The August lean hog futures price had been trending higher from September 2021 through late March 2022 when they corrected. The price got to a high of over $1.23 per pound, which was steep considering the all-time high in 2014 was at the $1.3380 per pound level. In April and early May, the bullish trend was interrupted as hogs ran out of upside steam and corrected, probing under the $1 per pound level. While hog prices corrected, pork prices continue to outperform beef historically, and that trend looks likely to continue.

Hogs find a bottom

Lean hog futures for August 2022 delivery rose from 85.025 cents per pound on September 15, 2021, to $1.2365 on March 31, 2022. The all-time continuous contract high in the hog futures was only 10.15 cents higher than the level at the end of March.

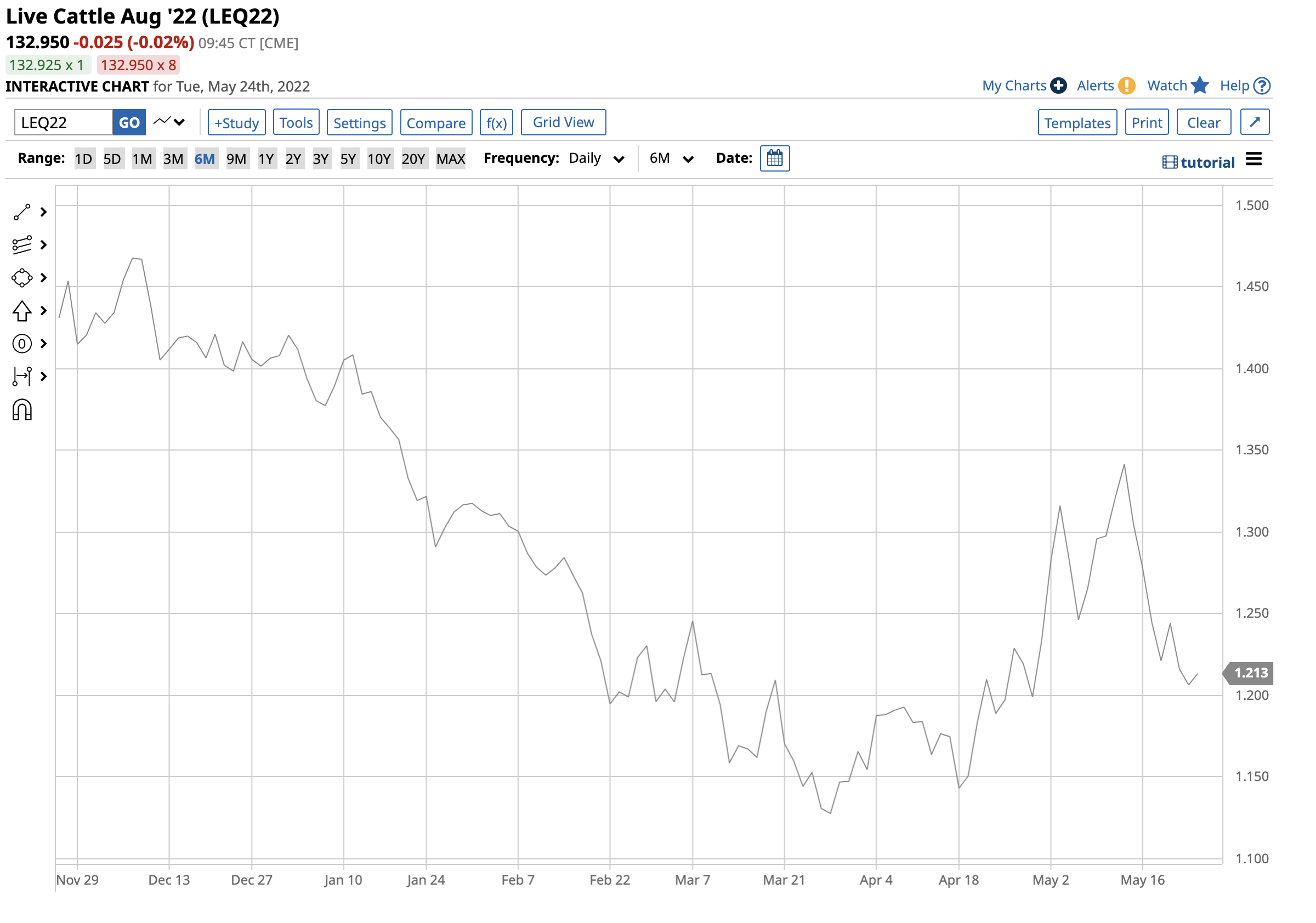

The chart highlights that August lean hogs ran out of upside steam in April and early March, falling to a low of 98.65 cents on May 12, where they found a bottom. After probing below the $1 per pound level, the hog futures recovered and were near the $1.10 level on May 24.

Pork is outperforming beef

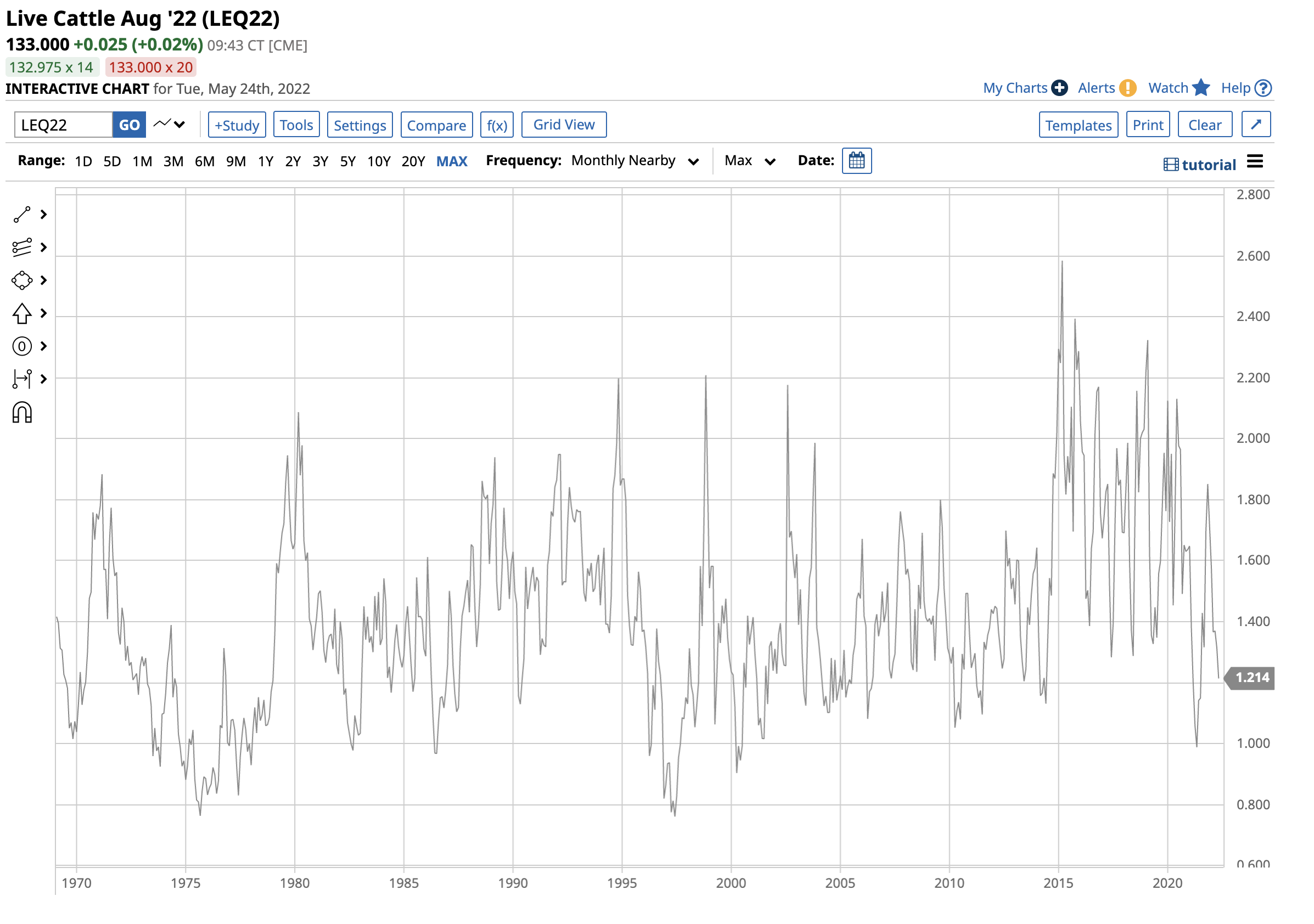

The long-term average for the price relationship between lean hog and live cattle futures is around 1.4 pounds of pork in each pound of beef.

The long-term chart illustrates the average at the 1.4:1 level for the price of live cattle divided by the price of lean hog futures ({LEQ22}/{HEQ22}).

When the spread is above the 1.4:1 level, cattle are historically more costly than hogs and vice versa when the spread is below the long-term average.

At around the 1.21:1 level on March 24, lean hogs are historically expensive compared to live cattle, making pork a historically more expensive choice compared to beef for consumers. However, with live cattle at over $1.30 per pound and pork below $1.10, the nominal expense favors pork.

Inflation makes pork the consumer’s choice

All goods and services prices have soared in 2022 as inflation has gripped markets. The recent consumer and producer price index data points to the highest inflation in over four decades. Many consumers need to cut corners to survive with energy and food prices soaring. While pork may be historically more expensive than beef, the actual price is lower at the supermarket counter. The spread’s level signifies that consumers are opting for pork instead of more expensive beef products to keep food expenses under control.

China restocks its frozen pork supplies

Over the past years, China had to dip into its strategic frozen pork stockpiles because a widespread African Swine Fever outbreak took the lives of millions of pigs. China is by far the world’s leading pork-consuming country. In 2013, a Chinese company acquired Smithfield Foods, the leading US hog processing company, taking the Virginia-based company private. Chinese ownership of Smithfield did not prevent a significant pork shortage that caused the Chinese government from releasing its stockpiles.

On May 20, the Chinese reserves management center announced the country would buy 40,000 tons of local frozen pork for its state reserves. The buying replaces some of the reserves released over the past years because of the ASF outbreak.

Levels to watch in the lean hog futures

At the end of May, we are at the beginning of the peak season for grilling meats. As steaks, burgers, hot dogs, ribs, pork chops, and other animal proteins begin sizzling on barbecues across the US, the pork price may be historically high, but it remains less expensive than beef.

The $1 per pound level on the August futures contract is a psychological, technical support level for the lean hog market, with the May 12 98.65 cents low the critical support. On the upside, the March 31, $1.2365 high is the target, with the 2014 all-time high of $1.3380 per pound the ultimate technical goal for lean hog bulls.

Inflation increases the cost of raising hogs, bringing them to processing plants, and packaging them for wholesale and retail consumers. The economic landscape favors the upside in late May 2022.

Moreover, Chinese buying to replace frozen pork reserves and the increasing demand for pork in the world’s most populous country could send the price to a higher high than the March 31, 2022 level over the coming weeks. Lean hog futures probed below the $1 level and bounced. We could see the price continue to climb over the coming weeks and months as the meat demand peaks during the summer months.

/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)