/Intel%20Corp_%20badge%20holder-by%20hasrul_rais%20via%20Shutterstock.jpg)

Intel (INTC) stock crashed more than 17% on Friday after the chipmaker delivered fourth-quarter earnings that beat Wall Street estimates but issued disappointing guidance for the current quarter. The selloff marked the worst single-day decline for Intel since August 2024.

Intel reported adjusted earnings of $0.15 per share on revenue of $13.7 billion for the fourth quarter, topping analyst expectations of $0.08 per share on $13.4 billion in sales. However, Intel projected first-quarter revenue between $11.7 billion and $12.7 billion with breakeven adjusted earnings per share, falling short of the Wall Street consensus for $0.05 earnings per share on $12.51 billion in revenue.

Intel Is Struggling With Manufacturing Challenges

CEO Lip-Bu Tan warned investors that the turnaround would take time and require resolve. Intel faces supply constraints that prevent it from meeting full product demand. Production efficiency, known as yield, remains below target levels across manufacturing nodes.

Finance chief David Zinsner told CNBC the supply situation should improve in the second quarter, but gross margins are expected to stay under pressure and remain below 40% for the foreseeable future.

Wall Street analysts expressed skepticism about Intel's path forward despite recent momentum. The stock had rallied sharply in recent months following major investments from the U.S. government, SoftBank (SFTBY), and Nvidia (NVDA), all of which became significant shareholders.

Investors had been hoping for clarity on foundry customers as the next catalyst for the stock, but analysts at RBC Capital Markets warned that meaningful revenue contributions from Intel's next-generation 14A technology might not materialize until late 2028.

The competitive landscape looks challenging. Analysts noted Intel continues to lose ground to AMD (AMD) in the server market and is missing out on strong demand for data center chips.

Intel is trailing peers in the AI segment, and its foundry opportunities remain uncertain. Let’s see if INTC stock can justify its current valuations and continue to deliver outsized returns to shareholders.

Is INTC Stock a Good Buy Right Now?

Intel depleted its buffer inventory in the second half of 2025 as it tried to meet demand from cloud computing customers. Management was prepared for higher core counts per server but not higher overall unit volumes.

Intel ended Q4 with $11.6 billion in total inventory, yet much of it remains in the wrong form or wrong location to address current shortages. The chipmaker is prioritizing available wafer supply toward data center customers rather than personal computer makers.

This shift has resulted in steeper projected revenue declines for the client computing business than the server segment in the first quarter. The midpoint guidance of $12.2 billion represents the low end of typical seasonal patterns for the period.

Gross margins dropped to 34.5% in the first-quarter outlook, compared with 37.9% in the fourth quarter.

The margin pressure stems from three factors:

- Lower revenue hurts margins in a business with largely fixed costs.

- Increased production volumes of the new Core Ultra Series 3 processors built on Intel's 18A manufacturing process are dilutive to the corporate average despite improving cost structures.

- The product mix also works against margins as Intel shifts toward lower-margin server chips to meet hyperscaler demand.

Management expects supply constraints to ease throughout 2026 as the factory network ramps up production. Intel plans to increase wafer starts across Intel 7, Intel 3, and 18A nodes every quarter this year.

The company is focused on capital spending on manufacturing tools rather than cleanroom space. This will help it maintain capital expenditures flat to slightly down year-over-year (YoY) in 2026 while shifting the mix toward production equipment.

CEO Tan emphasized yield improvements of roughly 7% to 8% per month as critical to addressing supply shortages without requiring additional capital investment. However, he acknowledged yields remain below industry-leading standards despite meeting internal targets.

What Is the INTC Stock Price Target?

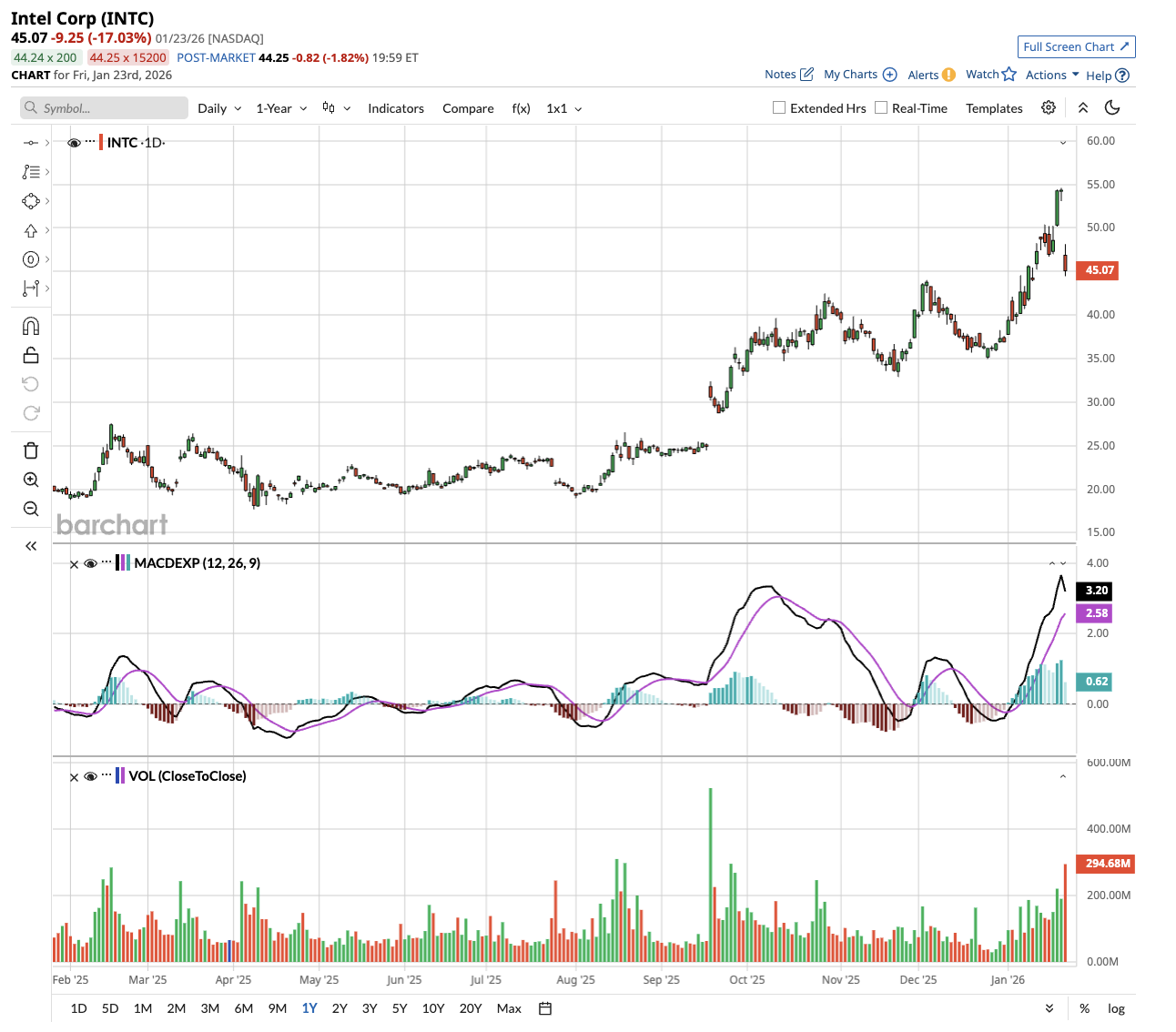

Despite the ongoing pullback, Intel's stock has returned more than 100% to shareholders in the last 12 months.

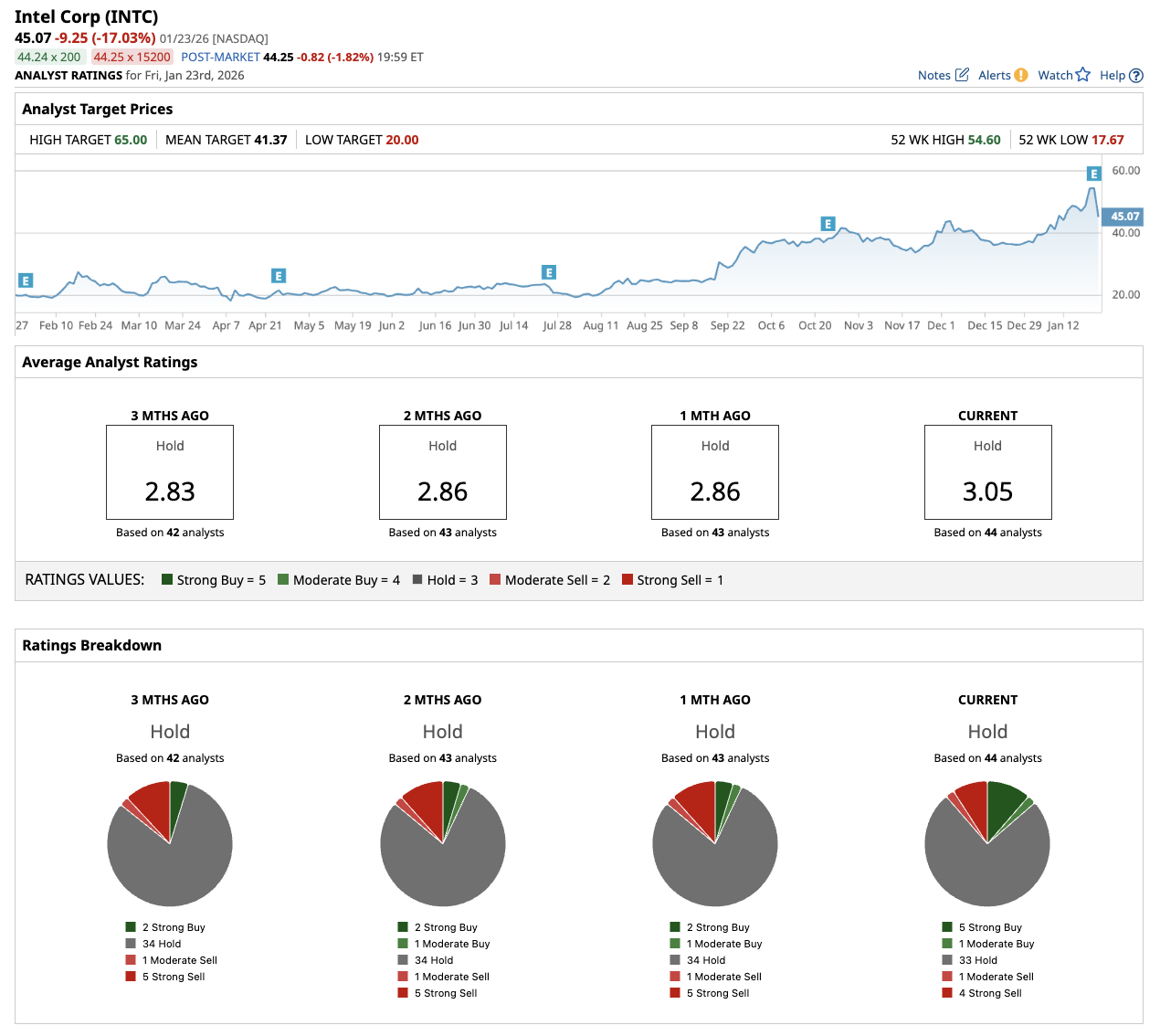

Out of the 44 analysts tracking INTC stock, five recommend “Strong Buy,” one recommends “Moderate Buy,” 33 recommend “Hold,” one recommends “Moderate Sell,” and four recommend “Strong Sell.” The INTC stock price target is $41, below the current price of $45.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)