/Microsoft%20France%20headquarters%20by%20JeanLuclchard%20via%20Shutterstock.jpg)

The last 52 weeks have been relatively volatile for Microsoft (MSFT) stock, with muted returns of 7.4%. Further, from highs of $555.45, there has been a meaningful correction, and MSFT stock currently trades at about $481.

Amidst this volatility, there have been few positive fundamental developments for Microsoft, making the stock attractive. Recently, Microsoft released its artificial intelligence accelerator chip, Maia 200.

The company’s executive vice president of cloud and AI, Scott Guthrie, has indicated that the chip outperforms AI chips built by competitors such as Amazon (AMZN) and Alphabet's (GOOG) (GOOGL) Google.

It’s worth noting that the Maia 200 chip is packaged with SRAM, which is a type of memory that provides a speed advantage for chatbots and other AI systems. With Maia 200 deployments set to ramp up in the second half of the year, it’s likely to have a positive impact on value creation.

About Microsoft Stock

Headquartered in Redmond, Washington, Microsoft is a provider of software, services, devices, and solutions globally. The software giant’s core segments include productivity & business process, intelligent cloud, and personal computing. Microsoft is currently focused on platforms and tools that are powered by AI.

For Microsoft, the intelligent cloud business has been a key growth driver in the last few years. For Q1 2026, revenue from Azure and other cloud businesses increased by 40% on a year-on-year (YoY) basis.

While business developments remain positive, MSFT stock has trended marginally lower by 6% in the last six months.

This seems like a good accumulation opportunity as AI tailwinds are likely to ensure healthy growth. As the company’s Chairman and CEO, Satya Nadella points out that Microsoft continues to increase its “investments in AI across both capital and talent to meet the massive opportunity ahead.”

Multiple Growth Catalysts

Data indicates that the cloud computing market is expected to swell from $1.3 trillion in 2025 to $2.3 trillion by 2030. This presents a big opportunity for Microsoft to sustain the growth momentum in the “intelligent cloud” segment. Further, with the innovation edge, AI is likely to unlock higher cloud value and ensure that Microsoft maintains or gains market share.

Recently, Morgan Stanley opined that “continued migration of data workloads to the cloud” will allow “hyperscalers” like Microsoft to increase their cybersecurity market share. It’s expected that the cybersecurity market size will increase to $878.48 billion by 2034. Therefore, this is another segment that can drive growth.

It’s also worth mentioning that the company’s new AI accelerator chips can potentially compete with Nvidia (NVDA) and provide some inroads in an attractive market. Amidst these positives, it’s important to note that Microsoft is well positioned from a financial perspective. As of Q1, the company reported $102 billion in cash and short-term investments. Further, operating cash flow for the quarter was $45 billion.

With high financial flexibility, Microsoft is well positioned to make big investments. For Q1, the company’s capital expenditure was $19.4 billion. At the same time, robust financial flexibility allows Microsoft to create shareholder value through dividends and share repurchase.

What Analysts Say About MSFT Stock

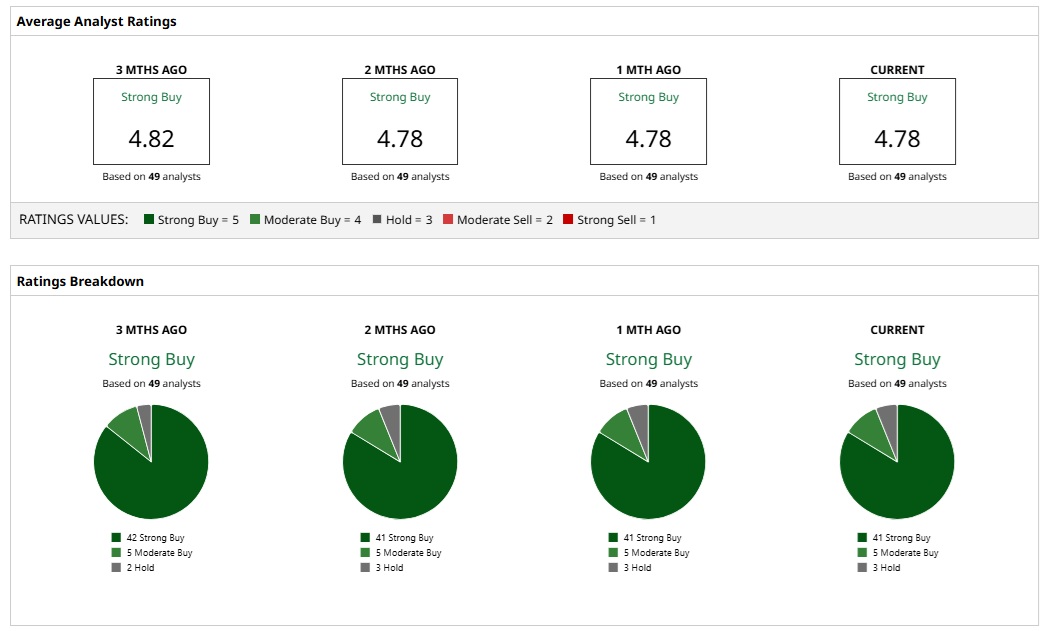

Given the ratings of 49 analysts, MSFT stock is a consensus “Strong Buy.” An overwhelming majority of 41 analysts assign a “Strong Buy” rating to MSFT. Further, three analysts and two analysts have “Moderate Buy” and “Hold” ratings, respectively.

Based on these ratings, analysts have a mean price target of $618.07 currently, which would imply an upside potential of 29%. Further, the most bullish price target of $678 suggests that MSFT stock could rise as much as 41% from here.

The positive view is further underscored by the point that MSFT stock trades at a forward price-earnings ratio of 29.4. With visibility for healthy earnings growth and sustained upside in cash flows, valuations are attractive.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)