/Technology%20abstract%20by%20Joshua%20Sortino%20via%20Unsplash.jpg)

Following financial services major RBC Capital's projections that AI revenue for chip companies will increase to $550 billion by 2028, its peer, BNP Paribas, has come out with a note making a case for the data center networking market.

Expecting the market to reach a value of about $120 billion by 2028, the firm stated, “The AI party continues [as] data center investment appears durable with lead times supporting improved visibility through '26 across the server, networking, and storage ecosystems. We are raising estimates for the companies most exposed to AI infrastructure bottlenecks, namely the optical transceiver supply chain, memory IC vendors, and [hard disk driver] vendors.”

As such, the firm has revealed some of its top AI picks that can benefit from this trend in 2026. However, they are not the usual suspects.

Next-Gen AI Stock 1: Arista Networks (ANET)

Founded in 2004, Arista Networks (ANET) is a networking hardware and software company best known for its high-performance cloud networking platforms and switches used in data centers, cloud environments, and enterprise networks. It designs, develops, and sells advanced networking solutions that enable highly scalable, programmable, and high-performance networking.

Valued at a market cap of $160.3 billion, the ANET stock is up 5% over the past year.

However, the company has grown its operations at an impressive rate over the past 10 years, clocking revenue and earnings CAGRs of 27.14% and 40.98%, respectively.

Further, the latest Q3 2025 results saw the company beating Street estimates on both the top line and bottom line. While revenues rose by 27.6% from the previous year to $2.31 billion, earnings for the quarter came in at $0.75 per share. Not only was this 25% higher than the prior year, but it also came in higher than the consensus estimate of $0.72 per share.

Net cash from operating activities for the first nine months of 2025 was $3.11 billion, up from $2.68 billion in the year-ago period. Overall, the company closed the September 2025 quarter with a cash balance of $2.33 billion with no short-term debt on its books.

Yet, the stock continues to trade at heady levels, with its forward P/E, P/S, and P/CF at 44.21, 18.01, and 39.89, much higher than the sector medians of 24.92, 3.62, and 19.78, respectively.

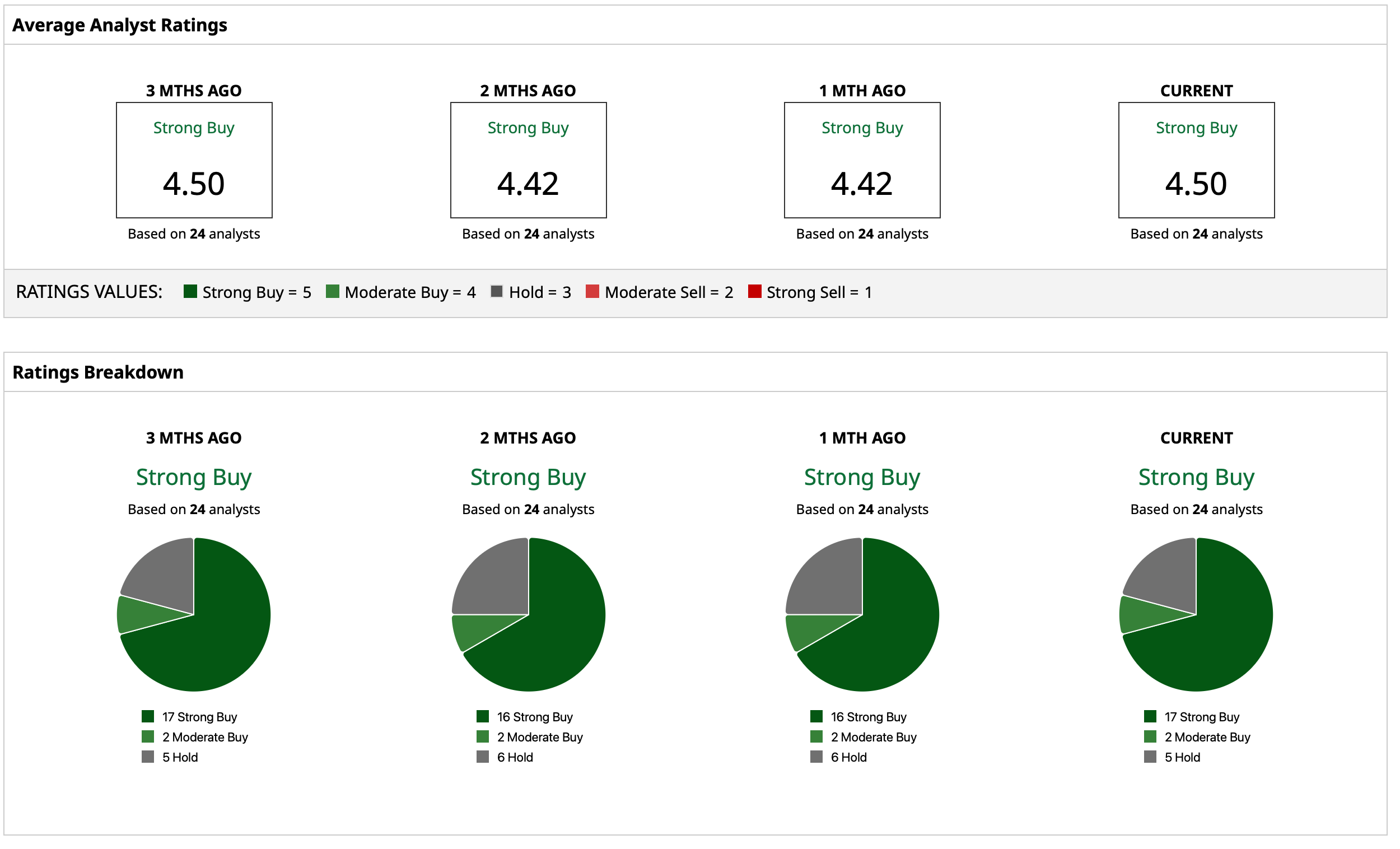

Despite that, analysts have deemed the ANET stock a consensus “Strong Buy,” with a mean target price of $167.22, which denotes an upside potential of about 21% from current levels. Out of 24 analysts covering the stock, 17 have a “Strong Buy” rating, two have a “Moderate Buy” rating, and five have a “Hold” rating.

Next-Gen AI Stock 2: Credo Technology

Founded in 2008, Credo (CRDO) is a fabless semiconductor company that develops high-speed connectivity solutions for data infrastructure, cloud computing, artificial intelligence (AI), and hyperscale networking. It designs high-speed connectivity semiconductors and related hardware/software that enable reliable and low-latency data movement between servers, switches, optical modules, and other components in modern data centers and AI infrastructure.

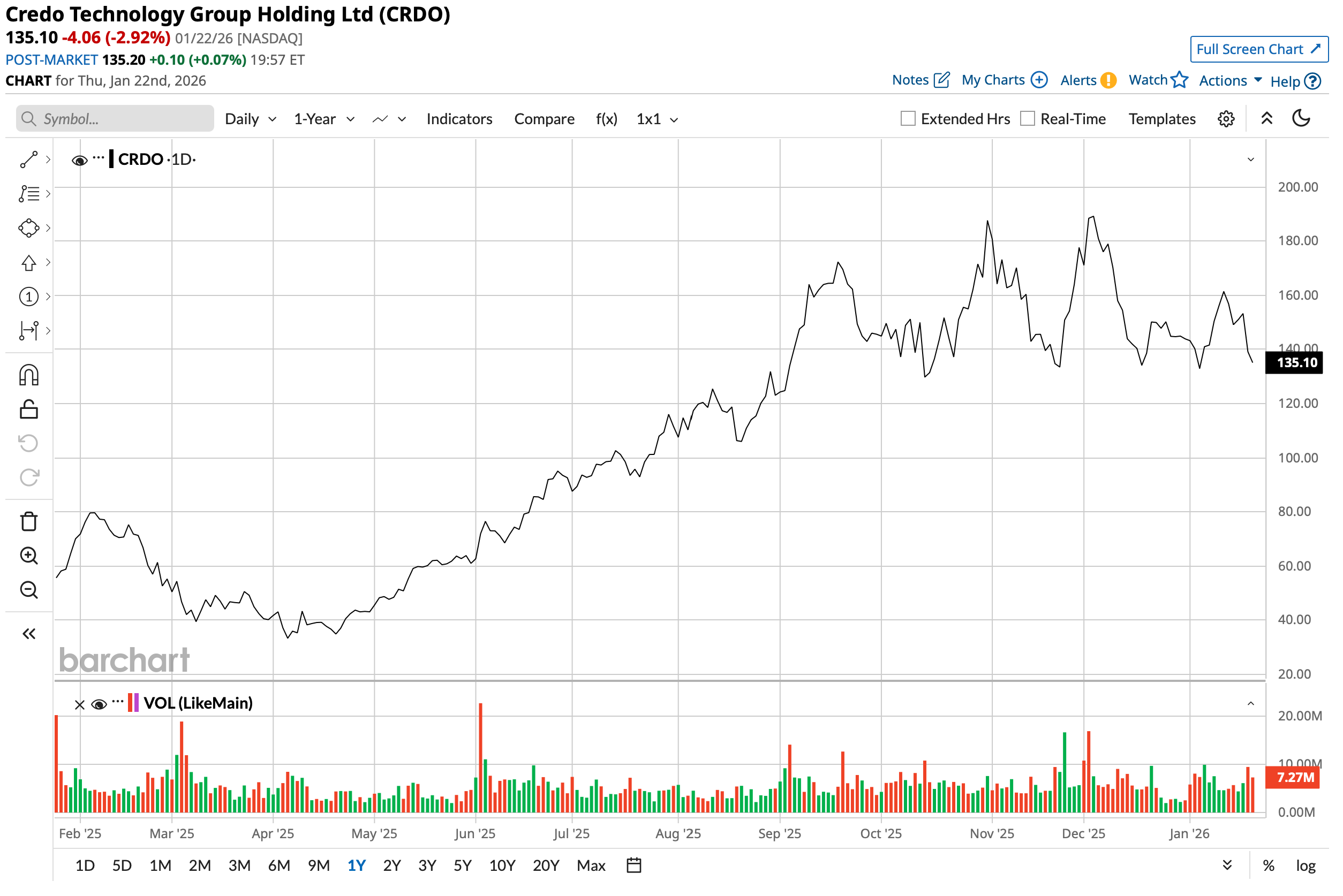

With a market cap of $25.1 billion, the CRDO stock has rallied by 61% over the past year.

Over the past three years, Credo's revenues have grown at a healthy CAGR of 68.25, with the company reporting an earnings beat in five consecutive quarters, including the most recent one. Speaking of the most recent quarter, revenues grew by 4x from the previous year to $268 million, with product and licensing revenues seeing a material uptick. Meanwhile, earnings witnessed an even sharper jump to $0.67 per share from $0.07 per share in the year-ago period. This also came in much higher than the consensus estimate of $0.49 per share.

Notably, net cash from operating activities saw a massive leap to $115.83 million from just $3.05 million in the year-ago period. Overall, the company closed the quarter with a cash balance of $567.58 million with no short-term debt on its books.

However, just like ANET above, overvaluation continues to plague the CRDO stock. Its forward P/E, P/S, and P/CF of 49.84, 21.05, and 54.14 are all higher than the sector median of 24.92, 3.62, and 19.78, respectively.

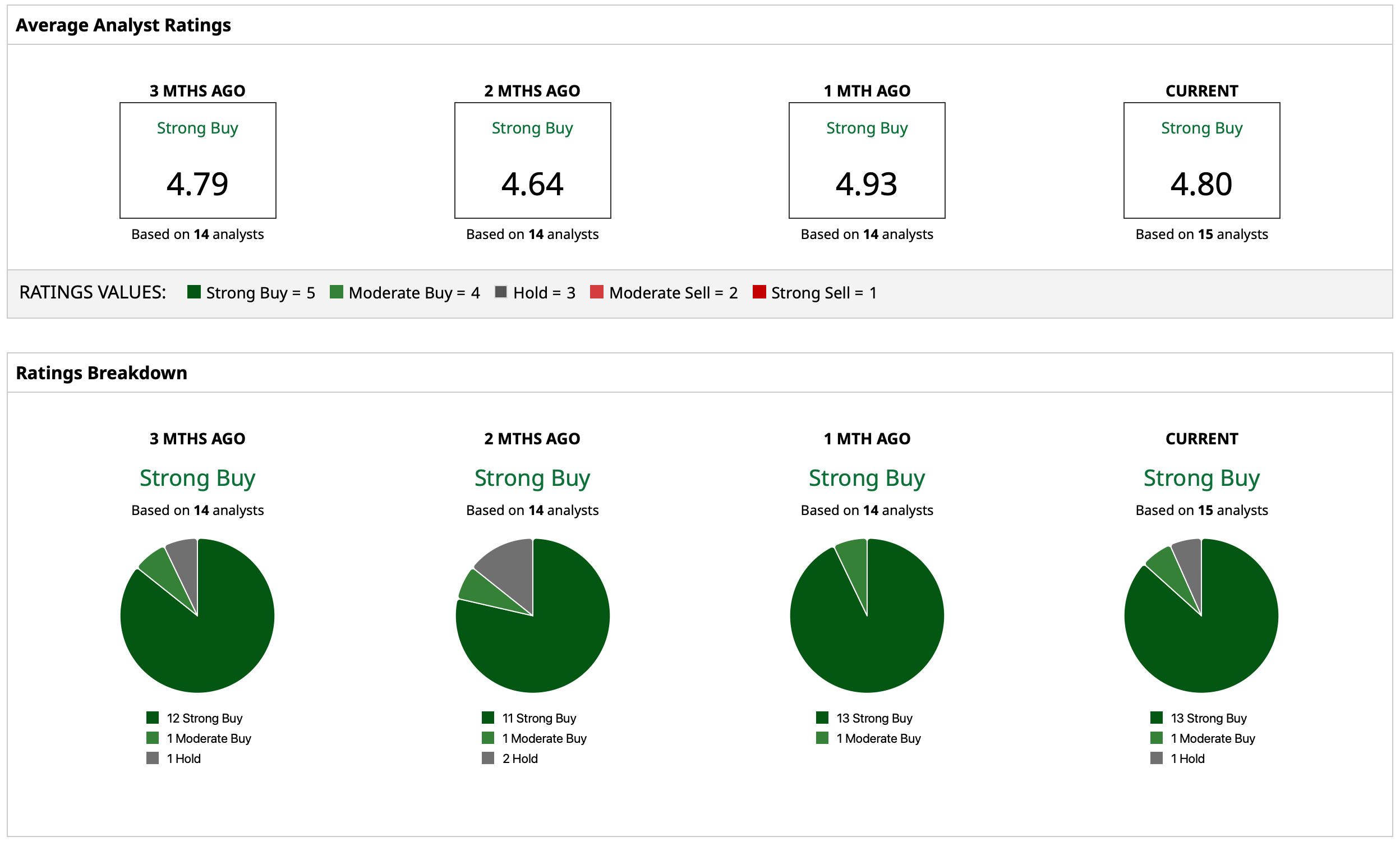

Overall, analysts have attributed to CRDO a consensus rating of “Strong Buy,” with a mean target price of $225. This indicates an upside potential of about 67% from current levels. Out of 15 analysts covering the stock, 13 have a “Strong Buy” rating, one has a “Moderate Buy” rating, and one has a “Hold” rating.

Next-Gen AI Stock 3: Celestica (CLS)

We sign off from our list of top next-gen AI stocks preferred by BNP Paribas with Celestica (CLS). Beginning life as a subsidiary of IBM (IBM), Celestica provides end-to-end design, manufacturing, hardware platform, and supply chain solutions to original equipment manufacturers (OEMs) and service providers globally.

Its market cap is currently at $35.6 billion, with the stock witnessing a sharp jump of 136% over the past year.

The past 10 years have seen the company reporting a revenue and earnings CAGR of 7.35% and 30.40%, respectively.

Notably, in the most recent quarterly results of Q3 2025, Celestica reported a beat on both the revenue and earnings front. Revenues for the quarter were $3.2 billion, up 28% from the previous year, with earnings of $1.58 per share representing an annual growth rate of 51.9%. The Q3 2025 EPS was higher than the Street's expectations of an EPS of $1.49, and it was the ninth straight quarter of earnings beat from the company.

Net cash from operating activities for Q3 2025 stood at $126.2 million, up from $122.8 million in the prior year. Overall, the company closed the quarter with a cash balance of $305.9 million, much higher than its short-term debt levels of $27.4 million.

However, unlike CRDO and ANET above, Celestica is not overvalued on all the key metrics. While its forward P/E and P/CF at 52.26 and 44.36 are certainly considerably higher than the sector medians of 24.92 and 19.78, respectively, its forward P/S of 2.91 is actually lower than the sector median of 3.62.

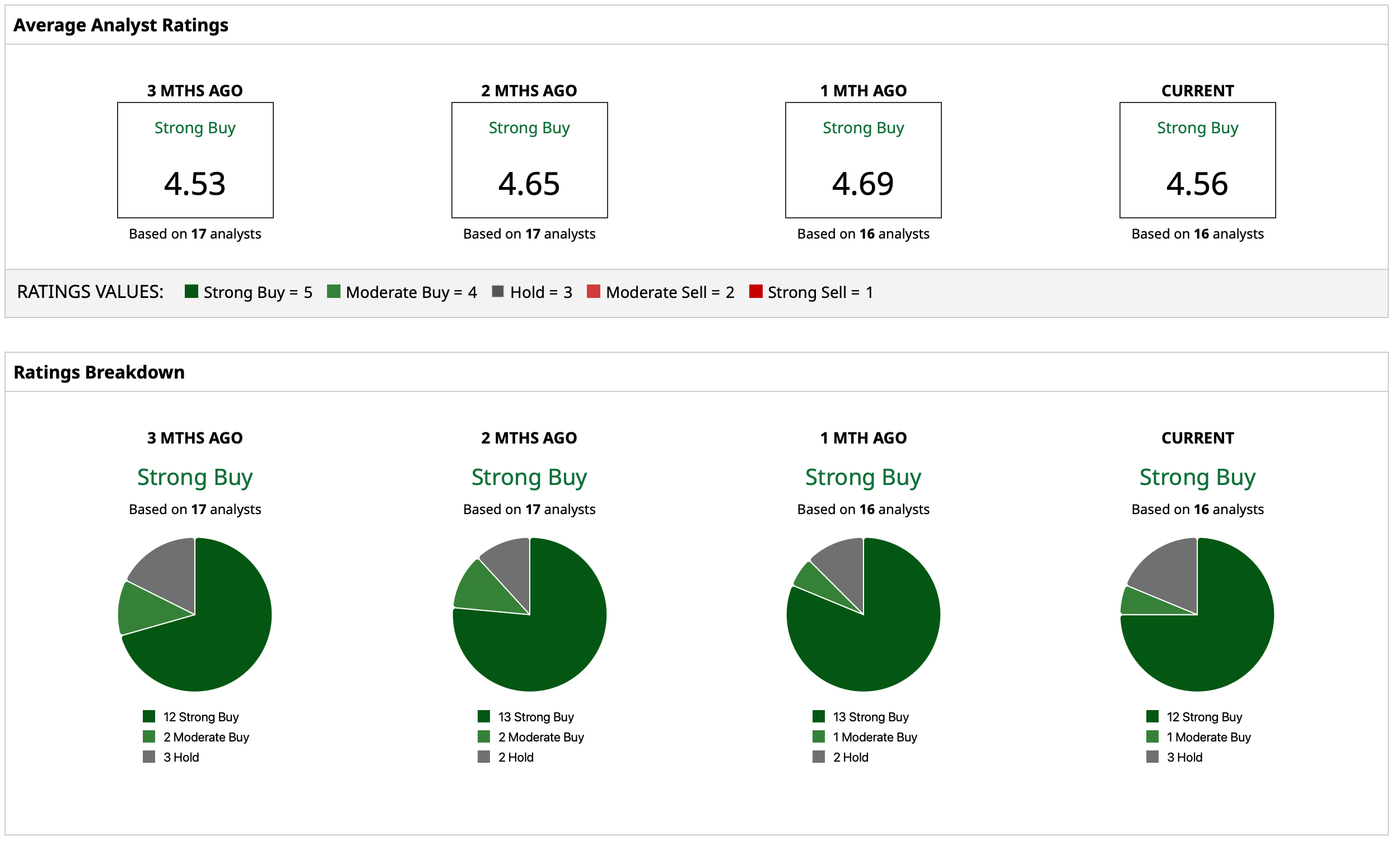

Thus, analysts have earmarked a consensus rating of “Strong Buy” for the stock with a mean target price of $352.22, which indicates an upside potential of about 21% from current levels. Out of 16 analysts covering the stock, 12 have a “Strong Buy” rating, one has a “Moderate Buy” rating, and three have a “Hold” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

/Cisco%20Systems%2C%20Inc_%20HQ-by%20Sundry%20Photography%20via%20iStock.jpg)