/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

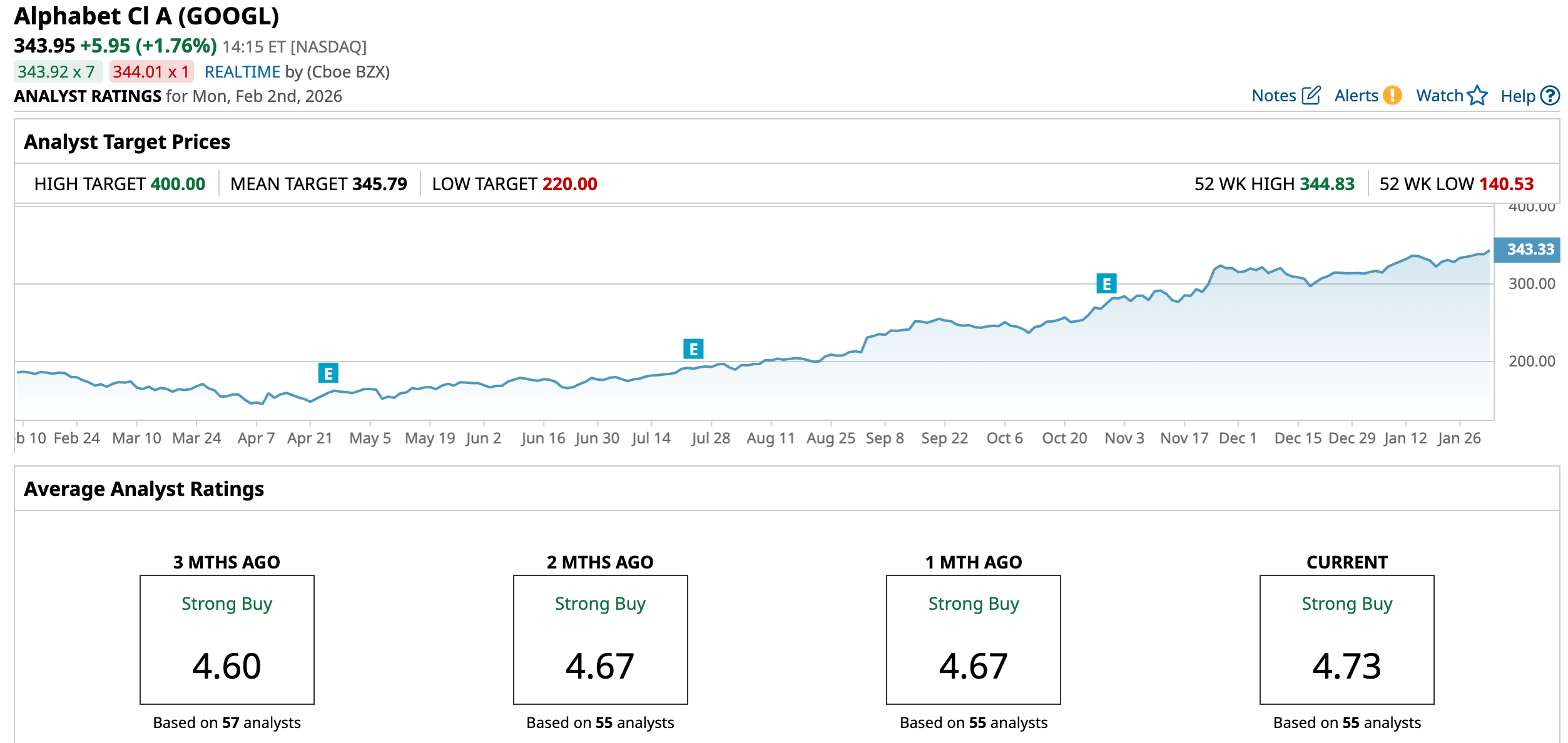

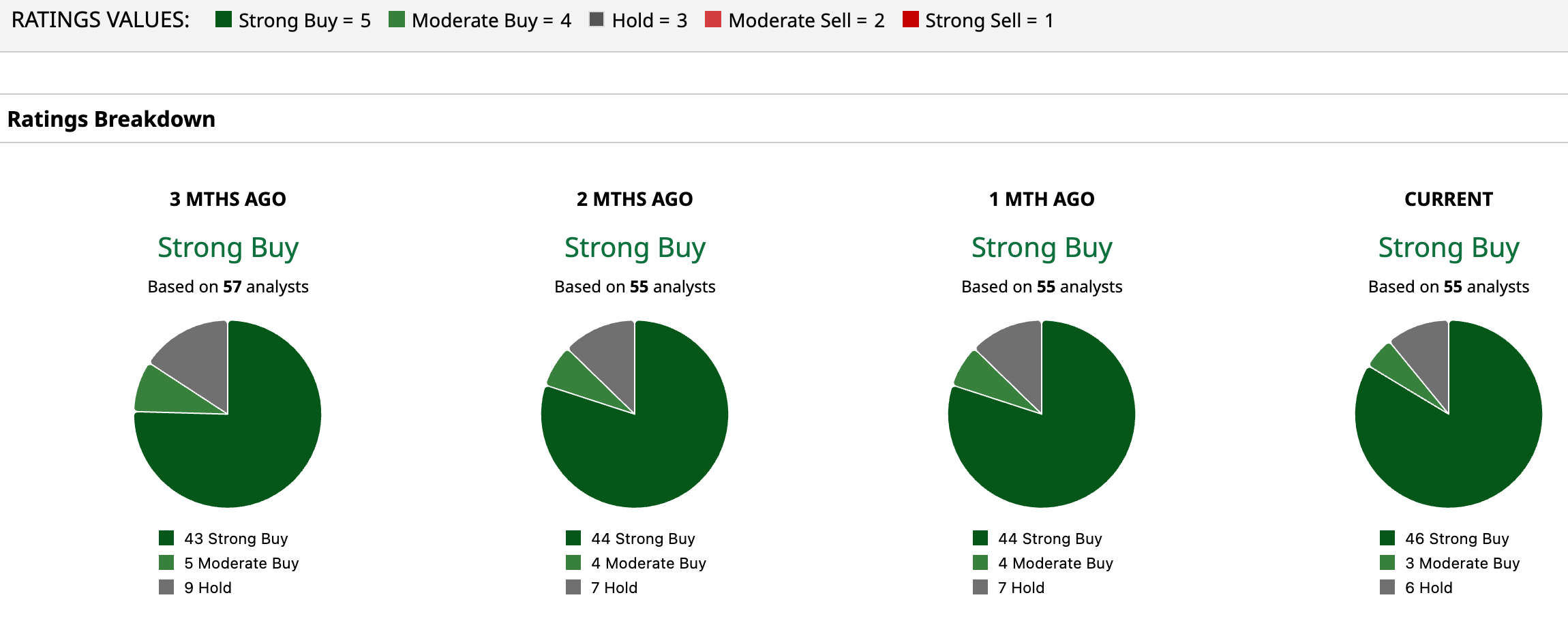

Alphabet (GOOG) (GOOGL) will release its fourth-quarter financial results on Wed., Feb. 4. Heading into the earnings, Alphabet stock has surged 81.35% over the past six months, reaching a fresh high of $344.83 today.

Alphabet stock has got a significant boost from its growing artificial intelligence (AI) capabilities and AI-driven momentum across its businesses. November's launch of Gemini 3 has strengthened Google’s position in the AI space. Further, investors’ optimism has also been supported by Alphabet’s expanding role in AI infrastructure.

For instance, the technology giant announced a major agreement with Anthropic that could provide the startup access to Google’s custom Tensor Processing Units. Valued in the billions, the deal reflects rising demand for Google’s in-house AI chips and opens up a new growth avenue.

Further, Alphabet’s recent partnerships with Apple (AAPL) and Walmart (WMT) lifted its share price. While the impact of these relationships will take time to play out, they add optimism around Alphabet’s ecosystem reach and provide new growth opportunities.

Given the strong AI-driven momentum, Google could once again deliver solid growth in Q4. However, after such a sharp rally, some caution is emerging. Alphabet’s 14-day RSI is 65.7 on a daily time frame. While it is below the 70 threshold that signals overbought conditions, it remains high, suggesting the stock is running hot heading into earnings and increasing the chance of volatility even if results are strong.

The options market is bracing for a higher-than-average move in GOOGL stock. Contracts expiring Feb. 6 are pricing in a post-earnings swing of about 5.3% in either direction, higher than Alphabet’s average earnings-related move of around 3.4% over the past four quarters.

Alphabet Q4: Here’s What to Expect

The ongoing strength in Search, Cloud, and YouTube will enable Alphabet to deliver strong financials in Q4. The technology company continues to benefit from steady demand in digital advertising and enterprise technology, while its expanding portfolio of AI-powered products is becoming an increasingly important growth driver.

A major driver of Alphabet’s performance remains the ongoing strength in Google Search. New AI tools such as AI Overviews and AI Mode are improving the user experience by making search more intuitive and personalized. As search, productivity, and content discovery become increasingly AI-driven, Alphabet appears well-positioned to capture additional growth from both consumers and advertisers. These enhancements are expected to support higher advertising revenue as engagement across Google’s ecosystem rises

Another key growth pillar supporting Alphabet’s outlook is Google Cloud. The segment has been one of the company’s fastest-growing areas, with revenue rising 34% YOY to $15.2 billion in the third quarter of 2025. This reflects strong enterprise demand for AI infrastructure, data tools, and cloud services. Importantly, Alphabet has been securing larger and larger commitments from organizations. In the first nine months of 2025, Google signed a significant number of billion-dollar cloud contracts, reflecting the sharp increase in the adoption of its platform.

AI usage within Google Cloud is also accelerating rapidly. More than 70% of cloud customers are now using Google’s AI products, while generative AI revenue has surged by more than 200%. Alphabet is also expanding AI into workplace productivity. Gemini Enterprise, its AI-driven business offering, has gained strong early traction, attracting more than two million subscribers. This adoption suggests Alphabet is building a meaningful foothold in the corporate AI market.

YouTube could again benefit from AI-enhanced recommendations and tools for creators. Advertising revenue could get a boost from higher engagement driven by Shorts.

With these diversified revenue drivers in place, Alphabet’s earnings outlook remains solid. Analysts expect the company to report earnings of $2.58 per share, representing 20% YOY growth.

Notably, Alphabet has a track record of outperforming expectations, including a 27% earnings beat in the third quarter. Overall, the combination of AI innovation, cloud expansion, and sustained advertising strength positions Alphabet for another strong quarter.

The Bottom Line

Alphabet’s long-term growth outlook remains compelling. The company is benefiting from AI-driven demand across its business, with solid momentum in its cloud business. Further, Wall Street analysts remain optimistic about GOOGL shares heading into the Q4 earnings release.

However, Alphabet’s recent rally suggests that investors have priced in many of the positives. Analysts’ average price target of $345.79 implies limited short-term growth.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/ServiceNow%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)