, metal and mineral prices are likely to turn higher.

Meanwhile, the US dollar index reached a new two-decade high at over 107 on July 6, which continued to weigh on the sector. After a relief rally that took the long bond futures market higher, it appears to have peaked on July 6 at just over the 142 level. The bonds were back below 139 on July 7.

The path of least resistance of interest rates and the US dollar and Chinese lockdowns remains bearish for metal and mineral prices in early Q3 and has turned the bullish trends that took prices to highs in early March bearish. Bull and bear markets tend to rise and fall to irrational, unreasonable, and illogical levels before turning. Expect lots of volatility in the metal and minerals arena over the coming weeks and months, and you will not be disappointed. Thin trading conditions over the summer months could exacerbate price moves. I believe we will see this sector find a bottom, but it could continue to be ugly over the coming weeks.

More Metals News from Barchart

/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)