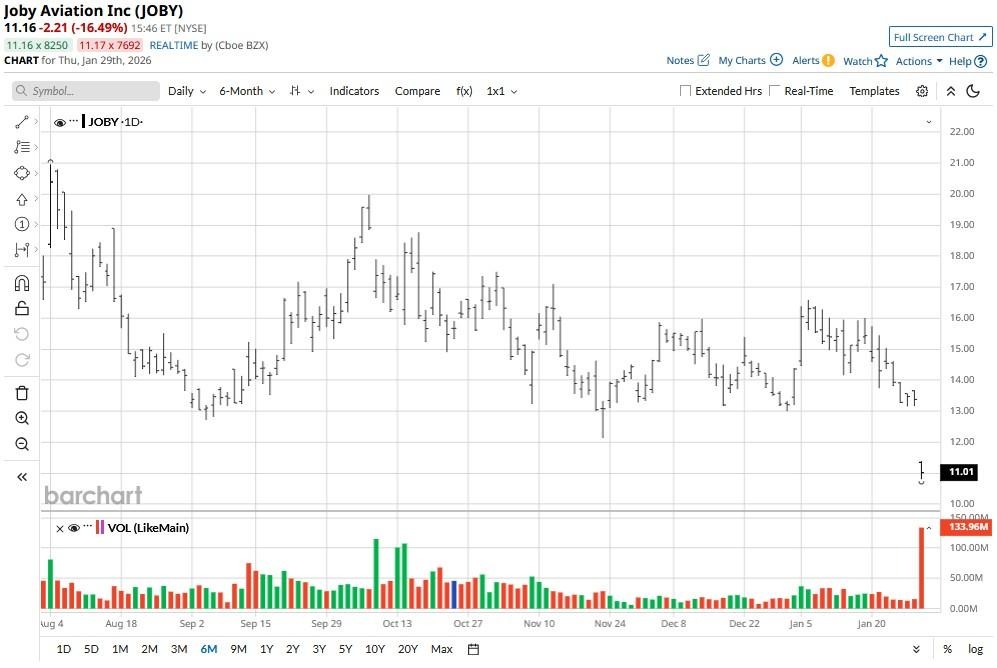

Joby Aviation (JOBY) shares crashed as much as 18% on Jan. 29, after the eVTOL firm announced a significantly upsized capital raise totaling about $1.2 billion. JOBY’s proposed offering includes $600 million in convertible senior notes due 2032 and nearly 53 million shares priced at $11.35, representing a 15% discount to its previous close.

The company’s share price cratered this morning as investors priced in the expected dilution from this capital injection. However, JOBY stock remains up 130% versus its 52-week low.

Here’s Why Joby Stock Is Still Worth Buying

Long-term investors should treat this selloff as a buying opportunity, since the convertible notes feature a 0.75% coupon with a conversion price of about $14.19 per share. This represents a healthy 25% premium to the offering price, indicating management’s confidence in achieving higher valuations over time.

Additionally, even without this capital raise, JOBY had robust liquidity, with roughly $978 million in cash and investments, suggesting the offering was discretionary, not an urgent response to cash depletion.

Following today’s plunge, Joby Aviation’s 14-day relative strength index sits at about 28, signaling extremely oversold conditions that often precede a move higher.

Joby Aviation Has Achieved Significant Milestones

JOBY stock remains attractive because the management’s committed to doubling domestic manufacturing capacity to four aircraft per month by 2027.

Last year, President Donald Trump's administration picked Joby Aviation for its eVTOL pilot program, which acts as major validation for the company’s positioning as a frontrunner in advanced air mobility.

The NYSE-listed firm is expected to secure regulatory approval for commercial air taxi operations in the United Arab Emirates later this year, signaling potential for revenue generation ahead of U.S. certification timelines.

This explains why options traders expect JOBY to be trading at about $13.68, or about 23% above current levels, within the next three months.

How Wall Street Recommends Playing JOBY Shares

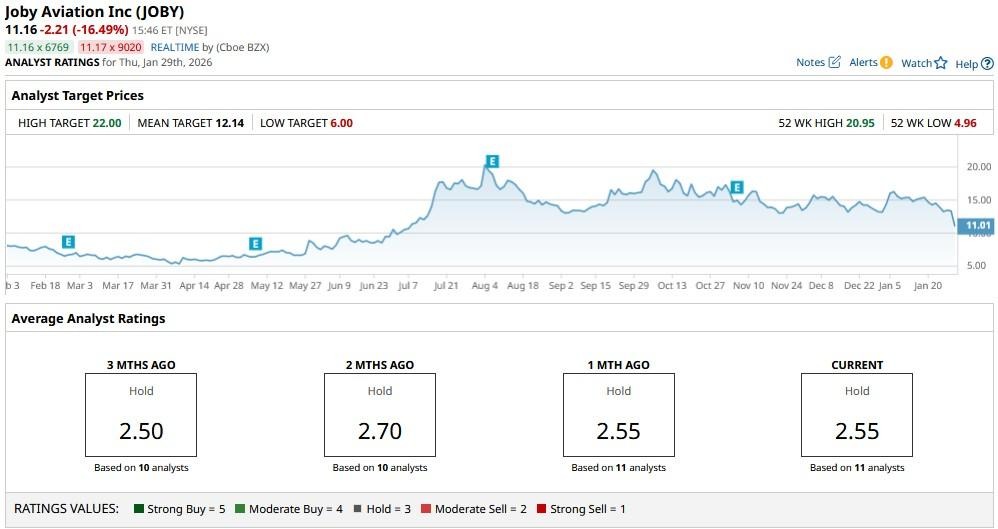

Wall Street analysts also seem to believe the pullback in JOBY stock went a bit too far on Thursday.

While the consensus rating on JOBY shares remains at a “Hold,” the mean target of about $12.14 suggests potential upside of about 10% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/AI%20microchip%20by%20DesignKingBD360%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)