Applied Digital APLD and Sandisk SNDK are well-positioned to benefit from the rapid build-out of AI-driven data infrastructure. Applied Digital enables AI deployment through the development and operation of power-dense, purpose-built data centers designed to support large-scale GPU clusters and high-performance computing workloads. Sandisk supports those same AI systems at the data layer, supplying high-performance NAND flash storage that underpins data ingestion, model training, inference and low-latency access across hyperscale and enterprise environments.

Per Mordor Intelligence, the global digital infrastructure market was valued at approximately $360 billion in 2025 and is projected to surpass $1.06 trillion by 2030, implying a CAGR of about 24.10%. As data center capacity and storage performance scale in parallel, Applied Digital and Sandisk are positioned to gain exposure to the same structural data infrastructure upcycle. Let's delve deeper to determine which is a better investment now.

The Case for APLD

Applied Digital's business strategy centers on building data centers in locations with structural cost advantages. North Dakota offers APLD access to inexpensive energy, natural cooling and favorable regulations that reduce operating costs. This approach addresses a critical constraint in AI infrastructure by securing reliable, affordable power at the scale required for GPU computing. The lease-based model converts these facilities into steady recurring revenue once operational.

Applied Digital has secured a $5 billion, 15-year lease with an investment-grade hyperscaler for 200 megawatts at Polaris Forge 2, with initial capacity expected in 2026 and full build-out targeted for 2027. This follows the 400-megawatt CoreWeave agreement at Polaris Forge 1, bringing total contracted capacity to 600 megawatts and approximately $16 billion in prospective lease revenues over 15 years. The on-time completion of the first 100-megawatt phase at Polaris Forge 1 reinforces confidence in construction and project management capabilities. Beyond core facilities, investments in advanced liquid cooling through Corintis and collaboration with Babcock & Wilcox to explore grid power expansion extend the company’s positioning within the broader data-center ecosystem.

However, the model remains capital-intensive and execution dependent. Multi-year construction timelines delay cash generation, while returns are contingent on securing additional long-term leases and managing construction, supply chain and weather-related risks effectively.

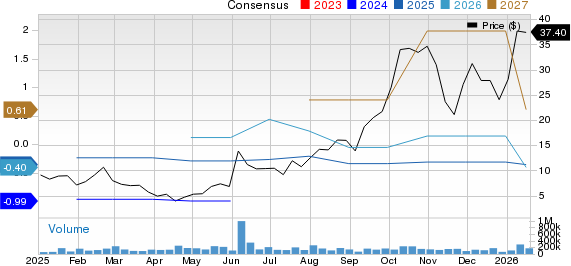

The Zacks Consensus Estimate for APLD's fiscal 2026 loss is pegged at 36 cents per share, up by 5 cents over the past 30 days, but suggesting an annual improvement of 55%.

The Case for SNDK

Sandisk operates across data centers, edge devices and consumer applications, supplying NAND flash storage that addresses critical AI infrastructure requirements. Expanding model sizes and context windows drive demand for high-performance, high-capacity storage solutions. The company maintains disciplined capacity expansion to support sustainable market growth. This positions Sandisk to serve the same hyperscale customers deploying AI infrastructure through storage that Applied Digital targets.

The competitive foundation rests on BiCS8 technology, jointly developed with Kioxia, utilizing CBA architecture that bonds logic circuitry separately from the 218-layer 3D NAND memory array to deliver industry-leading capacity and energy efficiency. BiCS8 accounted for 15% of bit shipments in the fiscal first quarter and is expected to become the dominant production node by year-end. The technology enables two product categories. High-speed TLC-based drives serve compute-intensive workloads requiring fast data access. High-capacity QLC solutions through the Stargate platform target storage-class applications, with 128TB enterprise SSDs currently under qualification with hyperscalers. The data center segment grew 26% sequentially in the first quarter.

Growth prospects center on data center becoming the largest NAND consumption segment. Sandisk is gaining traction through BiCS8-enabled products offering superior performance and energy efficiency aligned with AI workload requirements. The company is developing high-bandwidth flash technology specifically designed for AI inference applications in both data center and edge markets.

The Zacks Consensus Estimate for SNDK's fiscal 2026 EPS is pegged at $13.46, up by 7% over the past 30 days, suggesting a substantial improvement from the year ago EPS of $2.99.

Price Performance and Valuation of APLD and SNDK

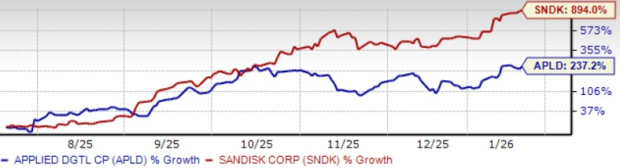

Over the past six months, Sandisk’s shares have jumped 894%, substantially outperforming Applied Digital’s shares, which are up 237.2%. Sandisk’s stronger performance reflects improving earnings visibility, accelerating data-center demand and firmer NAND industry fundamentals. Applied Digital’s performance has been driven more by expectations around future capacity ramp-ups and long-term lease monetization rather than current profitability.

APLD vs. SNDK Price Performance

Image Source: Zacks Investment Research

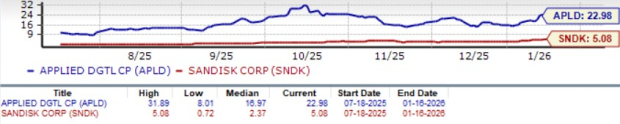

Sandisk shares are currently trading at a forward 12-month price-to-sales of 5.08x, which compares favourably with Applied Digital’s 22.98x, despite Sandisk’s stronger share price performance over the past six months and its transition into a focused, standalone storage business. The valuation gap suggests Sandisk’s improving fundamentals and expanding data-center exposure are not yet fully reflected in its multiple, while Applied Digital’s valuation continues to embed higher expectations around future execution and capacity ramp-ups.

APLD vs. SNDK Valuation

Image Source: Zacks Investment Research

Conclusion

While both Sandisk and Applied Digital are leveraged to the AI-driven expansion in data infrastructure, Sandisk’s growth profile appears more balanced at this stage. Applied Digital offers long-term upside through large-scale data center development, but its trajectory remains tied to capital-intensive execution and delayed cash generation. Sandisk, in contrast, benefits from improving earnings visibility, accelerating data-center demand and disciplined capacity expansion.

Sandisk sports a Zacks Rank #1 (Strong Buy), making it a better buy compared with Applied Digital, which carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank stocks here.

#1 Semiconductor Stock to Buy (Not NVDA)

The incredible demand for data is fueling the market's next digital gold rush. As data centers continue to be built and constantly upgraded, the companies that provide the hardware for these behemoths will become the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to take advantage of the next growth stage of this market. It specializes in semiconductor products that titans like NVIDIA don't build. It's just beginning to enter the spotlight, which is exactly where you want to be.

See This Stock Now for Free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sandisk Corporation (SNDK): Free Stock Analysis Report

Applied Digital Corporation (APLD): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)