When markets are volatile and clouded by uncertainty, investors look for stability. And you can find that stability in dividend stocks, especially Dividend Kings, which have a track record of paying and increasing dividends consistently for more than 50 years. Johnson & Johnson (JNJ), of the world’s largest and most diversified health care companies, is one such Dividend King.

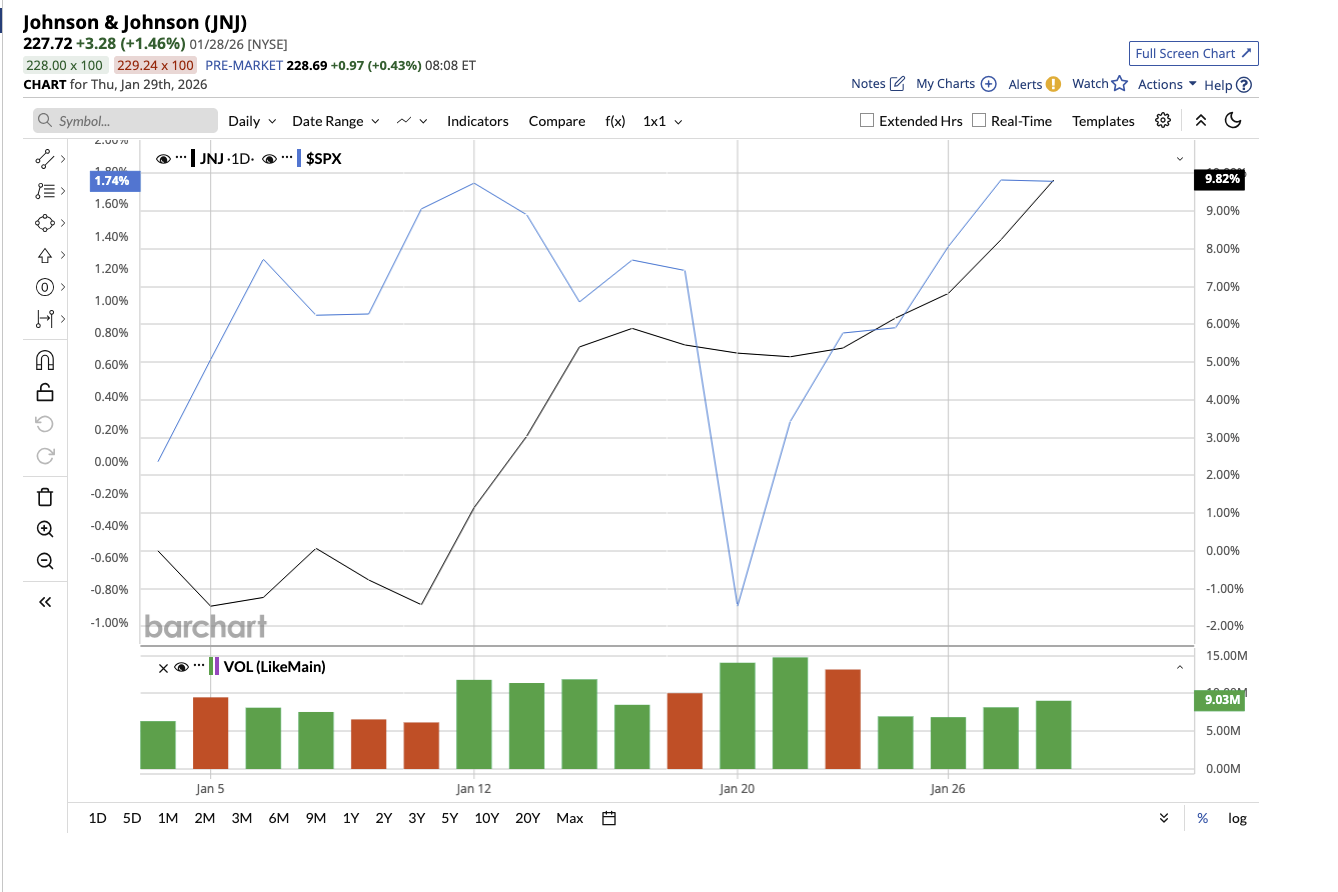

Although J&J is not a high-flying growth stock, it quietly outpaced the market last year. JNJ stock soared 43.7%, compared to the market’s overall gain of 16.6%. One month into 2026, the stock is up more than 10%, surpassing the S&P 500 Index ($SPX).

J&J’s recent fourth-quarter results reveal why you should buy and hold this dividend stock if you don't already.

A Business Built for Long-Term Stability

In 2023, Johnson & Johnson made a bold decision to spin off its consumer division — which was comprised of well-known, everyday brands such as Tylenol, Listerine, Neutrogena, and others — into a separate company called Kenvue (KVUE). The goal was to establish a pure-play health care innovation business concentrated solely on drugs and medical devices. This decision has worked well. Its business today operates in two major segments:

- Innovative Medicine (Pharmaceuticals) focuses on the development of prescription drugs in oncology, immunology, neurology, and cardiovascular and pulmonary diseases.

- MedTech (Medical Devices) refers to medical technologies utilized by hospitals and surgeons.

The Innovative Medicine segment generates the majority of J&J’s revenue and drives most of its growth. In the fourth quarter, the segment generated $15.7 billion in revenue, an increase of 10% year-over-year. For the full year, the segment revenue increased by 6% to $60.4 billion. The company reported a 5.3% increase in worldwide sales of $94.2 billion, despite a significant headwind from the loss of exclusivity on Stelara. Adjusted diluted earnings per share rose 8.1% year over year to $10.79.

With 21% operational sales growth in 2025 and projected annual sales of over $50 billion by 2030, oncology continues to be one of the company's biggest growth engines. Meanwhile, the MedTech segment’s revenue grew 7.5% in Q4 and 6.1% for the full year, generating $34 billion in sales, driven by Cardiovascular, Surgery, and Vision. With over 60 active clinical trials and multiple regulatory submissions planned, MedTech continues to provide a second major growth pillar alongside Pharmaceuticals.

Why This Dividend Stock Stands Out

Together, Johnson & Johnson's two business areas make money from both vital medical equipment and life-saving medications. Its diverse health care empire is not reliant on a single product or trend. Because of this, the company's revenues are often relatively steady, even during recessions, which has enabled it to continuously pay and raise dividends for 63 years. The company generated $19.7 billion in free cash flow in 2025, reinforcing its ability to fund innovation while returning value to shareholders.

Its strong balance sheet, consistent cash generation, and unmatched pipeline allow it to invest heavily in future growth while maintaining shareholder returns. It maintains a reasonable forward payout ratio of 41.4%, and its forward dividend yield of 2.3% is also higher than the health care sector average of 1.6%.

For 2026, management expects operational sales growth of roughly 6%, with total revenue projected to exceed $100 billion. Adjusted earnings per share (EPS) are forecast to rise to around $11.53, in line with consensus estimates. The company expects earnings growth to be supported by continued product launches, operating efficiency, and expanding margins. Free cash flow is expected to increase to roughly $21 billion, giving the company even greater flexibility to invest and reward shareholders.

What Does Wall Street Say About This Dividend Stock?

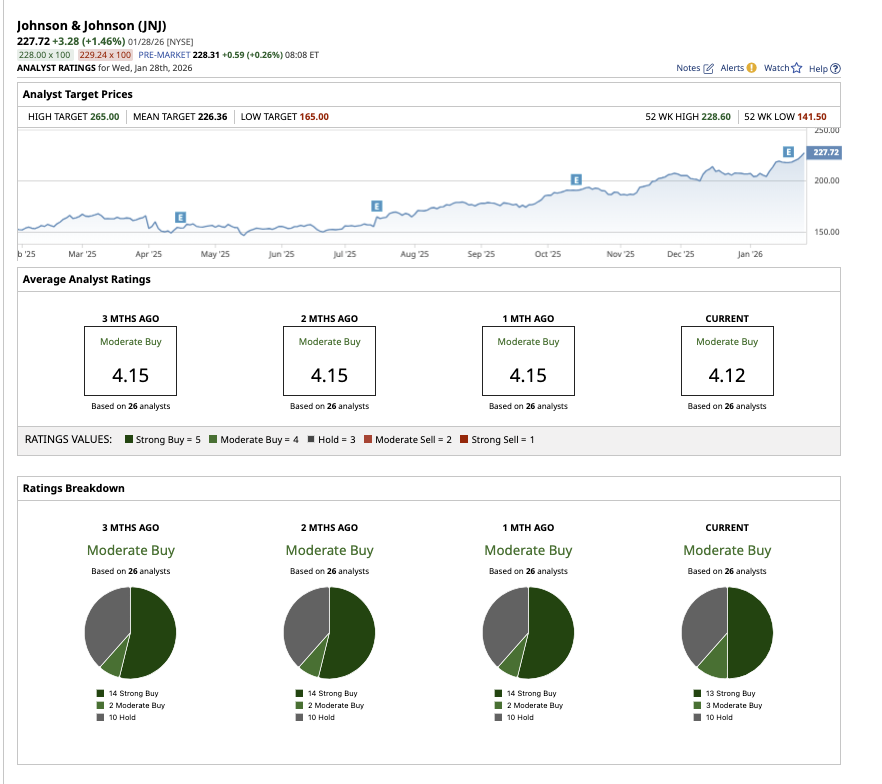

The consensus rating on JNJ stock as a “Moderate Buy.” Out of the 26 analysts covering the stock, 13 rate it a “Strong Buy,” three rate it a “Moderate Buy,” and 10 rate it a “Hold.” JNJ has surpassed its mean target price of $226.36. However, its high target price of $265 implies potential upside of 16.4% in the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

/PayPal%20Holdings%20Inc%20HQ%20photo-by%20bennymarty%20via%20iStock.jpg)