For most of the AI boom, investors have been fixated on GPU makers and hyperscale cloud players. This has been an incredible trade. Yet, according to a recent Jefferies note, the AI investment cycle is no longer in its expansion phase. It’s entering the phase where pricing power and capital discipline are more important than simply having the best computing platform.

In fact, according to Jefferies analyst Christopher Wood, memory makers are now the new chokepoints in the AI ecosystem. This is because AI workloads are moving from experiments to production inference. As such, there has been a sudden surge in the need for high-end memory and storage solutions. This is already evident in rising memory prices and the stock price performance of the leading memory makers.

The good news is that this trend is unfolding as some of the major storage and memory makers are about to report their quarterly earnings. This will give investors an opportunity to gauge whether this trend has legs.

About Micron Technology Stock

Micron Technology (MU) is one of the largest memory and storage makers in the world. The company’s products are used in various markets, including data centers, AI accelerators, consumer electronics, automotive, and industrial markets. The company’s headquarters are based in Boise, Idaho. It has a market capitalization of about $450 billion, putting it in the list of the most systemically important semiconductor makers in the world.

In the last 52 weeks, the MU stock has seen an incredible run. The stock has moved significantly higher from its low of about $62 to today's new high of about $414. MU stock has seen a huge gain over the last year, significantly outperforming the S&P 500 ($SPX).

From a valuation standpoint, Micron appears to still be reasonable in relation to its earnings capabilities. The current stock trades at 37x trailing earnings and 12.35x forward earnings, reflecting analysts’ estimates of further margin improvement and cash flow growth. With a return on equity above 22% and a debt-to-equity ratio of 0.20, Micron enters this phase with a solid balance sheet and flexibility.

In addition, Micron offers a dividend payout of $0.115 per share on a quarterly basis; however, this investment thesis has far more to do with earnings leverage than income generation.

Micron Beats on Earnings as AI Demand Accelerates

Micron announced fiscal Q1 2026 results on Dec. 17, which beat Wall Street estimates handily. Revenue was $13.64 billion, an increase from $11.32 billion the prior quarter and $8.71 billion a year ago. GAAP earnings came in at $4.60 per share, while non-GAAP earnings per share rose to $4.78.

Margins were equally impressive: gross margins rose to almost 57% on a non-GAAP basis, while operating income grew to $6.4 billion. Operating cash flow was $8.41 billion, and adjusted free cash flow came in at a record $3.9 billion, reflecting robust pricing across all memory markets.

Management expects further records to be set in fiscal Q2 as high demand from AI customers continues and high-value memory markets remain constrained. Micron CEO Sanjay Mehrotra stated that they are seeing sustained demand from AI customers and high-end memory markets.

While the company has yet to announce the exact date for the next earnings announcement, investors are eagerly awaiting confirmation that the price trend will continue into 2026.

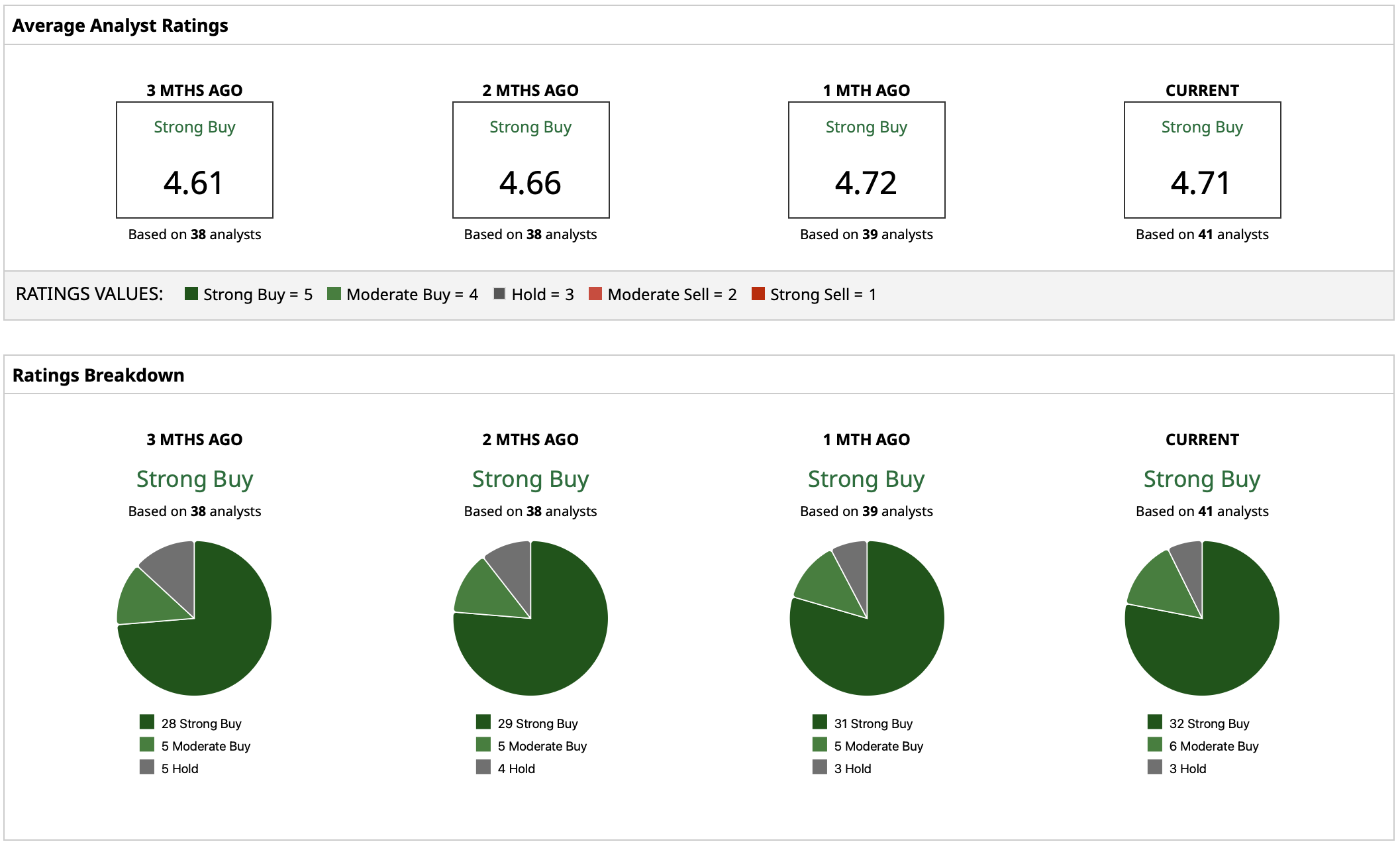

What Do Analysts Expect for MU Stock?

MU has a “Strong Buy” rating consensus, and while the stock has received price targets ranging from $107 to $500, the exact duration for which the company will benefit from the high prices of memory chips remains unknown. The mean price target for MU stock is $330.46, which indicates a decline from the recent stock prices. This may mean that the recent optimism for Micron's stock is already factored into the prices.

On the date of publication, Yiannis Zourmpanos had a position in: MU . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)