When Policy Patience Meets Long Term Duration

The 30 Year Treasury Bond represents the long end of the United States yield curve and is highly sensitive to inflation expectations, growth outlooks, and Federal Reserve policy guidance. While short term Treasury bills and notes such as the two year and five year maturities tend to respond most directly to changes in policy rate expectations, the long bond reflects investor confidence in long term price stability and fiscal sustainability.

Currently, bond prices are being shaped by persistently firm inflation data, a still resilient labor market, and deliberately cautious Federal Reserve communication. Policymakers continue to stress data dependence and patience, keeping risk appetite muted across duration. Ahead of the upcoming FOMC meeting, futures markets are positioned for no change in policy, with a 97.2 percent probability that rates remain on hold, signaling broad alignment among voting members to maintain restrictive conditions.

The two year Treasury yield reinforces this stance by indicating that markets are pricing out near term rate cuts. As a result, upside momentum in the long bond has remained constrained, with higher for longer expectations weighing on duration sensitive assets. Sentiment could shift quickly on inflation surprises, meaningful revisions to employment data, or any change in Federal Reserve language that signals growing concern over economic slowing relative to inflation risks.

What the Market Has Done

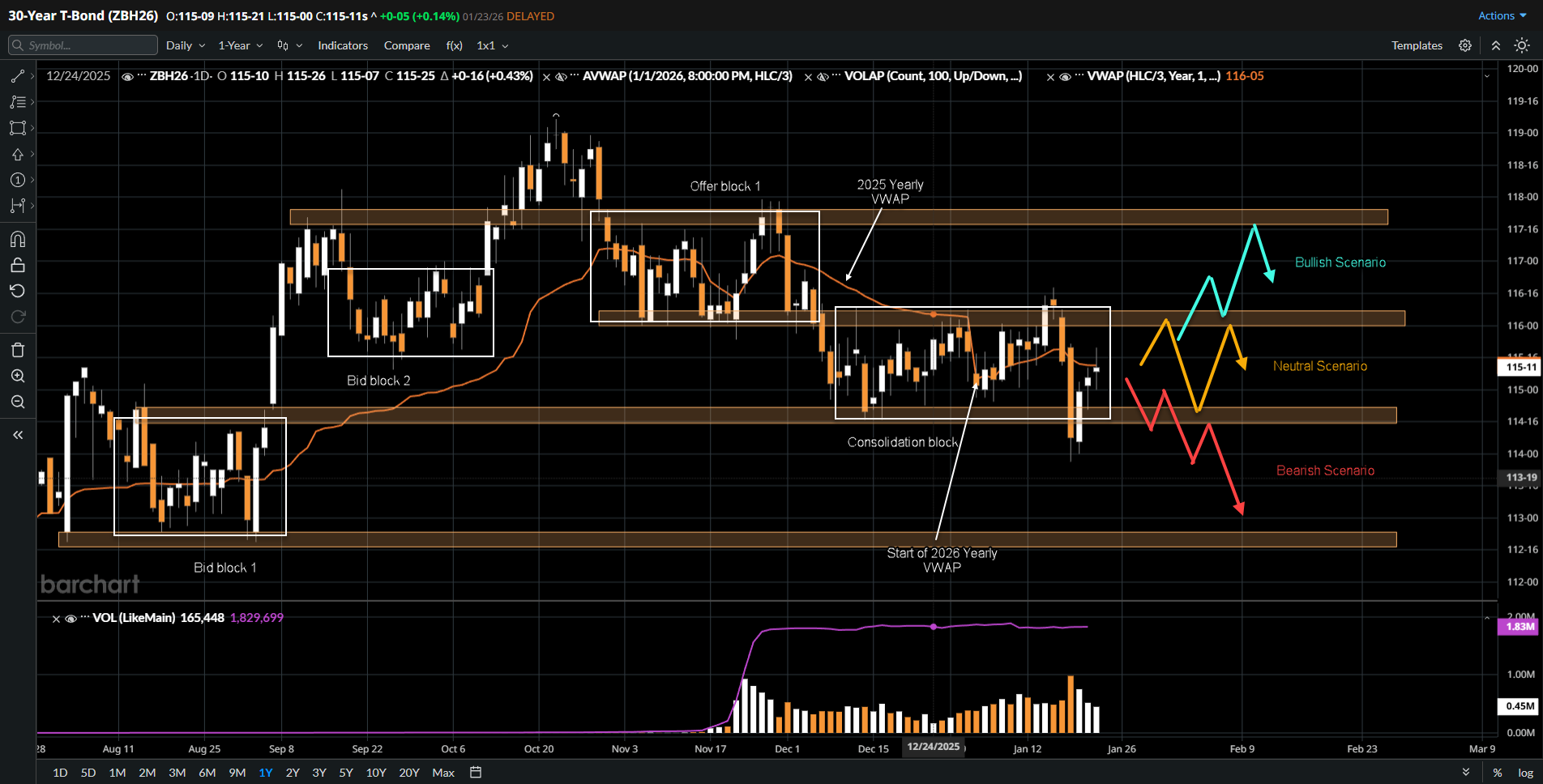

- The market attempted to stay above the 115'00 area in September 2025 as softer inflation readings and expectations for an eventual policy pivot attracted duration buyers seeking exposure to the long end.

- Price was able to accept higher above 115'00 into December, but buyers ultimately failed to defend that level as inflation remained firm and Federal Reserve messaging pushed back against near term easing expectations.

- Following the failed acceptance, the market auctioned back into the longer term balance range between 115'00 and 112'20, which has acted as structural support since the start of 2025 as longer term participants continued to defend value.

- The market is currently chopping around the 2025 yearly VWAP, reinforcing the view that price is in balance and that neither buyers nor sellers have established meaningful control.

- Overall, ZB remains balanced within a defined consolidation block between offer block 1 above and bid block 1 below, reflecting rotational trade rather than directional conviction.

What to Expect in the Coming Weeks

Key levels to watch remain the top and bottom of the current balance range at 116'00 and 114'20, as acceptance or rejection around these areas will likely dictate the next directional auction.

Neutral Scenario

- The market may remain balanced between 116'00 and 114'20 if inflation data fails to provide a new catalyst and expectations continue to center around rates holding steady.

- In this environment, rotational trade within the consolidation block is likely to persist as participants await clearer macro direction.

Bullish Scenario

- Early signs of strength would include the market holding bids above the 115'10 area, which represents the midpoint of the current consolidation block.

- If price is able to break and accept above 116'00, buyers could drive an auction higher through the offer block with upside targets toward the 117'15 area.

Bearish Scenario

- If buyers fail to defend the 114'20 level, sellers may regain control and offer prices lower through bid block 1.

- A sustained move lower could open the door for a deeper rotation back toward the 112'20 area, which remains a key long term support reference.

Conclusion

ZB futures remain in balance as macro fundamentals and technical structure align around policy uncertainty. With the Federal Reserve signaling patience, the two year yield pricing out near term cuts, and long term inflation expectations still elevated, the long bond is waiting for a catalyst to resolve its current range. Technically, acceptance above 116'00 or rejection below 114'20 will provide important clues about the next directional auction. Until then, traders should continue to respect the current balance while remaining alert to shifts in policy expectations and economic data that could drive a breakout.

If you are actively trading rates or related markets, now is a good time to refine your levels, scenarios, and risk framework as the bond market approaches an inflection point.

For traders focused on macro markets such as interest rates and currencies, trading futures offers transparency, centralized pricing, and regulated execution that ETFs cannot match. “Edge Clear LLC” provides direct access to global futures markets with reliable execution and trader focused platforms built for serious market participation. Traders looking to express views in the bond market may want to explore futures as a flexible and capital efficient alternative. Check out “Edge Clear LLC” at edgeclear.com.

Disclaimer:

This article is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. The analysis presented reflects the author’s market observations and opinions at the time of writing and is not a recommendation to buy or sell any futures contract, security, or financial instrument. Futures trading involves significant risk and is not suitable for all market participants. Losses may exceed initial margin deposits, and market conditions can change rapidly.

Any scenarios, levels, or market expectations discussed are hypothetical in nature and are intended solely to illustrate potential market behavior. They do not represent actual trading results and should not be interpreted as guarantees of future performance. Past performance, market behavior, or historical price action are not indicative of future outcomes.

Readers are solely responsible for their own trading decisions and risk management. Always conduct independent research, consider your financial situation and risk tolerance, and consult with a qualified financial professional if necessary before engaging in futures or derivatives trading.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/Intel%20Corp_%20badge%20holder-by%20hasrul_rais%20via%20Shutterstock.jpg)