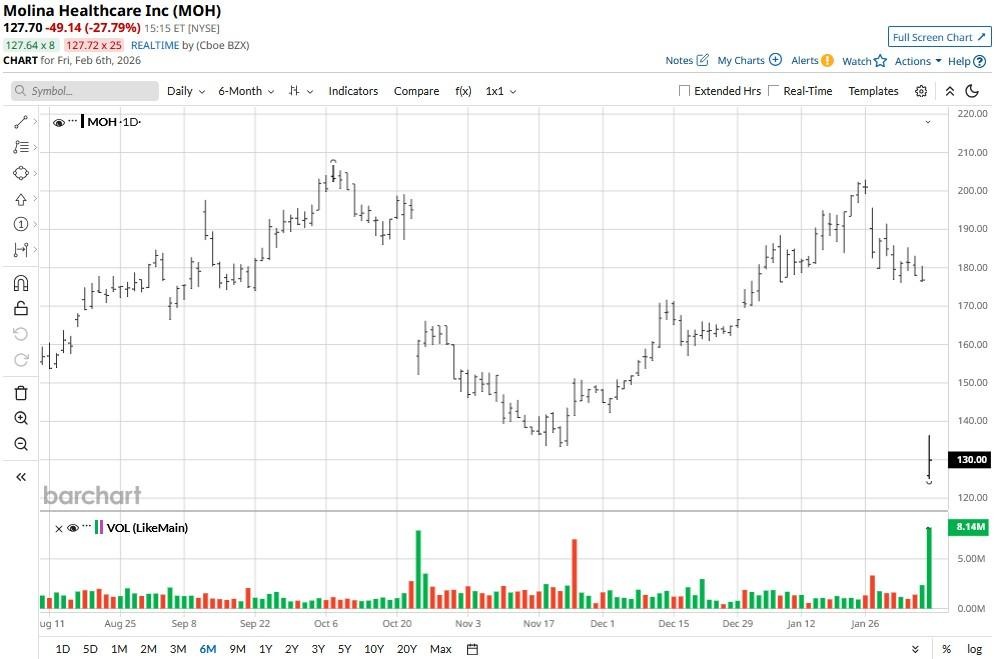

Molina Healthcare (MOH) shares crashed more than 25% today after the managed care company issued disappointing guidance for its fiscal 2026.

Molina said medical cost ratio was expected to remain elevated this year, as it guided for $5 a share of earnings for the full-year, alarmingly below the prior estimate of about $14.

Versus its year-to-date high, Molina Healthcare stock is now down nearly 35%.

Is It Worth Investing in Molina Healthcare Stock Today?

Despite a sharp post-earnings decline, famed investor Michael Burry remains “happy” with his MOH investment that he previously likened to Berkshire Hathaway’s contrarian bet on Geico.

However, his mean reversion thesis may not play out, given the firm’s decision to exit Medicare Advantage (MA) prescription drug plans in 2027.

While Molina Healthcare currently trades at a discount to its intrinsic value, increased pressure from President Donald Trump's administration’s proposed reductions in MA reimbursement rates suggests it’s still a high-risk investment.

Note that MOH stock is unattractive for income-focused investors as well, since, unlike its peers like UnitedHealth (UNH) and Humana (HUM), it doesn’t currently pay a dividend either.

Where Options Data Suggests MOH Shares May Be Headed

Molina Healthcare shares are different from Buffett's successful investment in Geico since the latter benefited from favorable claims dynamics and disciplined underwriting during its recovery period.

In comparison, MOH currently faces adverse medical-cost trends with limited near-term visibility into resolution.

The risk-reward profile appears asymmetric to the downside for investors, because the insurer sits decisively below its major moving averages, reinforcing that the broader trend remains downward.

It's also worth mentioning that options traders disagree with Burry’s optimism on Molina Healthcare as well.

The lower price on contracts expiring mid-June sits at about $103 currently, indicating the stock could crater another 20% over the next five months.

How Wall Street Recommends Playing Molina Healthcare

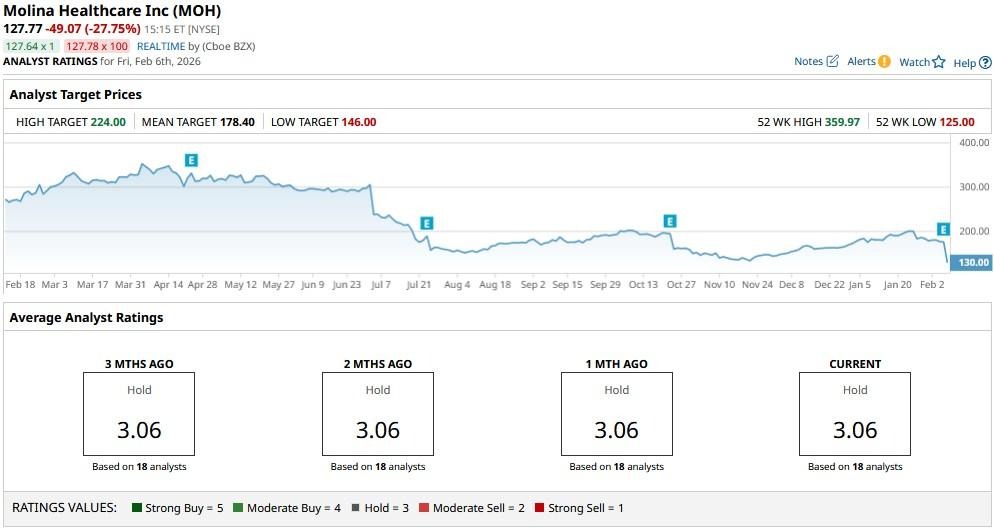

Despite aforementioned risks, Wall Street analysts seem to believe that the ongoing selloff in MOH shares has gone a bit too far.

According to Barchart, while the consensus rating on Molina Healthcare sits at a “Hold," the mean target of about $178 suggests it could rally about 40% over the next 12 months.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)