/AI%20(artificial%20intelligence)/Artificial%20intelligence%20and%20machine%20learning%20concept%20-%20by%20amgun%20via%20iStock.jpg)

Unity Software (U) stock plummeted 22% on Friday after Alphabet's (GOOG) (GOOGL) Google unveiled Project Genie, an AI-powered tool that lets users create interactive virtual worlds. The selloff marked Unity's worst single-day performance since May 2022, when shares tanked 37%.

Investors are concerned that Google's new offering could replace traditional game development tools such as Unity's Create platform, which powers roughly 70% of mobile games.

But here's why the fear might be overblown.

What Is Project Genie?

Project Genie is Google's experimental prototype that creates dynamic virtual environments using AI.

Users can generate customizable worlds through text prompts and images, complete with physics simulations and interactive elements. However, there are quite a few catches. The biggest by far is cost.

The tool is currently available only to Google AI Ultra subscribers, who pay $250 monthly. That's already pricier than Unity Pro, which costs $210 per user per month. Unity also offers a free version for developers generating under $200,000 in revenue.

Google itself admits Project Genie has limitations. For instance, the tech giant noted imperfect visual rendering and occasional control issues in its current form.

Unity's CEO Pushes Back

Unity CEO Matthew Bromberg didn't wait long to address the market panic. In a LinkedIn post, he argued that Project Genie isn't a threat but an opportunity.

His reasoning centers on a fundamental limitation of AI world models. Bromberg explained that tools like Project Genie can generate impressive visuals through prompting. However, they currently lack the determinism and precision needed for production-grade games.

"Their outputs remain probabilistic and nondeterministic, making them unsuitable on their own for games that require consistent, repeatable player experiences," Bromberg emphasized.

Unity's platform, by contrast, offers developers the control they need to create games with reliable mechanics. Bromberg sees AI-generated content as a starting point that Unity developers can refine using the company's deterministic systems.

What the Analysts Are Saying

Wall Street's reaction has been mixed, with skepticism about the severity of the selloff.

According to a MarketWatch report:

William Blair analyst Dylan Becker maintained an “Outperform” rating on U stock despite the competitive concerns. The analyst noted that investors are overlooking Unity's platform sophistication and its ability to manage the full lifecycle of mobile games within a single, unified system.

"We believe these fears overlook the complexity and sophistication of Unity's engine, including similar AI capabilities embedded within its own platform over recent years," Becker wrote.

BTIG reaffirmed its “Buy” rating with a $60 price target, citing improved growth trends and potential from Unity Vector, the company's AI-driven monetization tool. However, not everyone is convinced. Benchmark maintained its “Hold” rating, suggesting that AI could pose an existential risk to Unity's Create business.

The firm specifically highlighted how AI-native platforms might bypass traditional engines entirely.

Is U Stock Undervalued?

Analysts tracking U stock forecast revenue to increase from $1.81 billion in 2024 to $3.16 billion in 2029. In this period, adjusted earnings are forecast to expand from $1.06 per share to $2.34 per share. If Unity's stock is priced at 30x forward earnings, which is lower than its one-year average of 42x, it should gain 150% over the next three years.

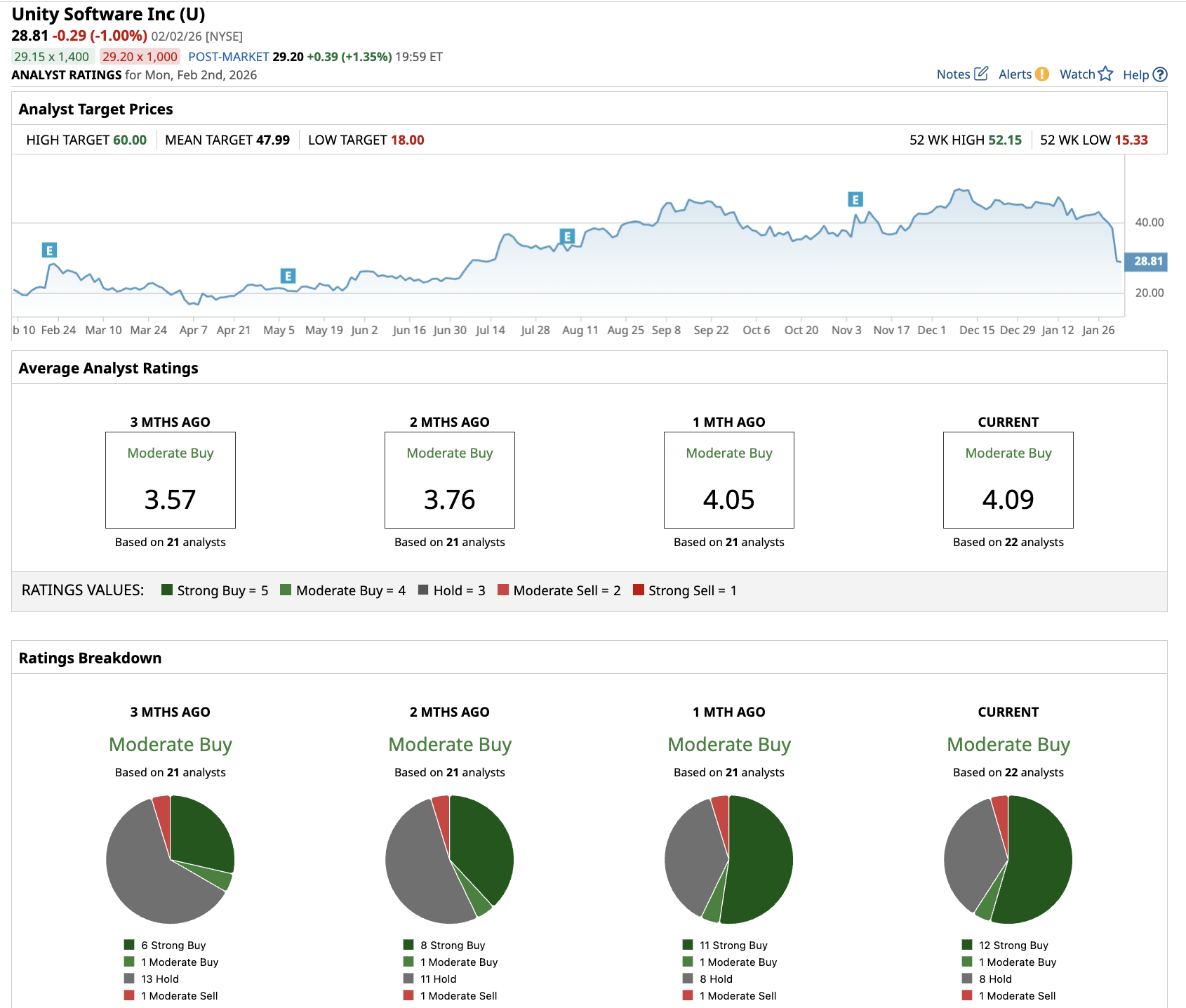

Out of the 22 analysts tracking Unity stock, 12 recommend “Strong Buy,” one recommends “Moderate Buy,” eight recommend “Hold,” and one recommends “Moderate Sell.” The average Unity stock price is $48, above the current price of $29.

The Bottom Line on Unity Stock

Unity's 22% haircut appears to be a knee-jerk reaction rather than a fundamental reassessment of the business. The company's recent financial performance has been strong.

- Unity Vector has been driving impressive growth in the Grow segment, with broad-based improvements across customer size, geography, and game genres.

- The Create business also showed momentum, with subscription revenue growing 13% year-over-year (YoY) after excluding nonstrategic revenue.

- The platform's deep integration across the game development lifecycle, from prototyping to live operations, isn't easily replicated by a prompt-based AI tool, regardless of how impressive the demo video appears.

For investors willing to stomach volatility, this selloff could represent a buying opportunity. Unity's platform isn't going anywhere, and AI tools like Project Genie might actually help developers create more content that needs Unity's runtime and monetization stack.

The real question isn't whether Google can generate pretty virtual worlds. The question is whether those worlds can become production-quality games without the deterministic systems Unity provides. Based on current AI limitations, the answer appears to be no.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)