/Quantum%20Computing/Image%20by%20Funtap%20via%20Shutterstock.jpg)

IonQ (IONQ) stock just got hammered by one of the market's most aggressive short sellers, and investors are scrambling to figure out what's real and what's noise. Valued at a market cap of $10.7 billion, IONQ stock lost almost 30% in the past three days but has started rebounding today by about 16%.

Earlier this week, Wolfpack Research dropped a scathing report and accused the quantum computing company of building its business on political earmarks rather than genuine technological merit.

The firm claims IonQ lost its primary revenue source when key political patrons lost power following the 2024 election, forcing management into a desperate acquisition spree to hide the damage.

It's a brutal allegation that raises serious questions about IonQ's path forward. But does the short thesis hold up against what management has been saying on earnings calls?

The Earmark Accusation Hits Hard

Wolfpack's most damaging claim centers on how IonQ generated revenue:

- The short seller alleges that approximately 86% of IonQ's recognized revenue from 2022 through 2024 derived from Pentagon "backdoor earmarks" totaling approximately $65.5 million.

- Unlike competitive bidding processes, these funds were allegedly directed by friendly lawmakers who inserted coded language into defense budgets.

- When those political patrons lost influence after the 2024 election, funding for IonQ's largest Pentagon contract vanished completely from the fiscal 2025 and 2026 budgets, according to Wolfpack.

The report also claims IonQ inflated its 2024 bookings by $54.6 million by including the maximum potential contract ceilings that Congress never actually funded. If true, that's a massive red flag suggesting the company misled investors about its commercial pipeline.

IonQ Reports a Strong Q3 Performance

On IonQ's Nov. 5 earnings call, the narrative couldn't have been more different. CEO Niccolo de Masi reported a "transformative quarter" with record revenue of $39.9 million, representing 222% year-over-year (YoY) growth that exceeded the high end of guidance by 37%.

"We are the market's only full stack quantum platform company," de Masi told analysts, emphasizing the company's expansion beyond pure quantum computing into networking, sensing, and cybersecurity.

CFO Inder Singh highlighted the business was becoming increasingly international, with roughly 70% U.S. revenue and 30% international in the third quarter, compared to almost entirely U.S.-based a year earlier. He mentioned IonQ was pursuing "potentially 3-digit million dollar opportunities" and had "more than $1 billion of proposals in progress."

IonQ raised its full-year 2025 revenue guidance to $106 million to $110 million and closed a $2 billion capital raise at $93 per share in October, bringing the pro forma cash balance to $3.5 billion.

The SkyWater Acquisition Raises Eyebrows

Wolfpack describes IonQ's proposed $1.8 billion acquisition of SkyWater Technology as "ridiculous," suggesting the company is primarily buying SKYT to claim its $34.2 million earmark as a new Pentagon win.

But on the Jan. 26 merger announcement call, de Masi painted the deal as critical to vertical integration. He explained that IonQ's path to scaling quantum computing runs through semiconductor engineering, and acquiring SkyWater would dramatically accelerate development timelines.

"We will reduce the time from design completion to first samples on our 256 qubit chip from 9 months to 2 months," de Masi said. "We will now be able to functionally test the first 200,000 qubit chip samples in 2028."

SkyWater CEO Thomas Sonderman emphasized his company would continue operating as a merchant foundry serving existing customers while supporting IonQ's quantum roadmap. The deal would create what they called the only completely U.S.-owned quantum platform with facilities across Maryland, Washington, Minnesota, Florida, Texas, and Colorado.

The DARPA Situation Looks Messy

Wolfpack's report highlights an embarrassing episode involving a 2025 DARPA competition. The firm claims that IonQ failed to advance to Stage B of the program on its own merits and then spent $1.596 billion to acquire Oxford Ionics, a company that had successfully advanced, presenting the achievement as its own.

On the November earnings call, when asked about the DARPA QBI program, Dean Kassmann acknowledged both the IonQ and Oxford teams received "immensely positive feedback" but couldn't comment until DARPA leadership announced Stage B performers.

The optics aren't great. If IonQ truly needed to acquire its way into DARPA validation rather than earning it through technological leadership, that contradicts management's claims about maintaining a five-year lead over competitors.

Perhaps the most troubling allegation involves insider trading. Wolfpack reports that between March 11 and 14, 2025, eight IonQ insiders sold or authorized sales of $396.6 million in stock during the exact window when Congress was voting on budget cuts that defunded IonQ's contracts.

The specific funding tables weren't public until March 19, leading Wolfpack to suggest that insiders may have traded on nonpublic information provided by lobbyists. Former CEO Peter Chapman's immediate resignation on Feb. 26, just as inflated 2024 bookings were announced, adds to the suspicious timing.

The Bottom Line for IONQ Stock Investors

IonQ's technology story remains compelling. The company achieved a record 99.99% two-qubit gate fidelity and shipped its fifth-generation Tempo system ahead of schedule. Management has assembled an impressive roster of talent, including former DARPA officials and defense leaders.

But Wolfpack's earmark allegations, if accurate, suggest the commercial foundation is far shakier than management lets on. The aggressive acquisition strategy could be brilliant vertical integration or desperate revenue backfilling.

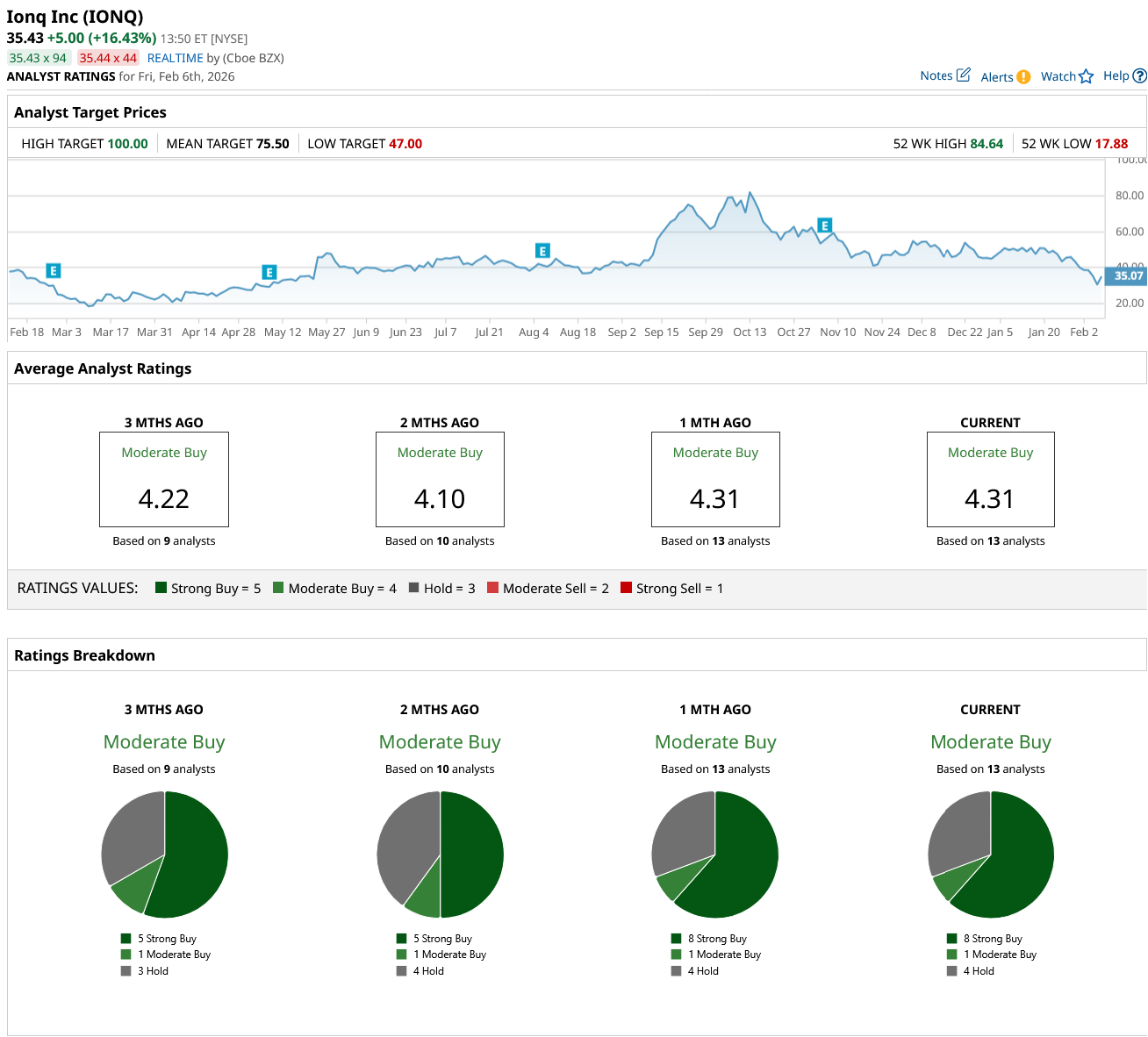

Out of the 13 analysts covering IONQ stock, eight recommend “Strong Buy,” one recommends “Moderate Buy,” and four recommend “Hold.” The average IONQ stock price target is $75.50, above the current price of $35.43.

For investors considering buying the dip, the key question is simple: Can IonQ generate meaningful commercial revenue without political support? Until that's proven, the stock remains a speculative bet on quantum's future rather than a solid investment in today's reality.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)