Elon Musk is renowned for his blunt takes, big stunts, and Silicon Valley ambitions. So when he starts talking up somebody else’s product, it’s got to be a pretty big deal, right?

That’s why everybody’s really paying attention to Nvidia (NVDA) at the moment.

As always, there were plenty of weird and wonderful innovations on display at this year’s CES 2026. But Nvidia blew all of its competitors out of the water with the unveiling of its new Rubin platform. Comprising six new chips, Rubin is effectively an AI supercomputer that’s cheaper, faster, and smarter than anything else ever to appear on the market.

That’s a pretty tantalizing proposition, which is why Elon Musk immediately took to X (formerly Twitter) and declared that Rubin will be “a rocket engine for AI.” He went on to call Nvidia “the gold standard” when it comes to infrastructure, and it's important to note that this isn’t just corporate flattery.

It’s a clear market signal.

Nvidia’s new chips aren’t just another showy GPU. If the company can deliver on what it’s promising for Rubin, these chips will unite to form a rack-scale AI supercomputer that solidifies Nvidia’s position as we move into the next phase of AI development.

But before we start fantasizing about the AI revolution and Nvidia’s rising share prices, let’s pump the brakes and take a look at what Rubin really is and what this all means for everyday investors.

What Can Nvidia’s New Rubin Chips Actually Do?

Nvidia has been at the forefront of the AI arms race for a couple of years now, so nobody was surprised to hear they’d have something shiny to present at this year’s CES in Las Vegas. Yet few pundits expected Nvidia’s new supercomputer to be a complete game-changer.

Rubin isn’t a faster GPU. It’s a brand-new ecosystem that’s been built from the ground up to support the next generation of AI models.

Its GPU is a graphics processor designed for colossal AI compute. We’re talking 50 petaflops of NVFP4 inference powered by a third-gen Transformer Engine. Then, its Vera CPU has been totally optimized for reasoning workloads and AI data movement (not just general compute). Rubin’s also got a chip that provides ultra-fast GPU-to-GPU connectivity, a next-level networking and data processing chip, and a Spectrum-6 Ethernet Switch to support high-bandwidth networking.

Okay, so, unless you're a complete computer geek and/or super into AI hardware, some of this will just sound like technical mambo-jumbo. In simpler terms, Rubin’s system makes chips and networking operate as a more cohesive unit rather than a loose set of components. That means costs are dramatically reduced, and companies need four times fewer GPUs to train giant models.

In practice, data centers using Rubin will be able to scale exponentially faster, cheaper, and more efficiently. Rubin isn’t just some “cool,” incremental improvement. It’s a complete change in how large-scale AI can be built and deployed, and big names like Elon Musk can clearly already envision what these new chips mean for the wider tech space.

Elon Musk’s Praise Is Strategic Recognition

Let’s be honest: Elon Musk doesn't hand out compliments to everybody. This is especially true when it’s a company that he’s more or less competing with in the AI vertical. That’s why the praise he’s been heaping on Nvidia carries a lot of weight.

Musk is already investing a lot of time and money into xAI, and he knows he needs top-tier infrastructure to make everything work. Although Musk is a guy who likes to cut out supply chains and do everything solo, he also seems to understand that you can’t reinvent every wheel. To succeed in Silicon Valley, you’ve got to partner up or use the best possible infrastructure to get the job done.

That’s where Rubin comes in.

These chips should bridge the gap between AI training and the real-world agentic systems Musk is keen to exploit. He wants to make things autonomous, and Nvidia’s new system sounds like it can get him there faster and cheaper.

Long story short, Elon Musk knows he’s going to need Nvidia’s help to achieve his AI ambitions. So, his tweets aren’t just a corporate courtesy or a favor to Nvidia CEO Jensen Huang. They're an acknowledgment that Rubin effectively changes the plumbing of AI infrastructure.

And because this is the layer where everyone thinks the real economic value of AI will materialize, Musk’s endorsement should drive serious market attention.

What Does Rubin Mean for Investors?

Still with us? Good, because this is where we can stop talking about tech jargon and get down to what all this means for Wall Street.

First and foremost, you can expect the cost per token to drop significantly for companies invested in AI. Every AI model consumes “tokens” in the same way your car burns gas. Every interference and interaction processes a token, which affects a company’s bottom line.

Well, Rubin is promising a 10-fold decrease in inference token costs (priced against current Blackwell platforms). That means AI services will either enjoy higher margins due to lower overheads or be able to price competitors out of the market by passing those savings on to consumers.

For data centers and hyperscalers like Alphabet (GOOG) (GOOGL), Amazon (AMZN), and Microsoft (MSFT), these savings could totally reshape business models. Share prices can only strengthen as a result.

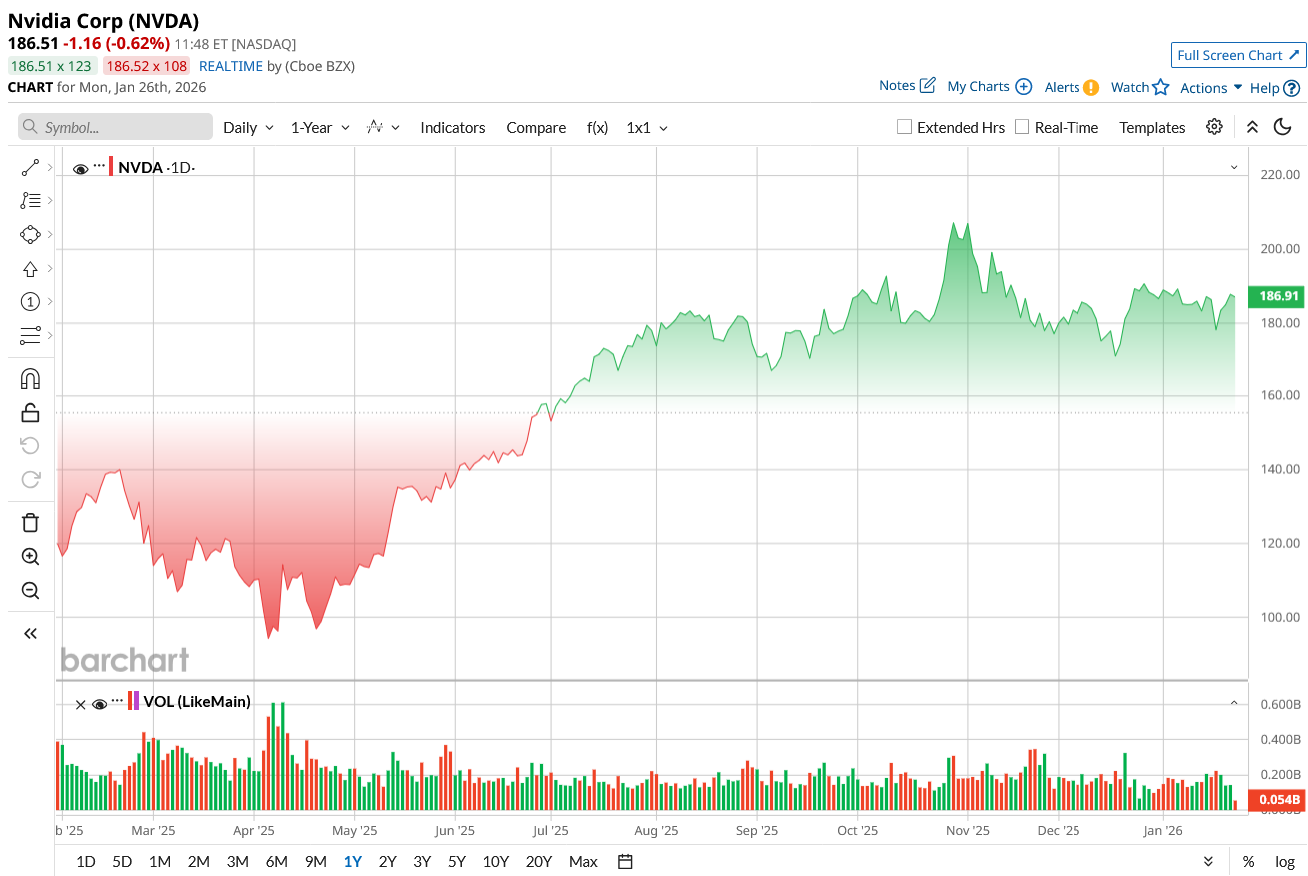

Meanwhile, Nvidia’s going nowhere but up.

Partners like OpenAI and Meta (META) already rely on Nvidia to help process and manage serious AI workloads. But Rubin has just cornered the market by creating a new all-in-one infrastructure. Hyperscalers don’t have to worry about piecemeal solutions anymore—and so they’re basically going to be trapped in partnership with Nvidia over the course of the next decade.

That’s a massive win for Nvidia and a challenge to anybody else trying to rival the company for a share in this space. Rubin systems are expected to start reaching customers in H2 of this year, and cloud providers will begin integrating the chips into real-world workloads almost immediately.

Infrastructure is the key factor that underpins revenue forecasts and valuation multiples. So if Rubin lowers barriers to AI adoption, services and applications will expand drastically. That’s going to matter a lot where earnings models and growth narratives are concerned—which means you can bet your bottom dollar this will impact many tech stocks in the year ahead.

Rubin has Elon Musk’s attention. That should be enough for you to keep a close eye on Nvidia, too.

On the date of publication, Nash Riggins did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)