.jpg)

These 3 stocks are in recession-resistant areas and have good dividend yields and low price-to-earnings (P/E) valuations. Investors should be able to avoid the depths of a recession with these stocks. They are:

- Hasbro (HAS) - This toy company is a brand-name toy company that is going to sell toys this Christmas, recession or not. It is projected to show 4.8% higher revenue and earnings this year and next. The stock pays an annual dividend of $2.80 and yields 3.42% and the P/E is low at 15.5x for this year and 13.9x for 2023. At its average yield of 2.92% over the last 4 years, HAS stock could rise 17.0% to $95.89. Moreover, Hasbro has been buying back its shares, which will act as an upside catalyst.

- Broadcom Ltd (AVGO) - This company designs and develops semiconductor chips, which are in high demand in many industries right now. In fact, earnings are forecast to grow 8.8% to the year ending Oct. 2023. At $474.74 the stock now has a low P/E of just 12.9x for this year and 11.9x for next year with earnings projected EPS of $40.25 per share. Its $16.40 per share annual dividend gives the stock an annual yield of 3.45%. That shows that Broadcom can easily afford to keep paying this dividend, recession or not. In fact, every year in the past 11 years, Broadcom has consistently raised its dividend. On top of that, the stock has a robust stock buyback program. It is on a run rate to spend $13.16 billion annually on share repurchases or 6.82% of its $193 billion market cap.

- Raytheon Technologies (RTX) - This defense contractor's prospects are not tied to the vicissitudes of the U.S. economy. The stock trades for just 16.8x next year's earnings forecast, which includes an earnings growth forecast of 21% over last year's earnings. In other words, the company's fortunes are not deeply tied to the economic cycle right now. In addition, it has a dividend yield of 0.96%, making it a recession-proof stock.

Selling Out-of-the-Money Covered Calls

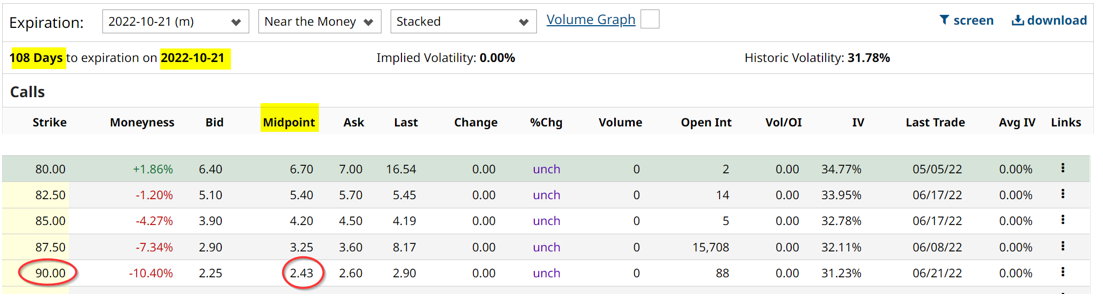

These stocks offer some interesting covered call plays to provide additional income. For example, the Hasbro Oct. 21, 2022, chain shows that an investor can receive $2.43 by selling the $90 call strike price.

This provides a potential income of 2.96% based on today's price $82.07 assuming the stock does not rise to $90 and gets exercised. Even if it does the investor gets to keep the 2.96% yield, plus the capital gain of $7.93 over $82.07, or 9.66%. That provides a potential total gain of 12.26%.

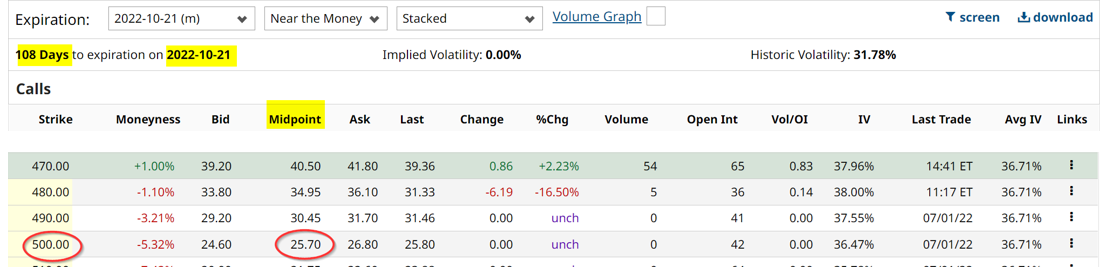

Another interesting covered call is the Broadcom Oct. 21 call option at the $500 strike price. The chart below shows how this is priced.

It shows that the $500 strike price calls sell for $25.70 at the midpoint. that represents a return of 5.40% based on its price today of $476.35. That works out to a great than 18.2% annualized return. This is because this covered call play could theoretically be repeated 3.38 times per year (i.e., 365 days/108 days to expiration). So 3.38x 5.40% equals 18.2%. This is a very good return for most investors. And even if the stock rises to $500 per share, the investor gets to make an additional 5.0% in capital gains. Very good returns for a recession-proof stock.

More Stock Market News from Barchart

/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)