Nvidia (NVDA) CEO Jensen Huang is preparing to visit China in late January, potentially meeting with senior officials in Beijing ahead of the Lunar New Year holidays. The trip comes as the chipmaker attempts to reopen what could be a $50 billion annual market for its artificial intelligence processors, though the regulatory landscape remains uncertain.

The visit follows a whipsaw of policy developments that left investors scrambling to assess Nvidia's prospects in China.

- Last week, the Trump administration formally approved exports of Nvidia's H200 chips to China.

- But the approval included certain conditions, such as shipment caps at 50% of domestic sales volumes, mandatory third-party testing, and delivery only to approved customers.

- The White House also imposed a 25% tariff on the chips and demanded that the government receive 25% of sales revenues.

- However, Chinese customs authorities blocked H200 shipments from entering the country. China stated that it would approve orders only in exceptional cases, such as university research labs.

China is a key market for Nvidia, and the chipmaker had already staged inventory in Hong Kong, anticipating strong demand. The customs block exposed a fundamental disconnect between U.S. export policy and Chinese import rules. Even with American approval and verification safeguards, Beijing maintains veto power through its own regulatory framework.

Suppliers, including printed circuit board makers, saw component production freeze as the uncertainty dragged on. Whether Huang's visit can break the impasse remains an open question for shareholders counting on Chinese revenue to supplement Nvidia's $500 billion two-year forecast.

Nvidia Focuses on Partnerships in 2026

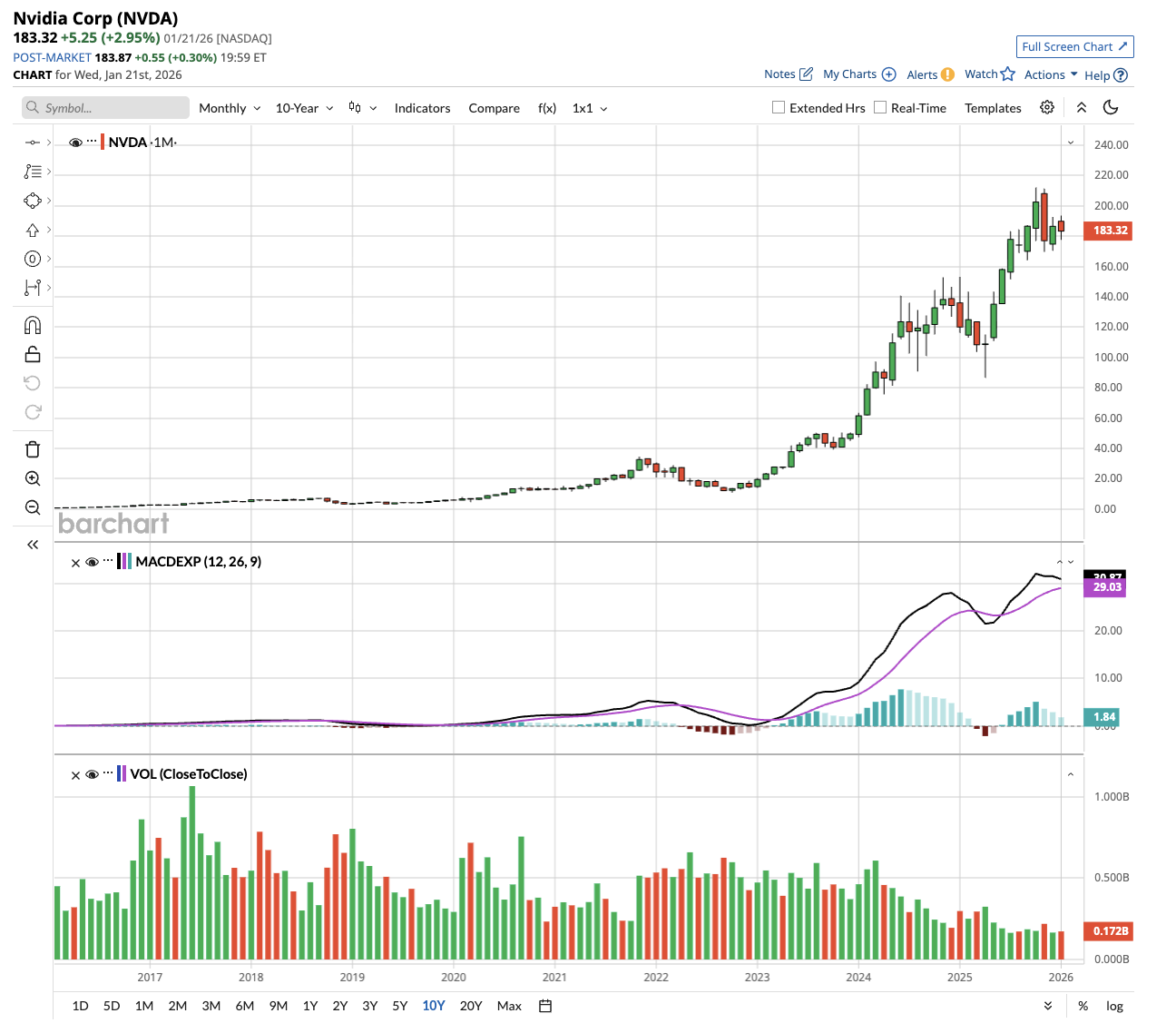

Valued at a market cap of $4.45 trillion, Nvidia has returned over 26,000% to shareholders in the past decade. It means a $1,000 investment in NVDA stock back in 2016 would be worth $263,000 today. Nvidia remains at the epicenter of the AI megatrend and continues to widen its competitive moat.

The Big Tech giant is making significant moves into the healthcare sector, announcing billion-dollar partnerships that could reshape drug discovery and position it for growth beyond its traditional markets.

The company unveiled a groundbreaking collaboration with pharmaceutical leader Eli Lilly (LLY). The partnership has committed up to $1 billion over five years to establish an AI co-innovation lab in San Francisco. The facility will bring together Lilly's medical experts and Nvidia's AI engineers to develop new approaches to discovering and developing medicines.

Jensen Huang, Nvidia's founder and CEO, described the project as inventing a new blueprint for drug discovery, enabling scientists to explore vast biological spaces before making a single molecule.

This partnership builds on Lilly's recently announced AI supercomputer, which Nvidia says is the most powerful in the pharmaceutical industry. The system will use Nvidia's DGX SuperPOD, comprising DGX B300 systems, to train large-scale biomedical models for drug discovery and development.

At the recent J.P. Morgan Healthcare Conference, Huang emphasized that AI has advanced “one million times” over the past decade and expressed confidence that similar progress lies ahead. The company also expanded its BioNeMo platform with new tools for predicting RNA structures and molecular design.

For investors, these healthcare initiatives represent Nvidia's efforts to diversify beyond its core semiconductor business. The partnerships could open new revenue streams as pharmaceutical companies turn to AI for drug discovery and development.

However, the five-year timeline suggests returns from these investments may take time to materialize as the technology proves itself in clinical applications.

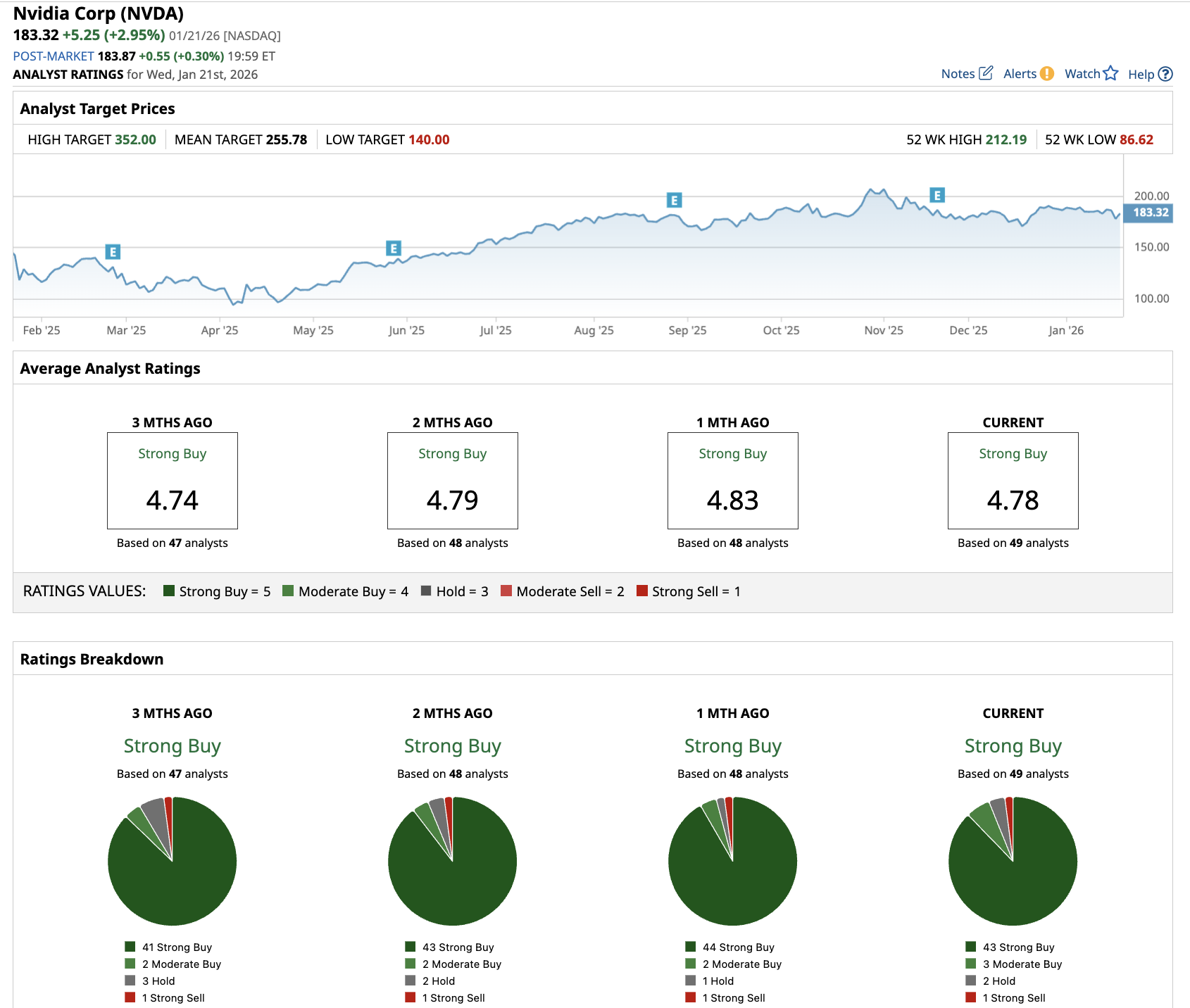

What Is the NVDA Stock Price Target?

Out of the 49 analysts covering NVDA stock, 43 recommend “Strong Buy,” three recommend “Moderate Buy,” two recommend “Hold,” and one recommends “Strong Sell.” The average NVDA stock price target is $256, above the current price of $183.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)