- The last four years have shown us stark examples of what can happen to markets when a country removes itself from global markets.

- Add to that a global pandemic and broken supply chains around the world, and the hue and cry for more a more nationalistic approach grows louder.

- However, the reality is, the more divided the world seemingly becomes, economically it gets pulled closer together.

As I watched the financial news play out this week, I was reminded of a cartoon with someone wearing a sandwich-board proclaiming, “The End of the World is Near!”. You don’t see those much these days, maybe because the last couple years have felt like Armageddon was actually here. What brought this to mind? Financial media has been filled with talk of the end of globalization, predictions made by folks at some large investment firms (most notably Larry Fink of BlackRock and Howard Marks of Oaktree Capital). I heard a solid recap of the debate on CNBC late Thursday when Senior Markets Commentator said something to the effect of the end of globalization has already been seen once the US got into a trade war with China. The general argument is that the move toward nationalism led by Trump and Putin will continue, with its so-called merits now highlighted by supply-chain breakdowns created by that same Twitter-driven trade war by Trump, a global pandemic (some attribute to China’s Xi), and now the invasion of a sovereign country by Russia’s Putin. It's interesting how those three go together, isn’t it? (For further reading, see Anne Applebaum’s book, “The Twilight of Democracy”.)

But as I write this piece there is whisky from Scotland in the glass, cigars from Nicaragua in the humidor (after all, it’s illegal to import cigars from Cuba), poutine from Canada on the table, avocados from Mexico ready to be used, and trinkets of every shape and size from China all around the house. If something breaks down or I have to schedule an appointment of some kind, my call to customer service is routed somewhere in India. It’s unlikely I’m alone in the world with this situation, putting a spotlight on Thomas Friedman’s tome “The World is Flat” from 2005.

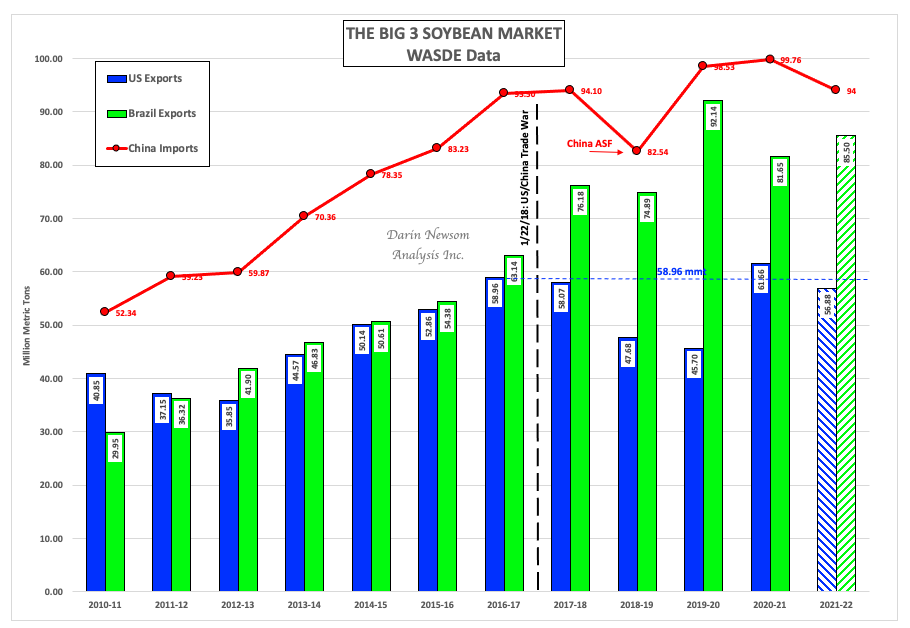

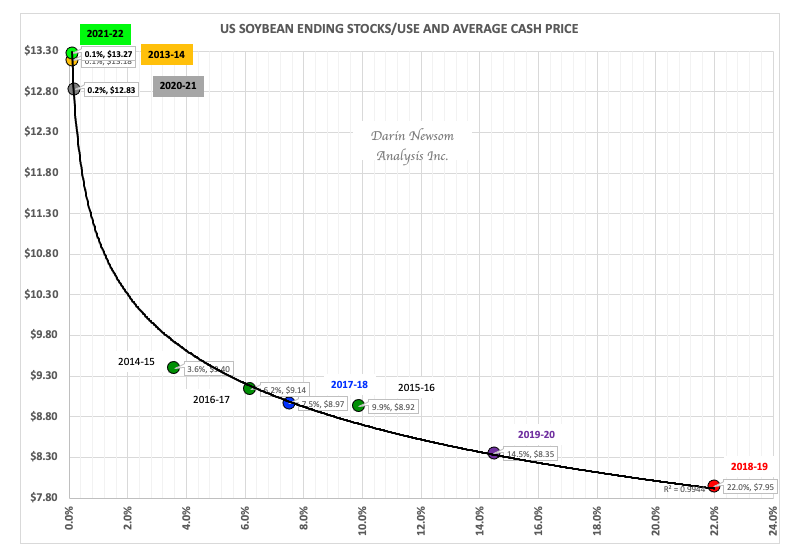

Despite the best efforts of Trump, Putin, et.al., I think global trade will continue to flourish. It has to. If you want an example of what happens when a country takes itself out of a key global market, look no further than what occurred with the US soybean industry when Trump started his trade war. The US, once one of the Big 3 players in the global market, was reduced to a secondary role – until China’s primary supplier Brazil ran into weather trouble and out of soybeans. We’ve seen the cmdty National Soybean Price Index (ZSPAUS.CM), the weighted national average cash price, go from a marketing year daily average of $8.97 during 2018-2019 to a high daily average of $13.27 this marketing year. What has the difference been? Increased demand for US soybeans while supplies continue to tighten.

The other example is Russia’s economy now that Putin’s war has unleashed historic sanctions from western allies. Of course these sanctions would hit even harder if not for China and India, showing their truly capitalistic side, buying up heavily discounted Russian commodities when the rest of the world has said “Nyet!”. Still, theoretically it will take many years, if not decades, for Russia to climb out from the economic rubble of its nationalistic mistake, though one has to know there was more to Putin’s invasion than just nationalism. With the world running out of nearly all commodities, what better way to make oneself rich than to take over a sovereign nation known as the “Breadbasket of Europe” and ship its good around the world.

If so, then doesn’t that sound more like globalization than nationalism?

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)