Kenvue (KVUE) shareholders will vote on Kimberly-Clark's (KMB) $48.7 billion acquisition proposal on Thursday, Jan. 29. The merge deal, announced in November 2025, would create a consumer health and wellness powerhouse, combining iconic brands like Band-Aid, Tylenol, and Listerine with Huggies, Kleenex, and Cottonelle.

The transaction offers shareholders $21.01 per share in total consideration, representing a meaningful premium over current trading levels of around $17. Yet with KVUE stock trading roughly 18% below the deal price, investors must weigh the arbitrage opportunity against execution risks, including regulatory hurdles and shareholder approval.

The proposed merger would unite two consumer goods giants serving nearly half the global population. Kimberly-Clark expects to unlock approximately $2.1 billion in synergies while maintaining industry-leading margins across categories. Current KVUE stock shareholders would own 46% while Kimberly-Clark shareholders would own 54% of the combined entity.

With that in mind, let's consider whether investors should buy, sell, or hold Kenvue stock right now.

Is Kenvue Stock a Good Investment Today?

Kenvue's operational struggles paint a concerning picture, making the Kimberly-Clark merger attractive to shareholders seeking an exit. The company posted disappointing third-quarter results with net sales falling 3.5% and organic sales declining 4.4%, continuing a pattern of weakness that has persisted throughout 2025.

What makes these numbers troubling is that volume dropped 4% while Kenvue also lost ground on pricing power, with value realization slipping 0.4%. The declines hit every part of Kenvue's business: Self-Care saw organic sales tumble 5.3%, Skin Health and Beauty dropped 3.5%, and Essential Health fell 4.2%.

Unusually low seasonal incidences of allergies and flu certainly hurt demand for products like Zyrtec and Tylenol. However, the company also faced inventory reductions at major retailers, along with shipment timing issues in China, suggesting deeper distribution problems. Management highlighted bright spots, such as market share gains and household penetration growth, for flagship brands.

Zyrtec has held the number one position in adult allergy for 17 straight quarters, and Tylenol continues gaining share in pain relief. But these wins haven't translated into actual sales growth, which raises questions about whether the company can turn things around on its own.

Free cash flow improved to nearly $1 billion from $700 million in the prior year, indicating management’s focus on cost control. Gross margins expanded by 60 basis points through productivity improvements, though operating margins still contracted as the company spent more on brand support trying to jumpstart growth.

Looking at these fundamentals, the merger starts making more sense. Kenvue has struggled to generate momentum as a standalone company since spinning off from Johnson & Johnson (JNJ). The combination with Kimberly-Clark offers shareholders a chance to exit at a premium while gaining exposure to a larger entity with better growth prospects and stronger operational leverage.

What Do Analysts Think of KVUE Stock?

Analysts tracking Kenvue forecast revenue to increase from $15 billion in 2025 to $17 billion in 2029. In this period, free cash flow is projected to grow from $1.55 billion to $2.8 billion.

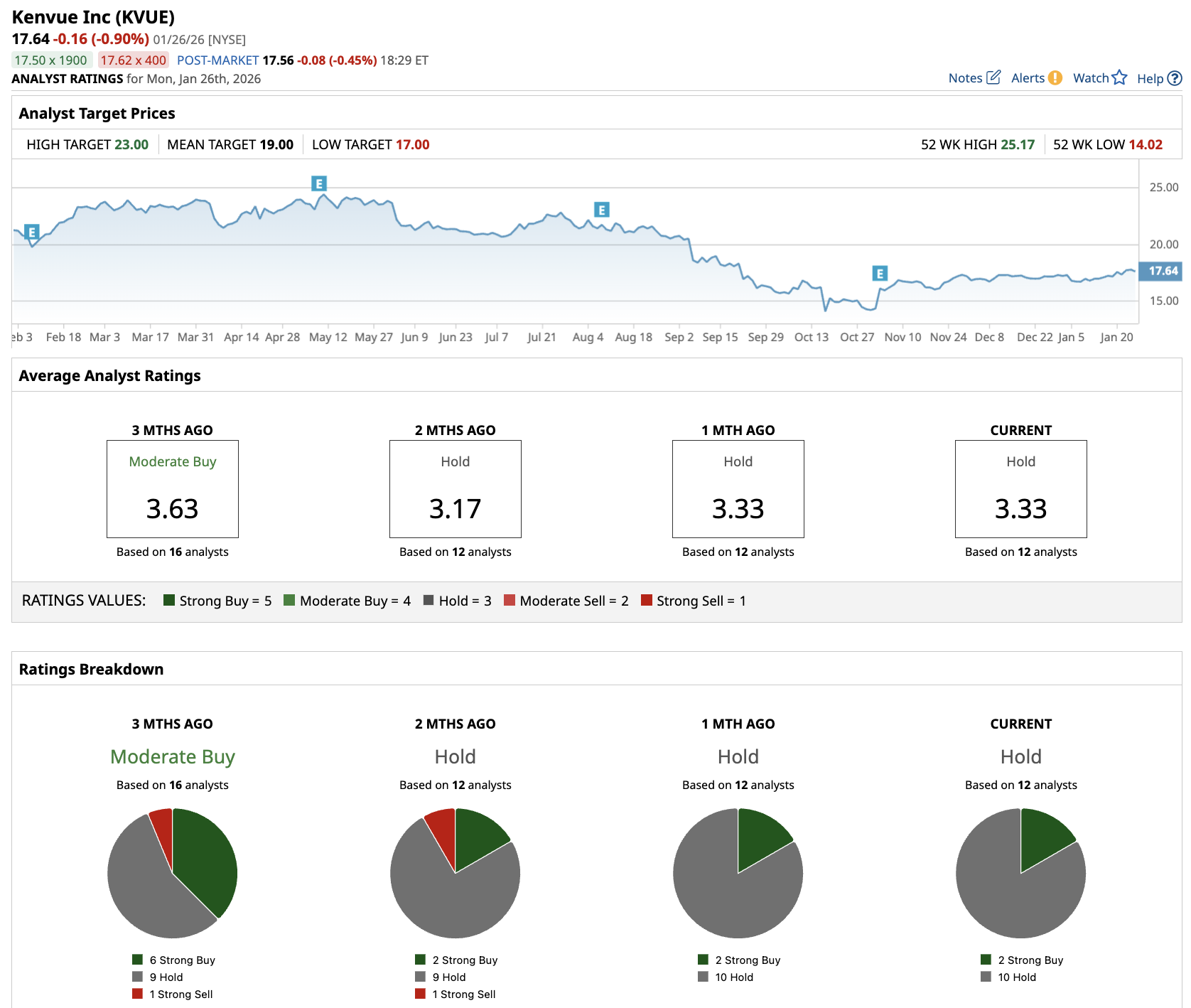

Out of the 12 analysts tracking KVUE stock, two recommend a “Strong Buy" while 10 analysts recommend a “Hold” rating. The average price target is $19 per share, which is roughly 10% above the current price of $17.30.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)