Liquidity, Tech Leadership, and Positioning Drive a Cautiously Constructive Tape

Equity markets remain supported by stable liquidity conditions and a U.S. economy that continues to show resilience, even as growth moderates. Within the S&P 500, performance has been heavily influenced by its concentration in large cap technology, making the health of the tech complex a key driver of index level direction.

Technology and AI related names have continued to attract capital, supported by strong balance sheets, durable earnings visibility, and sustained investment in artificial intelligence infrastructure. While upside momentum in some mega cap leaders has cooled from prior extremes, demand for AI exposure remains intact, helping stabilize the broader index during periods of rotation. This leadership has allowed the S&P 500 to grind higher even as participation across other sectors remains uneven.

Sentiment can best be described as cautiously constructive. Investors are willing to buy pullbacks in dominant tech and AI leaders, but remain selective elsewhere, resulting in persistent sector rotation and measured upside progress. This environment has reinforced the importance of technical levels, as index level moves are increasingly driven by positioning and flows rather than broad based risk appetite.

What the Market Has Done

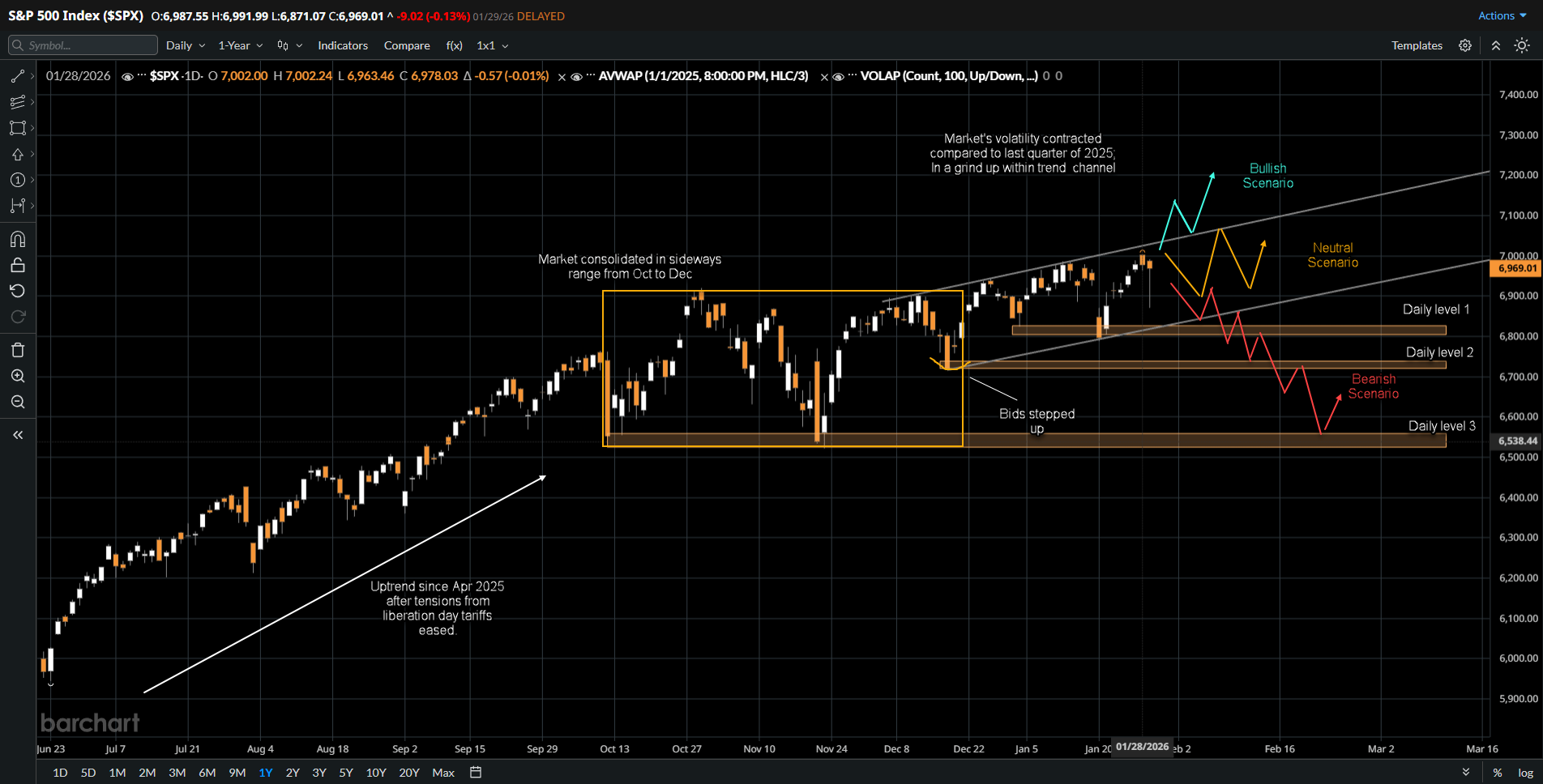

• The market has remained in a broader uptrend since April 2025 after tensions from Trump’s Liberation Day tariff rhetoric eased, allowing risk assets to reprice higher.

• Price action later entered a sideways range between 6965 and 6550, accompanied by increased volatility and larger sector rotations rather than sustained directional movement.

• Since the end of December, bids have stepped up consistently, resulting in a grind higher type trend with the market respecting both the upper and lower bounds of the rising trend channel.

What to Expect in the Coming Weeks

Neutral Scenario

• The market continues a two-way rotation within the established trend line channel as price drifts higher without the emergence of a fresh macro or data driven catalyst.

• Volatility remains contained as buyers defend higher lows while sellers lean against the upper boundary of the range.

Bullish Scenario

• If the market is able to break above the all-time high near the 7020 area and accept higher prices, the trajectory of the uptrend could steepen.

• This outcome would likely be supported by a risk on catalyst, such as geopolitical de-escalation including easing tensions with Iran or tangible progress toward a Ukraine Russia resolution, alongside constructive economic or corporate data that reinforces growth expectations.

Bearish Scenario

• The key level for buyers to hold is 6800 (daily level 1)

• If 6800 fails to hold, a move toward 6725 (daily level 2), becomes likely as short term longs begin to exit positions.

• A failure at 6725 could trigger broader long liquidation, opening the door for a deeper rotation back toward the lower end of the range near 6550.

Conclusion

S&P 500 continues to trade within a constructive technical structure, with price respecting a rising trend channel. Leadership from technology and AI remains a critical anchor for the broader index, helping absorb volatility generated by rotation and macro uncertainty. At the same time, geopolitical developments have emerged as an important swing factor for sentiment. Any signs of de-escalation could support a breakout above key resistance, while renewed tensions would likely pressure risk assets and test critical support levels near 6800 and below. As the market balances technical structure with macro and geopolitical inputs, traders should remain flexible, disciplined, and attentive to how price responds around these inflection points.

For traders interested in index products such as SPX options or the SPY ETF, trading futures may offer benefits including transparency, centralized pricing, and regulated execution. “Edge Clear LLC” provides direct access to global futures markets with reliable execution and trader-focused platforms designed for serious market participants. Traders looking to express views in the equity markets may want to explore futures as a flexible and capital efficient alternative. Check out “Edge Clear LLC” at edgeclear.com.

Disclaimer:

This article is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. The analysis presented reflects the author’s market observations and opinions at the time of writing and is not a recommendation to buy or sell any futures contract, security, or financial instrument. Futures trading involves significant risk and is not suitable for all market participants. Losses may exceed initial margin deposits, and market conditions can change rapidly.

Any scenarios, levels, or market expectations discussed are hypothetical in nature and are intended solely to illustrate potential market behavior. They do not represent actual trading results and should not be interpreted as guarantees of future performance. Past performance, market behavior, or historical price action are not indicative of future outcomes.

Readers are solely responsible for their own trading decisions and risk management. Always conduct independent research, consider your financial situation and risk tolerance, and consult with a qualified financial professional if necessary before engaging in futures or derivatives trading.

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)