Microsoft's (MSFT) stock lost 12% on Thursday. It’s now down 22% from its July 2025 all-time high of $555.45.

While the mega-cap’s quarter was a good one -- revenues and earnings were $1.0 billion and 23 cents higher, respectively, than Wall Street’s estimates -- its guidance for the future was softer than expected, prompting the big selloff.

Interestingly, despite Microsoft saying its Azure cloud computing business would see 38% revenue growth in Q3 2026, investors don't feel it's sufficient given the massive capital investment made over the past two years.

In the second quarter alone, its capital expenditures were $37.5 billion, $800 million higher than Wall Street’s estimate. According to Barron’s, Microsoft, Meta Platforms (META), Alphabet (GOOGL) and Amazon (AMZN) will spend $550 billion on AI in 2026.

Investors clearly are concerned that there may be no pot of gold at the end of the rainbow.

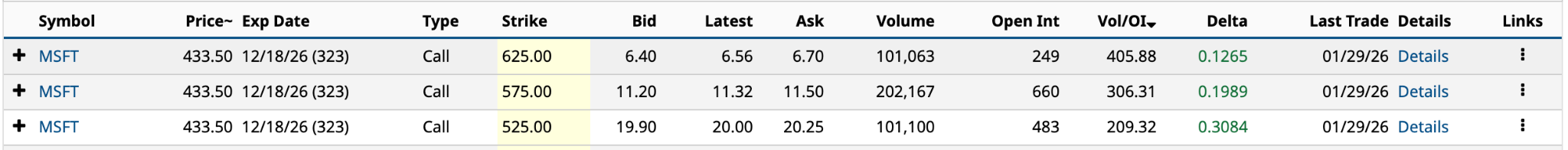

In yesterday’s options activity, Microsoft had the three highest Vol/OI (volume-to-open-interest) ratios among the 1,328 unusually active options. All three were calls.

Satya Nadella has done an excellent job since taking the top job in February 2014 -- MSFT stock is up 1,104% in the 12 years he’s been in the top job -- so I don’t think now is the time to worry that he’s lost his touch or vision for the company.

If you’re long-term bullish, this correction is an opportune time to make some targeted bets on its stock, using these three calls expiring a week before Christmas as your focus.

Have an excellent weekend.

Bull Call Spread

The bull call spread is a bullish option strategy with a limited loss and limited profit. The bet is made with the assumption that you expect the stock to rise in value over the duration of the call.

The strategy involves buying a call option and selling a call option at a higher strike price. The short call lowers the cost (net debit) of the long call.

So, based on the three unusually active call options from yesterday, you have 3 possible combinations: $525 and $575, $525 and $625, and $575 and $625.

Let’s consider each of them.

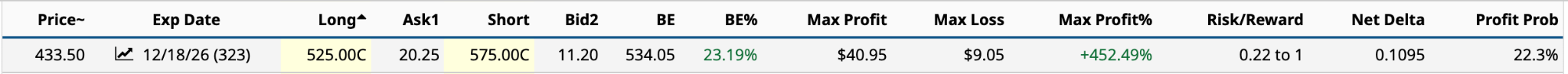

In the first example above, you have a $50 spread between the two strike prices. The long $525 call costs $20.25 ($2,025), while the $575 short call generates $11.20 ($1,120) in premium income, for a net debit of $9.05 ($905), or 2.09% of its share price.

The most you can lose is $905, while the most you can profit is $40.95 [$575 strike - $525 strike - $9.05 net debit]. The maximum profit percentage of 452.49% [$40.95 / $9.05] is very healthy, as is the risk/reward ratio of 0.22 to 1.

Of course, this explains the low profit probability of 22.3%, which is the likelihood that the share price at expiration in December is higher than the $534.05 breakeven [$525 long call strike price + $9.05 net debit].

The expected move over the next 10.5 months is 19.42%, a $84.15 gain, which puts the upper share price at $517.67 at expiration, about $17 below the breakeven.

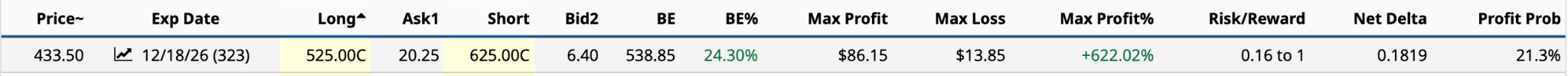

Here we have a $100 spread between the two strike prices, with a net debit of $13.85 ($1,385), which is 3.2% of the share price. That’s still relatively inexpensive. The bet provides a maximum profit that’s 169.53 percentage points higher than the previous example, while the risk/reward ratio is six basis points lower at 0.16 to 1.

Of these two, despite the much higher maximum profit percentage, I would go with the $525 and $575 combination because the $905 outlay is 35% lower and offers a higher profit probability.

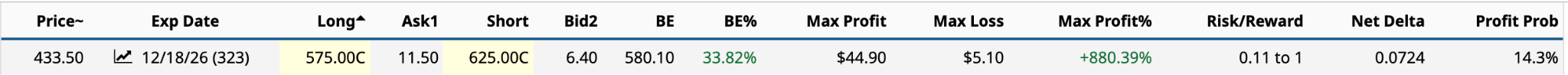

This last one has the lowest net debit of $5.10 ($510) and the highest maximum profit percentage of 880.39%. If you’re really concerned about your outlay per bet, this might hold some interest, but given the high breakeven of $580.10, your odds of success are slim.

Long Ratio Call Spread

The long ratio call spread, also known as a call ratio backspread, involves selling one call and buying two calls of a higher strike price, all with the same expiration date. It’s essentially the combination of a bear call spread and a long call.

The strategy is a bet that the stock’s share price or implied volatility will make a sharp move higher by expiration. While I’m generally bullish about the mid- to long-term direction of MSFT stock, I’m not sure we’ll see a sharp move higher in 2026.

Perplexity describes this strategy as a “leveraged moonshot,” so the odds of success aren’t great.

Based on the three unusually active options, we have several possible combinations. The important part is that the long call should be the higher strike price of the bear call spread. Further, the combined deltas of the two long calls should be approximately equal to the delta of the one short call.

The delta of the $525 call is 0.3084. So, if that’s the one short call, the delta of the two long calls should each be about 0.1542. The deltas of the $575 and 625 calls are 0.1989 and 0.1265, respectively. Of the two, the $625 call’s delta is closer, so let’s run with that.

Selling the $525 call generates $19.90 in premium income ($1,900). Buying two $625 calls costs $13.40 [2 * $6.70 ask price], or $1,340, for a net credit of $650.

The maximum loss would be $9,350 [$625 strike price - $525 strike price - $6.50 net credit] if the share price at expiration in December were at the higher strike price of $625. The maximum profit is unlimited.

Because there is a net credit rather than a net debit, there are two breakeven prices.

The lower $525 strike price’s breakeven is $531.50 [$525 strike price + $6.50 net credit], while the upper $625 strike price breakeven is $718.50 [$625 strike price + maximum risk = $100 difference in strike prices - $6.50 net credit].

Now we’ll use the $575 call as the long option with the $525 short.

Selling the $525 call generates $19.90 in premium income ($1,990). Buying two $575 calls costs $23.00 [2 * $11.50 ask price], or $2,300, for a net debit of $310.

The maximum loss would be $5,310 [$575 strike price - $525 strike price + $3.10 net debit] if the share price at expiration in December were at the higher strike price of $625. The maximum profit is unlimited.

Because there is a net debit, there is only one breakeven price. It is $678.10 [$625 strike price +maximum risk = $50 difference in strike prices + $3.10 net debit].

Lastly, we’ll use the $575 call as the short and two $625 calls as the long options.

Selling the $575 call generates $11.70 in premium income ($1,170). Buying two $625 calls costs $13.40 [2 * $6.70 ask price], or $1,340, for a net debit of $170.

The maximum loss would be $5,170 [$625 strike price - $575 strike price + $1.70 net credit] if the share price at expiration in December were at the higher strike price of $625. The maximum profit is unlimited.

The breakeven price is $676.70 [$625 strike price +maximum risk = $50 difference in strike prices + $1.70 net debit].

Bottom Line: If it were me betting on one of three moonshots, I’d probably go with the last one, primarily because losses on the short call don’t kick in until $575 rather than $525, giving you a little wiggle room if the stock jumps, but not nearly enough to hit the breakeven.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/Apple%20products%20arranged%20on%20desk%20by%20tashka2000%20via%20iStock.jpg)