/United%20Parcel%20Service%2C%20Inc_%20logo%20on%20truck-by%20100pk%20via%20iStock.jpg)

Champions of AI may continue to make a case that the massive infrastructure buildout will eventually be a net job creator for the economy. The real story, at least for now, is playing out differently, as companies lighten their workforce due to productivity gains from the revolutionary tech. After Amazon (AMZN) announced that it would slash about 16,000 jobs worldwide, its logistics partner, United Parcel Service or UPS (UPS), revealed that it would shrink its workforce by an even higher amount, at 30,000.

However, UPS's job cut is more of a strategic move from the company, as even though Amazon remains its biggest partner, the business accrued from the e-commerce giant is a low-margin one for the logistics and delivery giant. Consequently, it had decided last year to shave off 50% of its Amazon business volume by the end of 2026.

About UPS

Founded in 1907, UPS was the “OG” Seattle-based company before Amazon became the behemoth that it is today. Over more than a century, UPS has evolved into one of the world’s largest logistics and package delivery companies with a globally integrated air and ground network, spanning over 200 countries, and with a workforce of over 490,000 employees.

Valued at a market cap of about $91 billion, the UPS stock is down 22% over the past year. This downturn in the company's stock has ballooned its dividend yield to 6.13%, which is higher than the sector average of 1.16%. Notably, the company has been raising dividends consecutively over the past 16 years. However, with a payout ratio of over 85%, the scope for further growth remains limited.

Thus, with restrictions in the road ahead to raise dividends and a rapidly changing delivery landscape, can UPS still stay relevant in today's times? Or, will its resilience and survival in various market cycles over the past century hold it in good stead to tide over this period? Let's find out.

Growth Has Deserted UPS

UPS's financials are not something to be alarmed about yet. However, its growth over the years does not inspire much confidence in the company either.

Notably, revenue and earnings CAGRs in the last 10 years have been just 4.27% and 1.41%, respectively. Further, over the past nine quarters, although the company's earnings have surpassed Street expectations on seven instances, it has reported a year-over-year (YoY) decline six times, including the latest quarter.

The results for the most recent quarter of Q4 2025 saw the company reporting a beat on both revenue and earnings. However, revenues at $24.5 billion actually witnessed an overall decline of 3.25% on a YoY basis. The domestic segment of the U.S., which is its biggest revenue generator, saw its revenues fall by 3.2% in the same period due to a decline in volume.

Moreover, earnings slipped by 13.5% on an annual basis to $2.38 per share, surpassing the consensus estimate of $2.20 per share.

Cash flow from operating activities for 2025 also declined to $8.45 billion from $10.1 billion in 2024. Consequently, free cash flow for the year slipped as well to $5.5 billion from $6.3 billion in the same period. Overall, since the latest 10-Q has not been filed, the available cash balance for the quarter ended Sept. 30, 2024, stood at $6.8 billion. This was much higher than its short-term debt levels of $1.7 billion.

Moreover, the stock, after a muted return over the past year, is trading at undervalued levels when pitted against the sector median. Its forward P/E, P/S, and P/CF of 15.17, 1.02, and 9.61 are all below the sector medians of 22.03, 1.95, and 16.95, respectively.

Can UPS Take Advantage of Its Massive Scale?

UPS's growth may not be to the liking of many, but its scale of operations makes it difficult to ignore. The company serves more than 200 countries and territories, running one of the most extensive logistics networks anywhere. On average, UPS handles about 22.4 million packages each day worldwide, which adds up to roughly 5.7 billion packages over the course of a year. That kind of daily volume speaks to the sheer size and capability of its delivery system.

The latest quarterly results gave a clear look at how that scale translates into pricing strength. The average cost per piece for U.S. domestic packages rose to $12.92, a 12.3% increase from $11.50 a year earlier and above the nine-month average of $12.43. Customers are willing to pay more, which points to solid loyalty. At the same time, UPS has kept a tight grip on costs through a series of operational improvements. Purchased transportation as a share of total operating expenses fell from 16% to 12%, showing the company has become less dependent on outside carriers even as prices went up. Another helpful move has been embedding shipping tools directly into major e-commerce platforms like Shopify (SHOP). That integration makes it tougher for smaller merchants to switch providers.

The decision to reduce reliance on one major customer, Amazon, may create some short-term bumps, but it is part of a deliberate effort to spread out the revenue base and shift toward higher-margin business lines. B2B and healthcare shipments are now getting more focus, which should help profitability over time. On the labor front, UPS cut 48,000 operational roles in 2025, replacing much of that capacity with automated volume centers. These facilities use AI and robotics to sort packages faster and more accurately. Lastly, the company also finished retiring its MD-11 fleet this quarter, moving to a younger, more fuel-efficient air network that should bring down long-term operating costs.

Taken together, these actions reflect a clear plan to reshape the network for better efficiency and higher returns, even if the pace of revenue growth has been modest lately.

Analyst Opinion

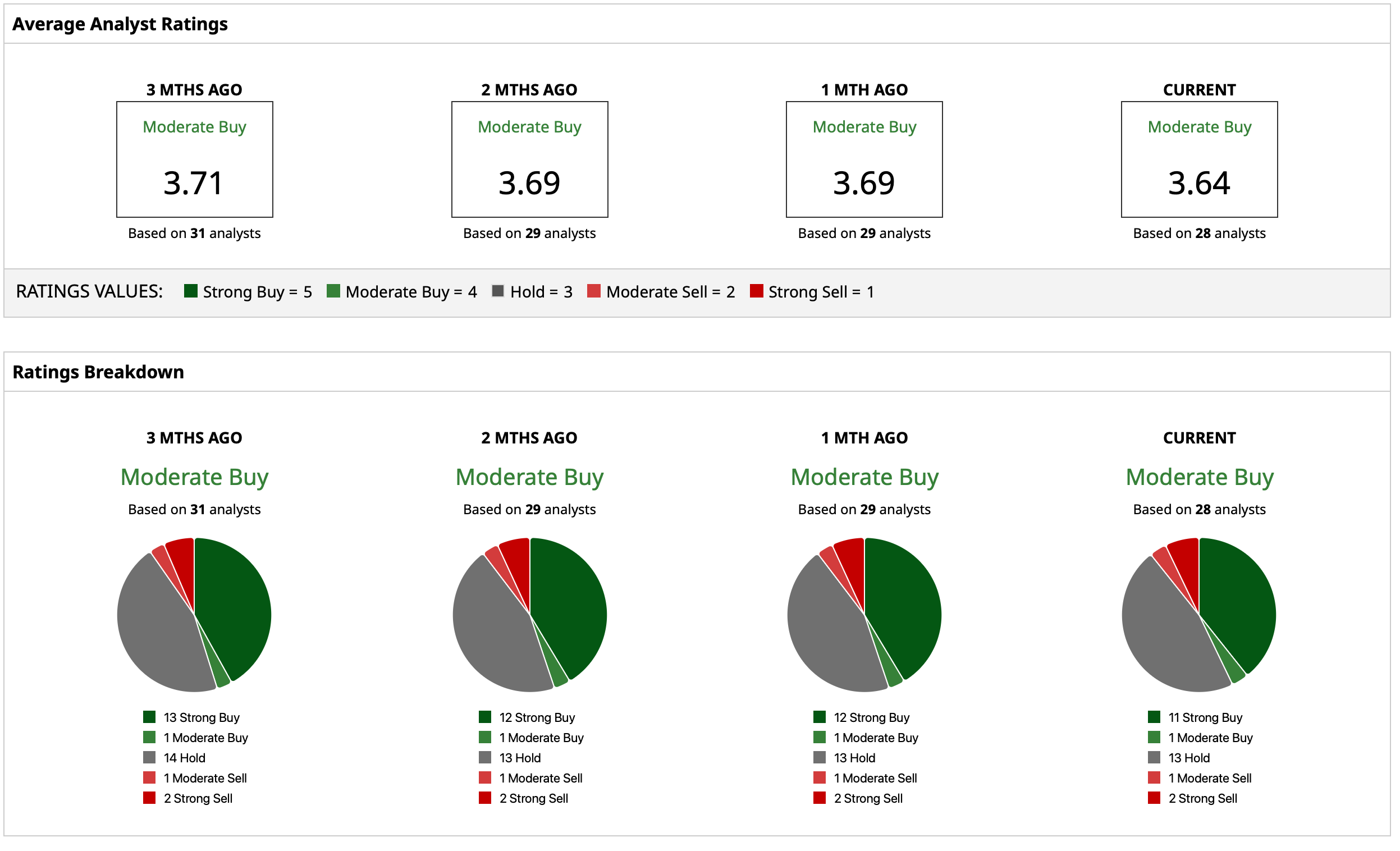

Taking all of this into account, analysts have deemed UPS stock to be a “Moderate Buy,” with a mean target price of $106.65, which indicates an upside potential of about 3% from current levels. Out of 28 analysts covering the stock, 11 have a “Strong Buy” rating, one has a “Moderate Buy” rating, 13 have a “Hold” rating, one has a “Moderate Sell” rating, and two have a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/AI%20microchip%20by%20DesignKingBD360%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)