As gasoline refiners (commercial traders, smart money) begin accumulating crude oil for the 2026 summer driving season, they are navigating a market defined by falling crude prices, shifting consumer behavior, geopolitical events (Iran and Venezuela), and regional capacity constraints. While the traditional ramp-up toward Memorial Day continues, macroeconomic factors and seasonal weather events are reshaping spring refinery strategies.

Macroeconomic and Market Drivers

- Auto Sales and Efficiency: While 2025 was not a record year for total U.S. car sales, it was the best year since 2019, with sales rising roughly 2%–3% to an estimated 16.2–16.3 million units. Despite market turmoil, including high interest rates and tariff-driven price concerns, demand recovered strongly, with SUVs and trucks leading the volume.

- GDP and Consumer Income: U.S. GDP is projected to grow by approximately 2.1% and 2.8% in 2026. Lower gasoline prices, expected to average around $2.90–$2.97 per gallon, down from $3.10 in 2025, nationally, are projected to save American consumers roughly $11 billion compared to 2025. This reduction means gasoline expenditures may fall below 2% of disposable personal income—the lowest share since at least 2005 (excluding 2020)—providing households with significantly more expendable income for summer travel. Putting this in context: If accurate, this would mark the fourth consecutive year of declining gas prices, with 2026 potentially being the cheapest year for gas since 2020.

- Crude Oil Surplus: Global oil production is expected to outpace demand in 2026, leading to a surplus that exerts downward pressure on the crude costs refiners pay. Brent crude is forecast to average roughly $55–$56 per barrel, down from over $80 in 2024.

- Geopolitical Factors: While the consensus is bearish, some volatility exists. Early 2026 saw temporary price spikes to around $70 due to geopolitical tensions in the Middle East and Venezuela, which could threaten to reduce the expected surplus if supply disruptions worsen.

Seasonal Impacts and Refinery Dynamics

- Polar Vortex and Heating Oil: Recent extreme cold from a polar vortex typically spikes demand for heating oil (distillate fuel), often forcing refiners to prioritize distillate production over gasoline in early Q1. This can lead to lower initial gasoline inventories heading into the spring transition.

- Refinery Maintenance and Closures: Refiners are preparing for the "maintenance season" ahead of the summer-grade fuel switch. Capacity is tightening, particularly on the West Coast, with the planned April 2026 closure of Valero's Benicia refinery and the recent shutdown of Phillips 66's Los Angeles facility. These closures are expected to reduce U.S. petroleum inventories to their lowest levels since 2000, potentially causing regional price spikes despite the national downward trend.

Technical Picture for Crude Oil

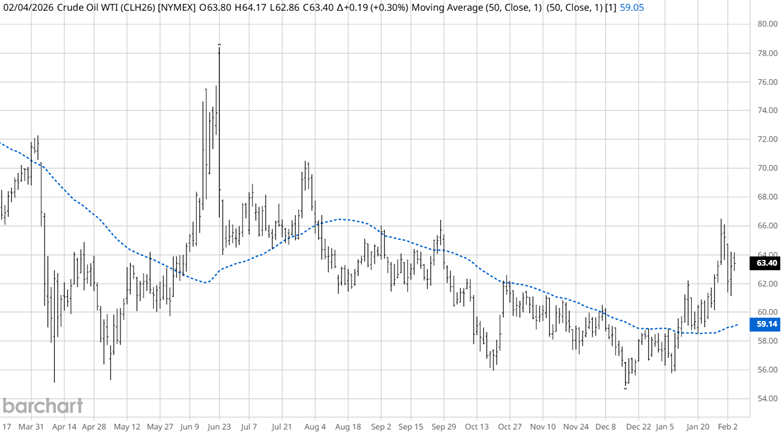

Source: Barchart

Fundamentals are supporting higher prices. Has the technical picture tilted bullish yet?

The daily nearby contract crude oil chart shows the recent downtrend breaking near the beginning of this year, as prices pierced the 50-day moving average and then spent enough time above it to turn it up, which should help the market find support/demand on price dips. The significance of this trend change correlates nicely with a reliable seasonal low in crude oil prices that we will discuss soon.

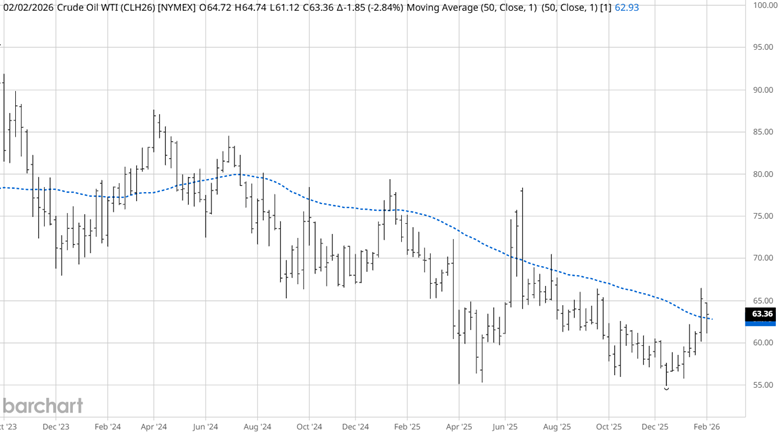

Source: Barchart

The weekly nearby contract crude oil chart shows the 50-week moving average still trending down. However, last week's close was above the moving average, and this week prices traded higher and have now come back to see if there is any demand to continue this breakout to the upside. One week does not make a trend change; perhaps some time is needed for the price to base at these higher levels before the moving average turns up. With the aforementioned fundamentals, the daily trend is already up, and the upcoming seasonal buy pattern, we may get the price boost we need.

Legacy Commitment of Traders Report (COT)

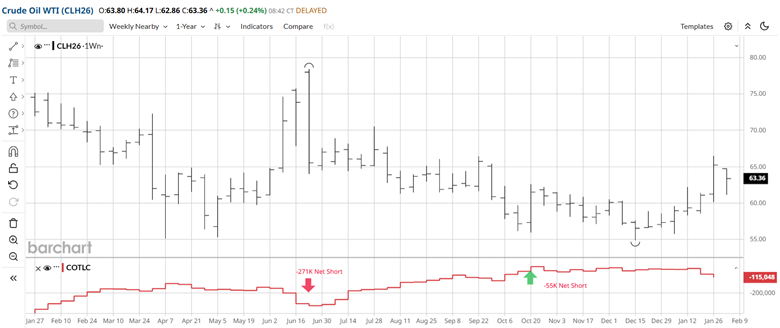

Source: Barchart

Given the reliability of the upcoming seasonal buying pattern, I would like to see the commercial traders (smart money) as the most bullish they have been in the past 12 months. Reviewing the COT report above, we can see that the commercial traders are currently net short the crude oil market, but they are the least bearish they have been in the past 12 months. Seeing this bullish pattern, where producers are not aggressively selling but are covering their short positions as refiners accumulate contracts at these lower prices.

Consumer demand for the summer driving season is about as reliable as when you visited your grandmother, and she made you sit down to eat a meal she fixed for you. Commercial traders know this pattern, and using the COT report to see whether they are participating in it is an edge all traders can use.

Seasonal Pattern

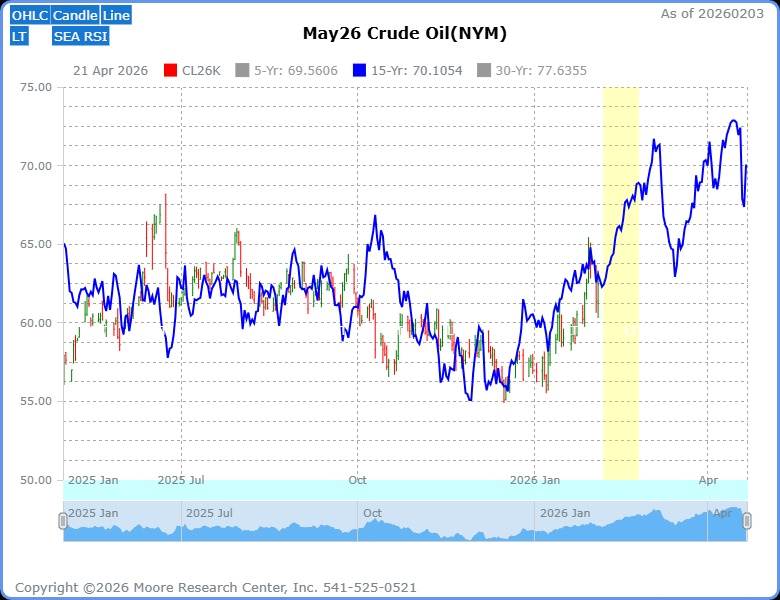

Source: Moore Research Center, Inc. (MRCI)

MRCI research on crude oil 15-year seasonal patterns (blue line) shows that it usually bottoms in December and begins its spring advance. Using the COT report to see whether commercials are participating this year confirms that the seasonal pattern is off to a good start. The seasonal bullish period usually runs from late December to early May. In between that period, MRCI identifies optimal seasonal windows (yellow box) to help balance profits and drawdowns.

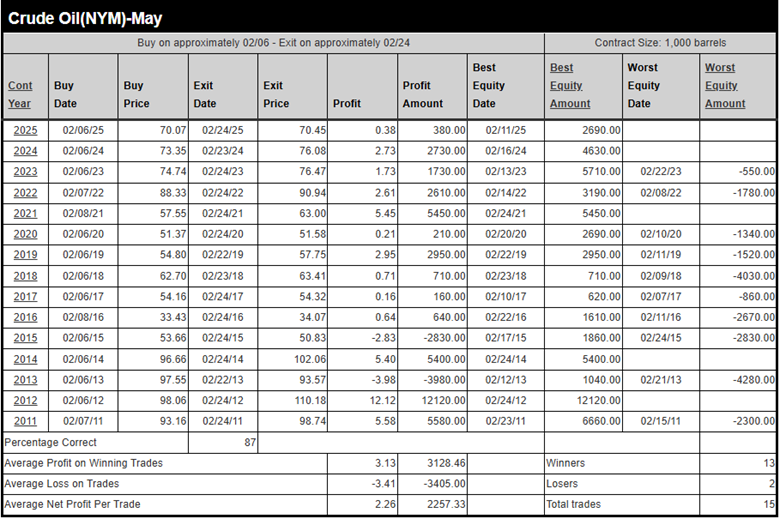

For this seasonal buy window, MRCI has found that the May crude oil contract has closed higher on February 24 than on approximately February 06 in 13 of the past 15 years, for an 87% occurrence. During this hypothetical testing period, the average profit per standard contract for crude oil (1,000 barrels) was $2.26 per barrel, or $2,257.

Source: MRCI

In addition, the testing showed that 5 of the years never had a daily closing drawdown after entering on February 06.

As a crucial reminder, while seasonal patterns can provide valuable insights, they should not be the basis for trading decisions. Traders must consider various technical and fundamental indicators, risk management strategies, and market conditions to make informed, balanced trading decisions.

Markets to Participate in Crude Oil Trades

Futures market traders could trade the standard-size (CL) crude oil contract, the mini (QM) contract, or the micro (CY) contract. Equity traders may be interested in trading the exchange-traded fund (USO). Options on crude oil futures or the USO ETF are also available.

In Closing…

Refiners have been accumulating crude oil in a market where falling prices, a projected global surplus, and lower gasoline prices are setting the stage for a demand-driven spring and summer recovery, even as geopolitical risks and regional refinery closures add volatility. Fundamentally, cheaper crude, rising consumer disposable income, and reliable summer driving demand support higher prices from current levels. Technically, the daily chart has already flipped into an uptrend after reclaiming and turning up the 50-day moving average, aligning with a historically reliable December seasonal low that typically transitions into a spring advance. That seasonal signal is further confirmed by the COT report, where commercial traders are the least bearish in a year and actively covering shorts as refiners accumulate at lower prices. For traders, the convergence of seasonality, improving daily trend structure, supportive fundamentals, and bullish commercial positioning highlights a clear opportunity window—provided risk is managed, and confirmation remains intact.

On the date of publication, Don Dawson did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)