/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

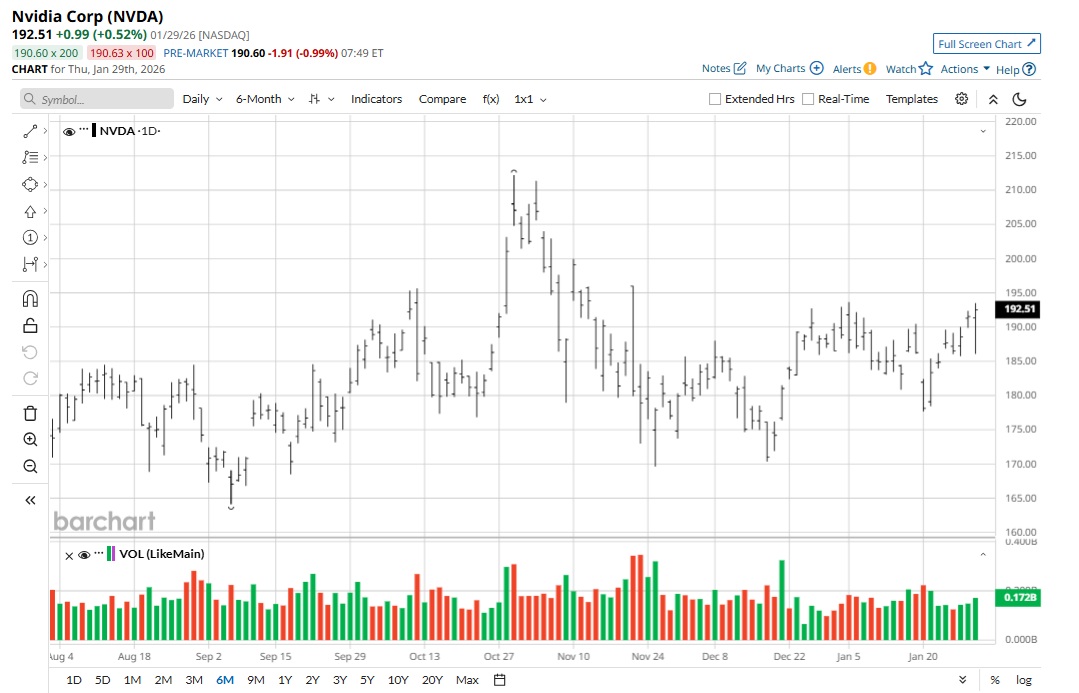

Considering the monumental gains clocked by Nvidia (NVDA) stock in the last five years, the price action has been relatively subdued in the last few months. However, NVDA stock is likely to remain in a long-term uptrend considering the industry outlook and continued positive developments.

In recent news, China has approved the import of a first batch of H200 chips, Nvidia’s second most powerful AI chip. Currently, ByteDance, Alibaba (BABA) and Tencent (TCEHY) have all received the go-ahead to buy more than 400,000 H200s. Additionally, China has conditionally given its AI startup, DeepSeek, approval to purchase H200 AI chips.

With orders starting to flow, this development will likely have a positive impact on NVDA stock as growth potentially accelerates. To put things into perspective, China previously represented 20% to 30% of Nvidia’s revenue share.

About Nvidia Stock

Headquartered in Santa Clara, California, Nvidia has been one of the biggest beneficiaries of the structural tailwinds for artificial intelligence. The company identifies itself as a global leader in accelerated computing and currently commands a market capitalization of $4.64 trillion.

Nvidia’s growth has been backed by innovation and the company has 8,700 granted and pending patents globally. As a “full-stack computing infrastructure company with data-center-scale offerings,” Nvidia believes that it has a $1 trillion available market opportunity.

For the third quarter of fiscal 2026, Nvidia reported revenue of $57 billion, which was higher by 62% on a year-over-year (YOY) basis. Robust top-line growth was associated with healthy GAAP gross margin of 73.4% for the quarter.

In the last six months, NVDA stock has trended higher by about 8%. With strong earnings growth expectations coupled with impending exports to China, the outlook remains positive.

Nvidia's Big Addressable Market

A key growth catalyst for Nvidia is its re-entry into the Chinese market. However, even as China sales declined in the last 24 months, Nvidia’s growth remained robust. Therefore, Nvidia's bullish growth outlook has multiple drivers.

Nvidia expects accelerated computing, agentic applications, and AI models to be on track for $3 trillion to $4 trillion in annual AI infrastructure build. This will ensure that the growth momentum sustains.

From the perspective of value creation, Nvidia reported free cash flow (FCF) of $22.1 billion for Q3. Considering the growth trajectory, FCF may likely be more than $100 billion in the next 12 to 24 months. This will provide the company with enough flexibility to significantly invest in innovation while pursuing aggressive share repurchases at the same time.

High financial flexibility also allows Nvidia to pursue acquisitions from the perspective of growth and innovation. In 2024 and 2025, Nvidia completed 11 acquisitions. Most recently, the company acquired AI accelerator chip startup Groq for a consideration of $20 billion.

It’s also worth noting that Nvidia’s growth is likely to come from new sectors. For example, Nvidia and Eli Lilly (LLY) are partnering on an AI co-innovation lab for drug discovery. BNP Paribas has also identified robotics as a key emerging tech market, and Nvidia is positioned to benefit from growth in this market.

What Do Analysts Say About NVDA Stock?

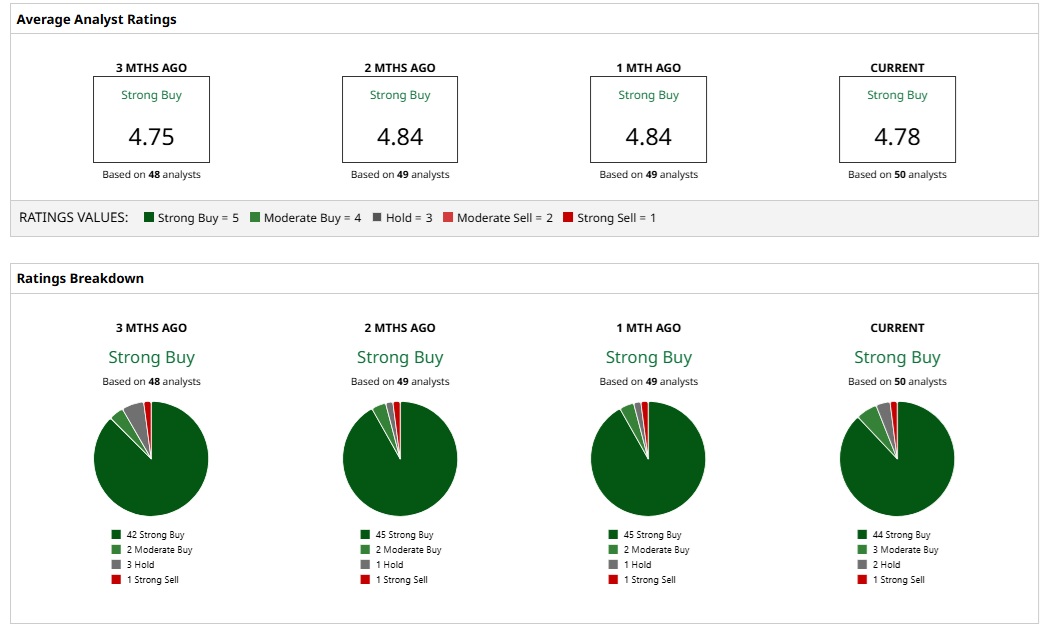

Based on the ratings of 50 analysts, NVDA stock is a consensus “Strong Buy.” An overwhelming majority of 44 analysts assign a “Strong Buy” rating to NVDA. Further, three analysts have a “Moderate Buy”, two have a “Hold” rating, and only one analyst opines that NVDA is a “Strong Sell.”

Analysts have a mean price target of $254.81 currently, which implies potential upside of 36% from here. Further, the most bullish price target of $352 suggests that NVDA stock could rise as much as 88% from current levels.

This might not come as a surprise considering the multi-year tailwinds that can translate into robust earnings growth and cash flow upside. For fiscal 2027, analysts expect earnings growth of 59%.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Alphabet%20Inc_%20and%20Google%20logos%20seen%20displayed%20on%20a%20smartphone%20by%20IgorGolovniov%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)