/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

Amazon's (AMZN) stock came under pressure after the company released its fourth-quarter earnings, sliding more than 11% in pre-market trading. While Amazon’s Q4 results were mixed, they were not disastrous. The real reason for the selloff was Amazon’s announcement that capital expenditures (capex) will rise sharply in 2026.

Management revealed that Amazon expects to invest roughly $200 billion in capex through 2026, with the bulk of that spending directed toward Amazon Web Services (AWS), its cloud computing arm. The announcement raised concerns that have been building across the tech sector as companies race to scale up artificial intelligence (AI) infrastructure. Amazon is now following the same path as peers such as Microsoft (MSFT) and Alphabet (GOOG) (GOOGL), both of which have sharply increased spending to capture AI-driven growth opportunities.

For investors, the concern isn’t whether AI demand exists, but whether these enormous investments will deliver returns quickly enough to justify the scale of spending. Markets have become increasingly sensitive to any signal that near-term cash flows or margins could be pressured, even if the long-term opportunity remains attractive.

Amazon Doubles Down on AWS as Demand Accelerates

Amazon is making one of the largest investment pushes in its history, and management is increasingly confident that the payoff will justify the scale. Addressing investor concerns around sharply higher capex, the company pointed to sustained demand across its core businesses and what it sees as significant opportunities in AI, custom chips, robotics, and even low-earth-orbit satellite infrastructure.

The bulk of this investment will flow into AWS, where demand continues to strengthen. AWS growth accelerated to 24% in the fourth quarter, up from 20% in Q3, reflecting that enterprise cloud spending is expanding. Revenue increased by $2.6 billion sequentially and nearly $7 billion year-over-year (YoY), driven by rising customer usage and Amazon’s ability to bring new capacity online quickly.

At its current pace, AWS is operating at a $142 billion annualized revenue run rate and remains the company’s key profit engine. Further, within the segment, Amazon’s in-house chips business, which includes Graviton and Trainium, has become a meaningful contributor to its financials. Management disclosed that Graviton and Trainium combined have surpassed a $10 billion annual revenue run rate and are growing at triple-digit rates.

Beyond AI, AWS is also seeing strong momentum in traditional workloads as enterprises refocus on migrating infrastructure to the cloud. Amazon’s broad service portfolio, industry-leading security, and extensive partner ecosystem are translating into wins with large enterprises and government customers.

Looking forward, management emphasized that adoption of AWS for both core workloads and AI applications is accelerating. Importantly for investors, Amazon believes it is monetizing new capacity as fast as it can deploy it. That suggests the current investment cycle is being driven by customer demand rather than speculative overbuilding. Over time, management expects these investments to deliver strong returns on invested capital, strengthening the view that 2026’s elevated spending is laying the groundwork for durable, long-term growth.

Is AMZN Stock a Buy, Sell, or Hold?

AMZN stock dipped after the company announced a major increase in capex. However, the company’s core businesses are performing exceptionally well, supporting its long-term investment case.

The cloud segment remains a core engine of profitability and cash generation, benefiting from sustained enterprise demand and the expanding use of data, analytics, and AI-driven workloads. At the same time, its advertising business is soaring. In the fourth quarter, advertising revenue rose 22%. Further, over the course of 2025, advertising contributed more than $12 billion in incremental revenue, highlighting its role as a fast-scaling, high-margin business.

Its retail operations are also showing encouraging momentum. Improvements in the fulfillment network and continued progress in optimizing the cost structure are helping Amazon deliver faster and more efficiently, which supports both customer satisfaction and sales growth.

While elevated capital spending may weigh on margins in the short term, these investments position the company to capture future growth opportunities.

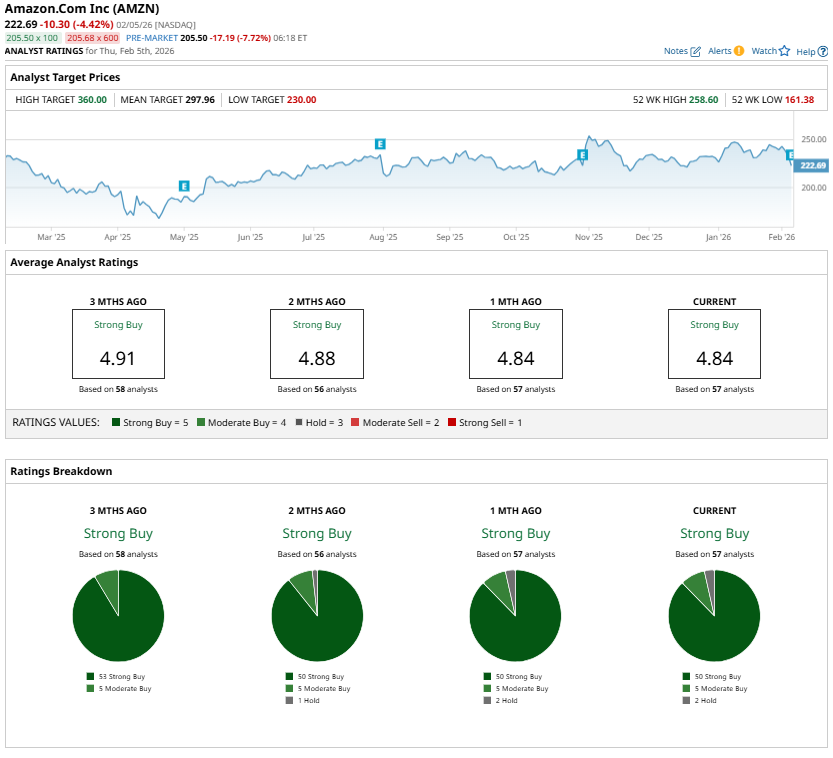

Wall Street analysts remain optimistic. AMZN stock carries a “Strong Buy” consensus rating, signaling confidence that Amazon’s diversified growth engines and strategic investments could generate strong returns.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/International%20Business%20Machines%20Corp_%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)