Bitmine Immersion Technologies (BMNR) just made a move that’s hard to ignore. The Ethereum (ETHUSD) treasury firm, chaired by Fundstrat’s Tom Lee, has committed $200 million to Beast Industries – the business engine behind YouTube powerhouse MrBeast. At first glance, it feels like crypto colliding with internet celebrity. In reality, it is a sharper strategic bet.

More than just a content creator, MrBeast has built a global consumer brand with unmatched reach among Gen Z and Gen Alpha. Beast Industries spans merchandise, food brands, and now eyes financial services. And BitMine’s Ethereum and DeFi muscle comes into play here.

By backing a creator-led platform with massive cultural gravity, BitMine is betting on relevance, scale, and mainstream adoption. It is bold, unconventional, and definitely risky, but potentially transformative.

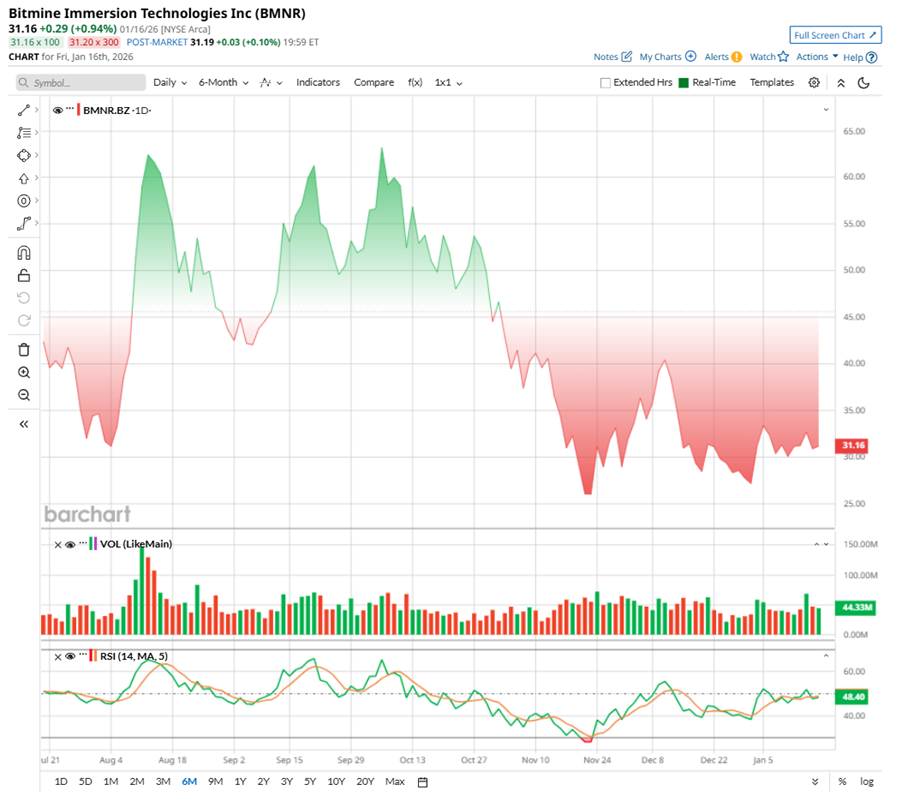

Although BMNR stock has slipped nearly 81% from last year’s peak, momentum has recently started to turn. So, should you snag BMNR stock now?

About Bitmine Stock

Founded in 2019 and headquartered in Las Vegas, BitMine has evolved into a hybrid Bitcoin (BTCUSD) and Ethereum network company with a clear long-term vision. The firm focuses on building digital asset exposure through mining operations, advisory services, and strategic capital raising. Now valued at a market capitalization of about $12.85 billion, BitMine operates across multiple verticals, including traditional Bitcoin mining, synthetic hashrate products, corporate mining services, and broad-based crypto consulting.

Its operations are anchored in low-cost energy regions such as Trinidad and Pecos, Texas, giving it a durable advantage in power-intensive activities. In mid-2025, BitMine unveiled the world’s largest ETH treasury, signaling a decisive pivot and cementing its growing role in Ethereum-focused infrastructure and treasury strategy.

BMNR was listed on the NYSE on June 5, and it opened at $7.35, with little fanfare. Everything changed on June 30. The company named Ethereum its main treasury asset, raised $250 million in a private placement, and brought Tom Lee on board as chairman. That combination impressed investors, and in a single day, BMNR skyrocketed 695%, touching a high of $161 by July 3 and grabbing instant attention.

The excitement did not last. As crypto markets cooled, BMNR came back down to earth, falling about 81% from its peak and sliding 47% over the past three months. With its strategy closely tied to ETH, the stock moved in step with the broader crypto sell-off.

On valuation, BMNR trades at a steep 30.93x forward adjusted earnings and about 34.62X forward sales, levels that sit well above sector averages, even after the sharp pullback. By traditional measures, it is expensive. But BitMine isn’t priced like a typical crypto miner. Investors are also weighing its sizable Ethereum reserves and steady, non-dilutive cash flows from ancillary operations.

What strengthens the story is capital return. BitMine recently paid a $0.01 annual dividend on Dec. 29, becoming one of the first large-cap crypto names to do so. It has also approved a share buyback program, signaling confidence while continuing to build its ETH treasury.

A Closer Look at Bitmine’s Fiscal 2025 Financials

BitMine Immersion’s fiscal 2025 earnings, released on Nov. 21, generated revenue of $6.1 million, up 84% year-over-year (YOY). This was powered by self-mining and leasing. The company flipped from losses to a staggering $328.2 million in net income. EPS came in at $13.39 – numbers that, on paper, screamed momentum. Its balance sheet told an even bigger story, with crypto and cash holdings swelling to roughly $11.8 billion, cementing BitMine as a heavyweight in the digital-asset space.

Yet, the market hesitated. BMNR shares slipped as investors dug past the headline figures and focused on what was not happening fast enough – Ethereum staking. For a company holding billions in ETH, staking represents a relatively simple way to earn yield, and progress there has been measured rather than aggressive.

That picture sharpened in early January. On Jan. 5, BitMine disclosed crypto, total cash, and “moonshots” holdings of $14.2 billion. As of Jan. 4, the company held 4,143,502 ETH, valued at $3,196 per token, along with 192 Bitcoin, $915 million in cash, and a $25 million stake in Eightco Holdings (ORBS) (moonshots). Those ETH holdings represent about 3.43% of the total Ethereum supply. Of that, roughly 659,000 ETH – worth about $2.1 billion – are already staked, earning a composite rate near 2.81%.

BitMine is currently working with three staking partners as it prepares to launch its Made-in-America Validator Network, or MAVAN, in 2026.

Chairman Tom Lee remains openly bullish, pointing to growing U.S. policy support for crypto, Wall Street’s push into tokenization and its embrace of stablecoins, and crypto’s appeal to younger investors. Add in the historical link between rising metal prices and crypto, and BitMine is positioning itself not just for the next quarter, but for the next cycle.

Lee is striking a confident tone on crypto’s next act. He expects Bitcoin to hit fresh highs in 2026 but sees Ethereum leading the charge sooner. With U.S. lawmakers advancing market-structure rules, Lee believes the sector is set for a strong recovery after last year’s selloff.

Why BitMine Is Betting Big on Beast Industries

BitMine Immersion’s $200 million investment targets Beast Industries’ next phase of expansion, anchoring the crypto firm more deeply in mainstream digital commerce. The deal gives BitMine exposure to a creator-led ecosystem that operates far beyond ad revenue, spanning consumer products, brand licensing, and emerging financial services.

Beast Industries, built around MrBeast’s media empire, commands more than 450 million subscribers across its YouTube channels and generates roughly 5 billion monthly views, offering BitMine instant access to one of the largest digital audiences on the planet. Strategically, the investment opens the door for BitMine to deploy its Ethereum treasury and decentralized finance expertise into Beast Industries’ planned financial platform.

For BitMine, the upside lies in relevance and reach, aligning its crypto-native balance sheet with a globally trusted consumer brand. If executed well, the investment could diversify revenue pathways and reposition BitMine at the intersection of digital assets, entertainment, and next-generation finance.

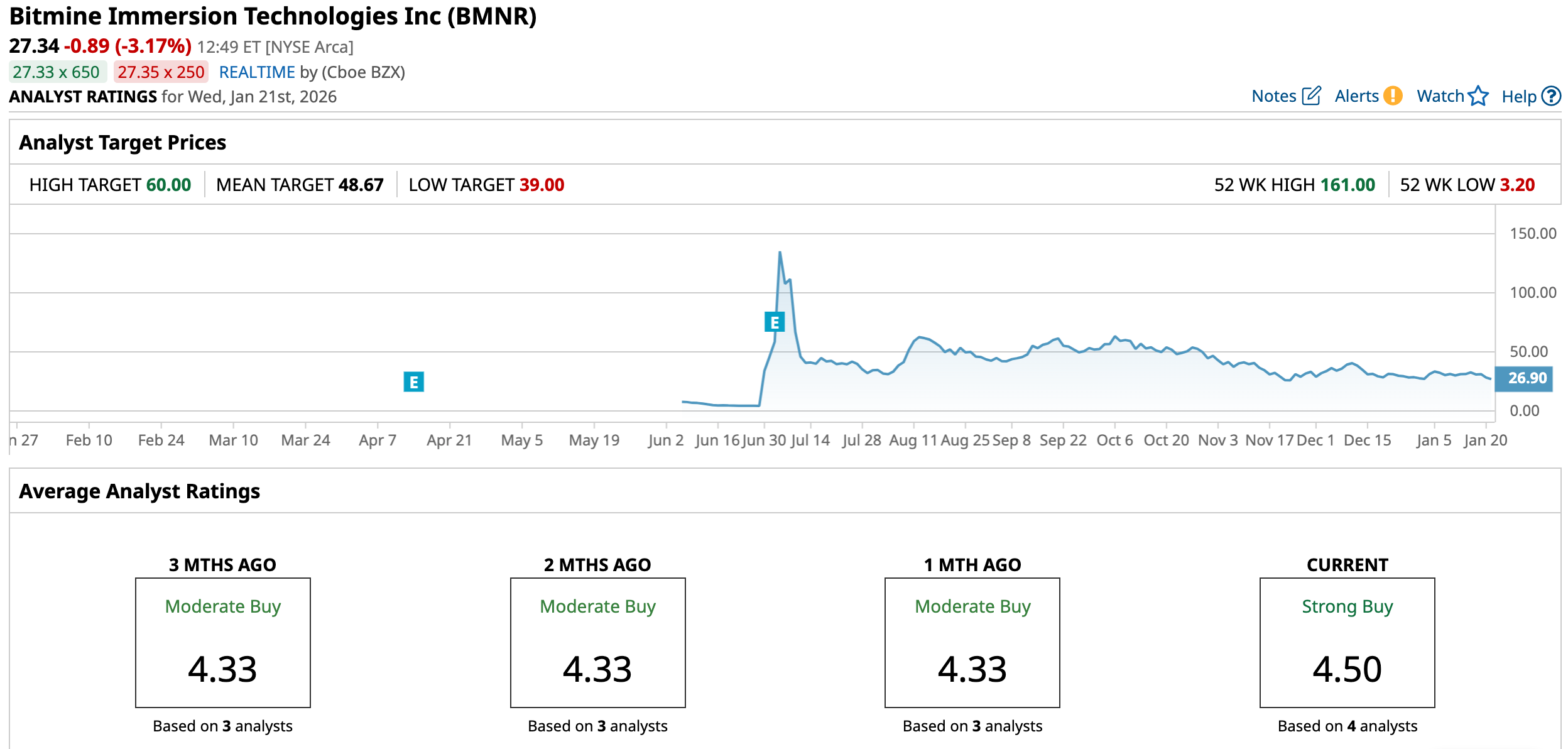

What Do Analysts Expect for Bitmine Stock?

Recently, B. Riley reiterated its “Buy” rating on BMNR, maintaining a $47 price target. The brokerage firm sees BitMine’s $200 million investment in Beast Industries as more than just a flashy partnership - viewing it as a smart step forward. According to analyst Fedor Shabalin, the deal helps BitMine move beyond simply holding Ethereum and positions it as a company actively putting its capital to work.

The appeal is clear. Beast Industries brings massive reach through MrBeast’s 450-million-plus audience, while BitMine brings its Ethereum treasury and MAVAN staking platform. Together, that could open up new revenue streams tied to DeFi services, consulting, and transaction activity once Beast’s financial platform launches.

Risks include regulatory uncertainty and the fact that some initiatives are still in early stages. Even so, B. Riley believes the move fits neatly with BitMine’s long-term strategy of betting on Ethereum’s growth through staking rather than passive ownership. With BMNR trading at about 1.0x modified NAV, B. Riley’s new price target suggests meaningful upside potential of 50.8% if execution follows.

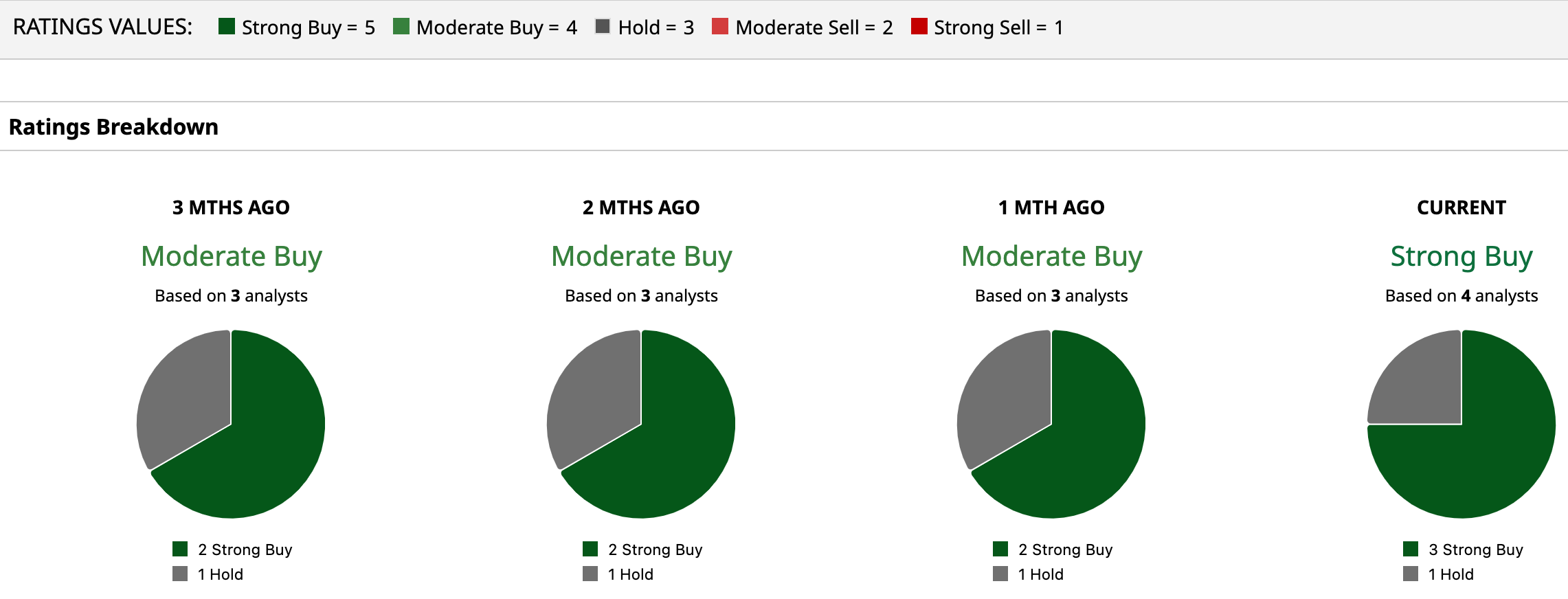

BitMine may not be a Wall Street favorite just yet, but the stock's momentum is taking shape. Investor interest has steadily grown, and the consensus is a “Moderate Buy” rating overall. Among the four analysts tracking BMNR, three maintain “Strong Buy” ratings while one recommends a “Hold,” reflecting cautious optimism rather than unqualified enthusiasm.

The average price target of $48.67 signals an upside potential of 78% from current levels. Plus, with a Street high target of $60, the forecast hints at a potential 119.46% upside from current levels, suggesting growing confidence in BitMine’s long-term direction rather than mere speculation.

Bottom Line on BMNR

BitMine’s $200 million bet on Beast Industries captures both the promise and the risk embedded in BMNR stock. On one hand, the company boasts a massive ETH treasury, improving capital returns, and analyst support pointing to meaningful upside if execution holds. On the other hand, the valuation remains demanding, staking progress is still unfolding, and the new investment must prove it can deliver real cash flows.

The newly introduced dividend and buyback signal discipline, but execution matters. For aggressive investors who believe in Ethereum’s next cycle and BitMine’s strategy, BMNR could be worth a closer look. Cautious investors may prefer to wait for clearer execution and steadier crypto markets before jumping in.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)