/Robinhood%20app%20on%20phone%20by%20Andrew%20Neel%20via%20Unsplash.jpg)

Investors are bailing on Robinhood (HOOD) shares amid a broader rout in cryptocurrencies that’s pushed Bitcoin (BTCUSD) back to its April low below the $75,000 level.

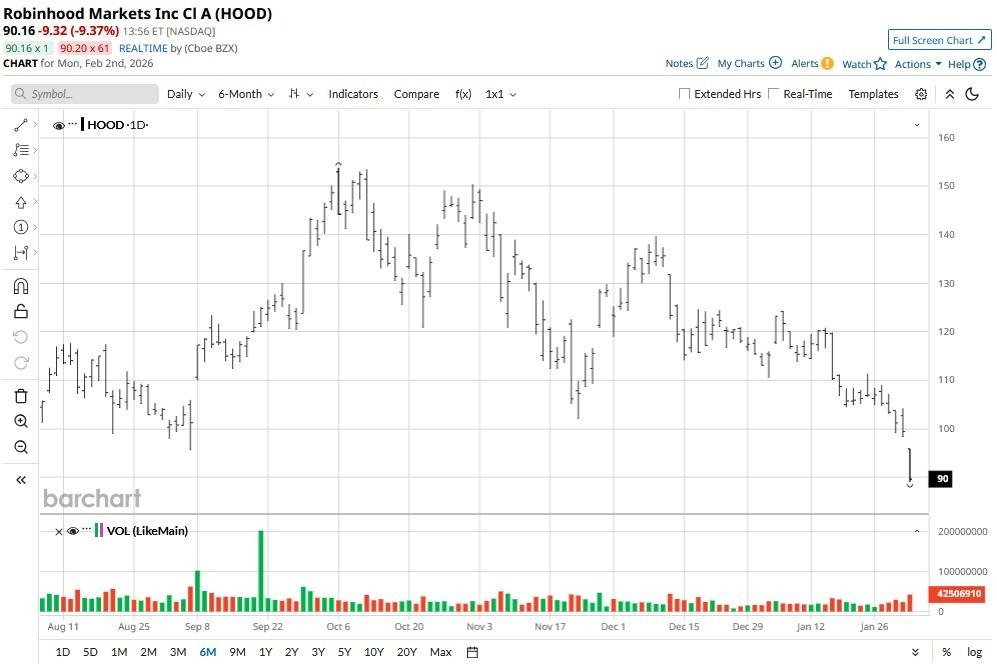

With a 14-day relative strength index (RSI) at about 23 only, HOOD stock now sits firmly in oversold territory, signaling a near-term rebound.

At the time of writing, Robinhood stock is down well over 25% versus its year-to-date high.

How to Play Robinhood Stock at Current Levels

According to Piper Sandler analyst Patrick Moley, long-term investors should treat the recent selloff in HOOD shares as an opportunity to buy a quality name at a significant discount.

In his research report, Moley agreed the end of football season is a “headwind” for Robinhood’s prediction market revenue given it drove almost half the volume.

However, with winter Olympics starting this month and the NCAA basketball tournament scheduled for March, Robinhood is strongly positioned to offset that loss, he added.

Piper Sandler currently has an “Overweight” rating on the financial technology giant. Its $155 price target signals potential upside of more than 70% from current levels.

HOOD Shares to Benefit From CLARITY Act

Moley favors buying Robinhood shares at the current oversold levels also because they stand to benefit from the CLARITY Act, a crypto market structure bill the Senate Agriculture Committee advanced last week.

According to the Piper Sandler analyst, the said legislation may accelerate blockchain adoption, helping HOOD scale its token offerings over the next few months.

“Long term, we believe Robinhood is the best way to play secular growth in retail trading and the closed FinTech platform we’ve seen to achieving super app status,” he told clients.

On Monday, the Nasdaq-listed firm launched stocks and shares individual savings account (ISA) in the UK, which may further boost its revenue base and – by extension – its share price in 2026.

Wall Street Remains Bullish on Robinhood

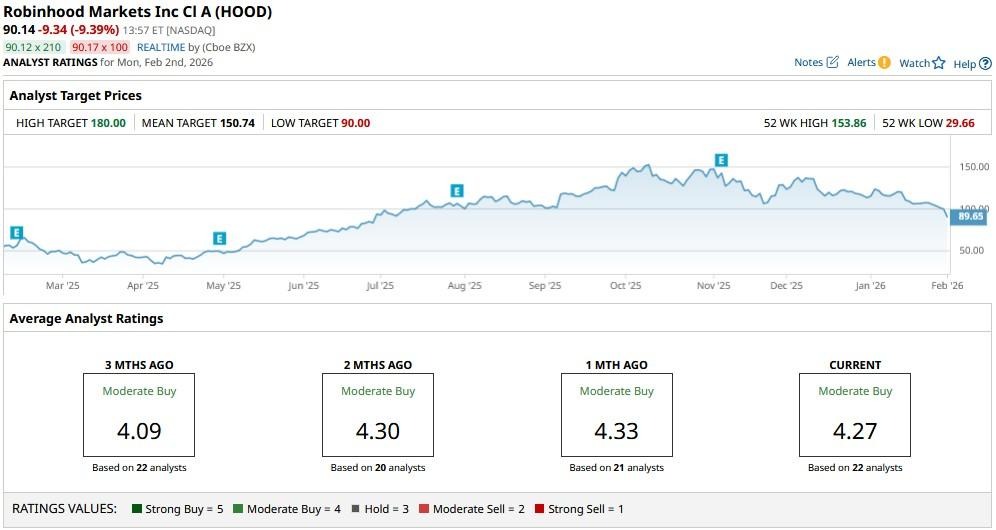

Other Wall Street analysts seem to agree that the recent selloff in Robinhood Markets has indeed gone a bit too far.

According to Barchart, the consensus rating on HOOD shares remains at “Moderate Buy” and the mean target currently sits at about $151.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/ServiceNow%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)