/Apple%20Inc%20phone%20and%20data-by%20Anderson%20Reis%20via%20Shutterstock.jpg)

Apple (AAPL) just delivered one of its strongest iPhone quarters ever, but that alone isn’t enough to trigger a buy on AAPL stock right now.

The company posted exceptionally strong financial results for the December quarter, with revenue rising 16% year-over-year to $143.8 billion, well above expectations. The star of the report was the iPhone, which generated a record $85.3 billion in revenue. That represents 23% year-over-year growth, with strong demand across every geographic region.

Normally, numbers like these would send shares sharply higher. Instead, Apple’s stock barely moved after earnings. Investors weren’t focused on the demand story. Instead, the market focused on what could slow Apple down next.

One major concern is supply constraints. Management acknowledged that customer response to the latest iPhone lineup was stronger than anticipated, leaving Apple with lean inventory at the end of the quarter. The challenge is that supply chain flexibility is tighter than normal, which could limit iPhone sales.

On top of that, cost pressures are beginning to build. While memory pricing had only a minimal impact on gross margins in the December quarter, management expects a larger hit in the March quarter. Looking further out, Apple continues to see memory prices rising significantly, which could weigh on profitability.

What’s Ahead for Apple?

Apple appears well-positioned to benefit from strong product demand. Further, its expanding ecosystem of active devices continues to support long-term growth, particularly through the company’s high-margin services business.

For the second quarter, Apple expects total revenue to increase between 13% and 16% year-over-year. This outlook factors in the impact of iPhone supply constraints during the period, suggesting underlying demand remains healthy despite supply limitations.

Apple projects gross margin in the March quarter to range from 48% to 49%, the midpoint of which is slightly above the 48.2% reported in the first quarter. While cost pressures persist, the company is benefiting from a favorable product mix and operating leverage, both of which should help protect margins. Importantly, the services segment continues to play a growing role in supporting overall profitability.

Apple’s high-margin services business has been delivering solid growth. Services revenue reached a record $30 billion in the first quarter, rising 14% year-over-year. Growth was broad-based, with advertising, music, payment solutions, and cloud services all posting double-digit gains in paid subscribers. Services gross margin climbed to 76.5%, improving sequentially by 120 basis points, largely driven by mix.

With more than 2.5 billion active devices in its installed base, Apple has a solid foundation for future growth. Customer engagement across its services portfolio continues to rise, with both paid accounts and transaction activity reaching an all-time high during the quarter.

Management expects services revenue growth to remain at a similar year-over-year pace as seen in the December quarter.

Should Investors Take a Pause on AAPL Stock?

Apple’s business momentum is expected to remain steady through the second quarter, supported by continued demand across its product ecosystem. In addition, the company’s strong brand loyalty and recurring services revenue provide a solid foundation for growth, even as it navigates a challenging operating environment.

That said, investors should not overlook the near-term challenges Apple continues to face. Ongoing supply constraints and rising costs remain key headwinds, and these pressures could limit Apple's upside potential.

Another important consideration is valuation. The positive from record iPhone sales and momentum in its services business is already priced into the stock. Apple currently trades at 31.4 times forward earnings, which is a high multiple relative to its projected earnings growth over the next couple of years. Wall Street expects Apple’s earnings per share to rise by 9.5% in fiscal 2026 and 11.6% in 2027. However, those forecasts could come under pressure if cost challenges persist or margins tighten.

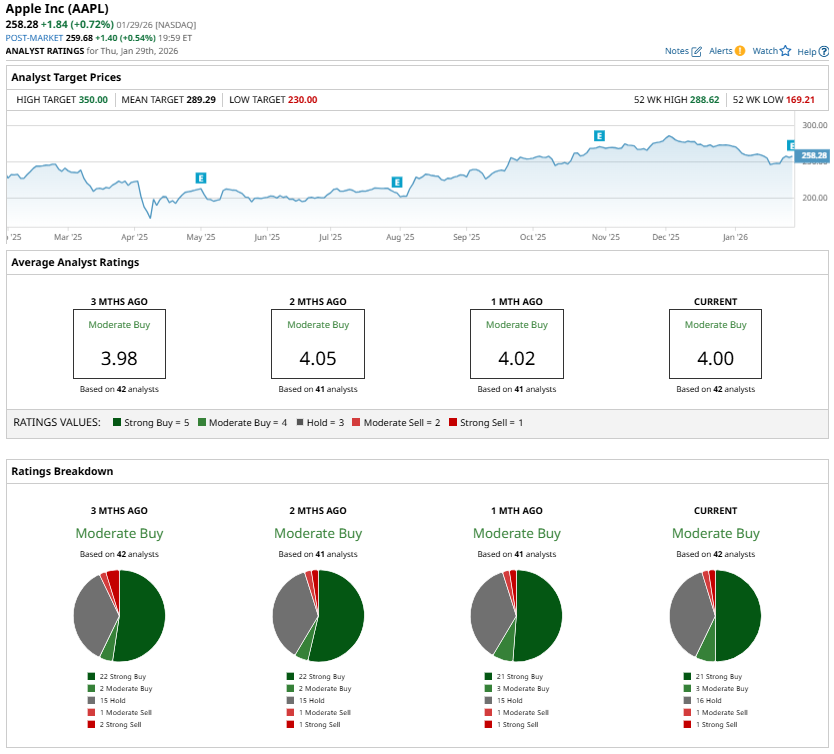

Apple stock spots a “Moderate Buy” consensus rating. Overall, Apple’s long-term growth prospects remain solid. However, investors should take caution in the near term.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/Apple%20products%20arranged%20on%20desk%20by%20tashka2000%20via%20iStock.jpg)