/AI%20(artificial%20intelligence)/Image%20of%20server%20racks%20in%20modern%20server%20room%20data%20center%20by%20Sashkin%20via%20Shutterstock.jpg)

Advanced Micro Devices (AMD) stock has been riding the AI wave with an upside of 116% in the last 52 weeks. Further, according to Holly Newman Kroft, managing director at Neuberger Berman Private Wealth, the “AI euphoria is far from finished.”

The big investments in AI will therefore continue to benefit the “Magnificent Seven tech companies” and the other participants with a product portfolio that benefits from the structural tailwinds. AMD is among the high-performance computing companies that are positioned to benefit.

Specific to AMD, Wedbush Securities is bullish ahead of the company’s earnings. Analyst Matt Bryson expects earnings to exceed Q4 estimates. In addition, Bryson expects “gross margin and profit growth through 2026.” Another potential catalyst is China starting to “green-light some AI-related shipments.” Overall, Wedbush has an “Outperform” rating and a $290 price target for AMD stock.

About AMD Stock

Headquartered in Santa Clara, Advanced Micro Devices is an innovator in high-performance computing, graphics, and visualization technologies. With a global presence, AMD operates in three segments: Data Center, Client and Gaming, and Embedded.

For Q3 2025, AMD reported 36% year-on-year (YoY) growth in revenue to $9.2 billion. This growth was driven by demand for the company’s data center AI, server, and PC business. For the same period, the company’s GAAP gross margin was robust at 52%.

Considering the strong financial performance and continued tailwinds for the industry, AMD stock has trended higher by 44% in the last six months. With AI-driven industry investments, it’s likely that robust growth will ensure that AMD stock remains in an uptrend.

Ample Growth Opportunities

The bullish view on AMD stock is underpinned by the point that the addressable market is significant. To put things into perspective, AMD believes that the compute market is likely to be worth $1 trillion by the end of the decade. With a broad portfolio of hardware, software, and solutions coupled with technology leadership, AMD is positioned for robust growth.

In November 2025, the management outlined its long-term growth targets. Over the next three to five years, AMD expects to deliver top-line growth exceeding 35% with a non-GAAP operating margin of over 35%. During this phase, the data center business is likely to be the dominant growth driver.

In the foreseeable future, AMD’s strategic partnership with OpenAI is for the deployment of 6 GW of AMD GPUs. This is likely to have an impact on growth from the second half of 2026. The company will also be delivering 50,000 AMD Instinct MI450 Series GPUs to Oracle (ORCL) starting the second half of 2026. Other strategic partners include Meta (META) and the U.S. Department of Energy. These serve as growth catalysts and are likely to ensure that AMD achieves its guidance.

From a financial perspective, AMD reported a cash buffer of $7.2 billion as of Q3. Further, free cash flow for the quarter was $1.5 billion and implies an annualized FCF potential of $6 billion.

This is important, as AMD has made $40 billion in organic investments in the last five years. Further, $60 billion worth of acquisitions have been made during the same period. Financial flexibility remains high for the company to continue making strategic investments that support the robust growth trajectory.

What Analysts Say About AMD Stock

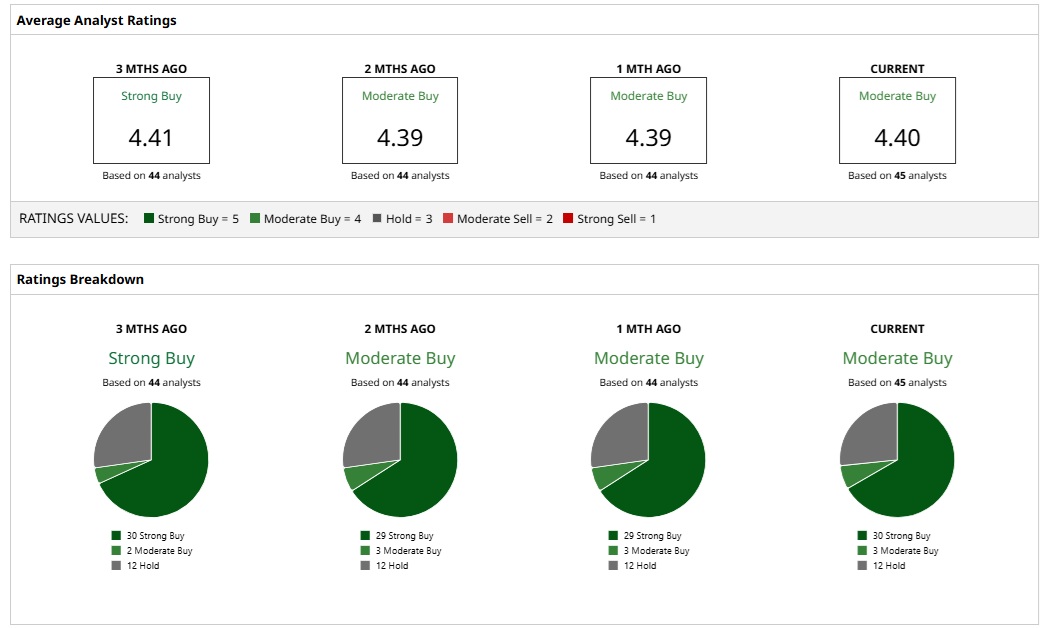

Based on the ratings of 45 analysts, AMD stock is a consensus “Moderate Buy.” While 30 analysts assign a “Strong Buy” rating to AMD, three and 12 analysts have assigned a “Moderate Buy” and “Hold” rating, respectively.

Based on these ratings, analysts have a mean price target of $286.49 currently, which would imply an upside potential of 16.3%. Further, considering the most bullish price target of $380, the upside potential for AMD stock is 54.3%.

An important point to note is that for FY26, analysts expect earnings growth of 77%. A forward price-earnings ratio of 45.5, therefore, does not look stretched considering the growth momentum.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Quantum%20Computing/Image%20by%20Funtap%20via%20Shutterstock.jpg)