I am Stephen Davis, senior market strategist at Walsh Trading, Inc., Chicago, Illinois. You can reach me at 312-878-2391.

In last week's post, I mentioned that China's economy is growing. Its Gross Domestic Product (GDP) will hit the target of 5%, said Chinese President Xi Jinping in his 2026 New Year message. This growth could mean China's demand for commodities, and especially soybeans, could increase dramatically, in my opinion. China has fulfilled its initial commitment to buy 12 million metric tons of soybeans from the United States. However, fluctuating Trump administration trade policies could affect China's commitment to purchase 25 million metric tons of American soybeans in each of the next three years.

Meanwhile, the soybean harvest is beginning in Brazil, which means an increasing amount of soybeans will be on the market. Analysts reports indicate that due to record production and competitive prices, China is expected to increase imports of Brazilian soybeans in the first half of 2026.

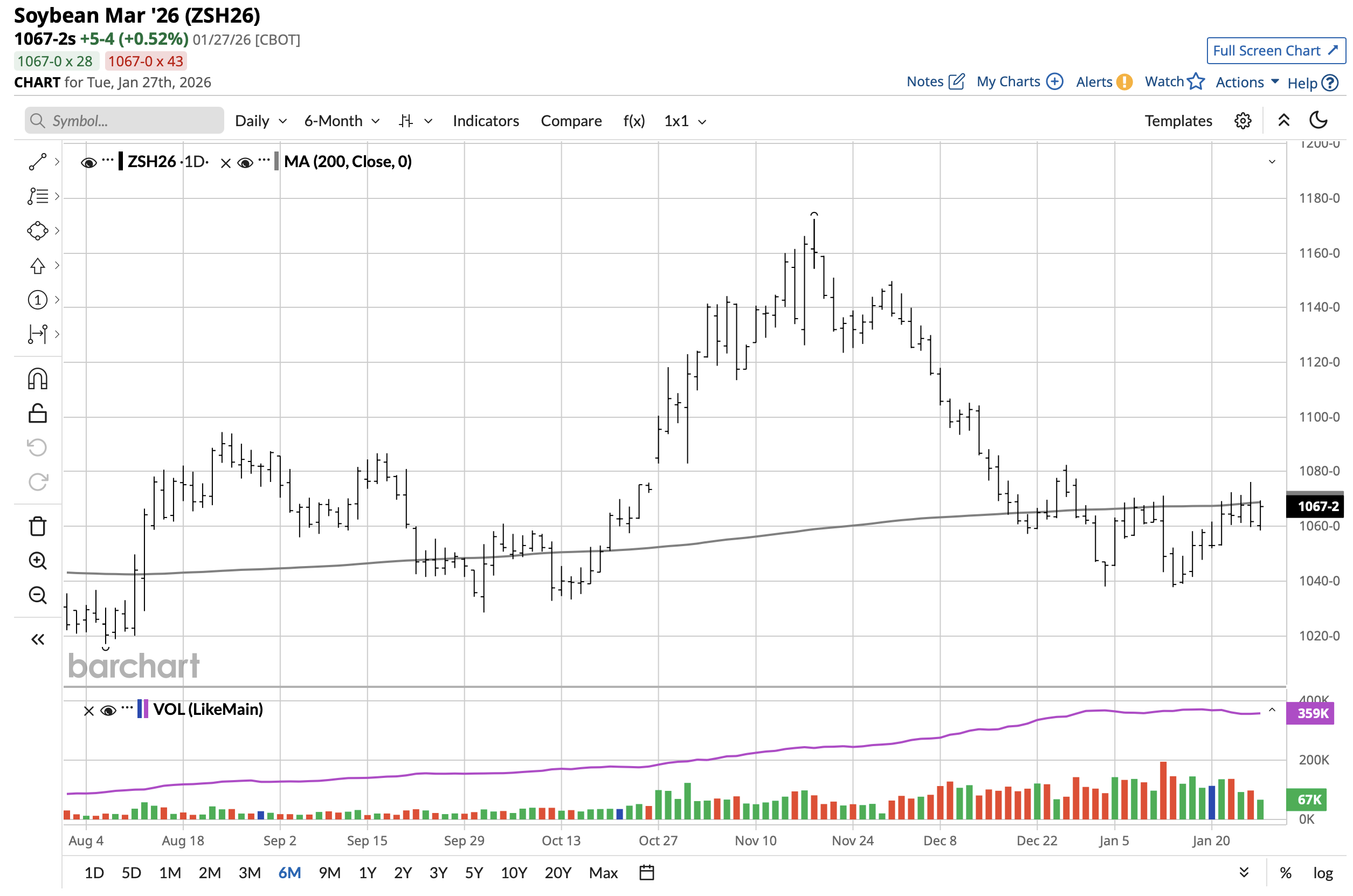

Below is a daily chart that shows today's March 2026 soybean futures prices flirting with the 200-day moving average. Back in October, soybean futures started a rally at 1050 reaching 1172-4 on November 18. Some would say this is a contrarian view, but, in my opinion, being bullish on soybeans at this time of year is a good thing.

A futures trade strategy is to buy March 2026 soybean at 1059.6, which was yesterday's low. Risk the trade 1047.0 stop. Profit objective is 1079.6. That's a good risk/reward ratio, in my opinion.

An options strategy is to sell three March 2026 soybean 1050 puts at 6.0. With that premium, buy one May 2026 soybean 11.00 at 17.3 (today's settlement price). The puts you sell will pay for the call you buy. The March 2026 soybean expiration is February 20, 2026.

.

To discuss trading strategies, contact me anytime. Have an excellent day.

Stephen Davis

Senior Market Strategist

Walsh Trading

Direct 312 878 2391

Toll Free 800 556 9411

sdavis@walshtrading.com

www.walshtrading.com

Use this link to join my email list: SIGN UP NOW

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)

/Seagate%20Technology%20Holdings%20Plc%20office-by%20JHVEPhoto%20via%20Shutterstock.jpg)