Netflix (NFLX) stock has been in a severe downtrend for the best part of three months.

Today, we’re looking at a calendar spread on Netflix stock.

Calendar spreads are an option trade that involves selling a short-term option and buying a longer-term option with the same strike.

Traders can use calls or puts and they can be set up to be neutral, bullish or bearish with neutral being the most common.

When doing bullish calendar spreads, we typically use calls to minimize the assignment risk. Likewise, if the calendar is set up with a bearish bias, we use puts.

Neutral calendars can use calls or puts, but calls are more common.

Let’s look at an example using Netflix.

Netflix Calendar Spread Example

With Netflix stock trading around $90, setting up a calendar spread at $90 gives the trade a neutral outlook.

Selling the February 20 call option with a strike price of $90 will generate around $488 in premium, and buying the June 18, $90 call will cost approximately $940.

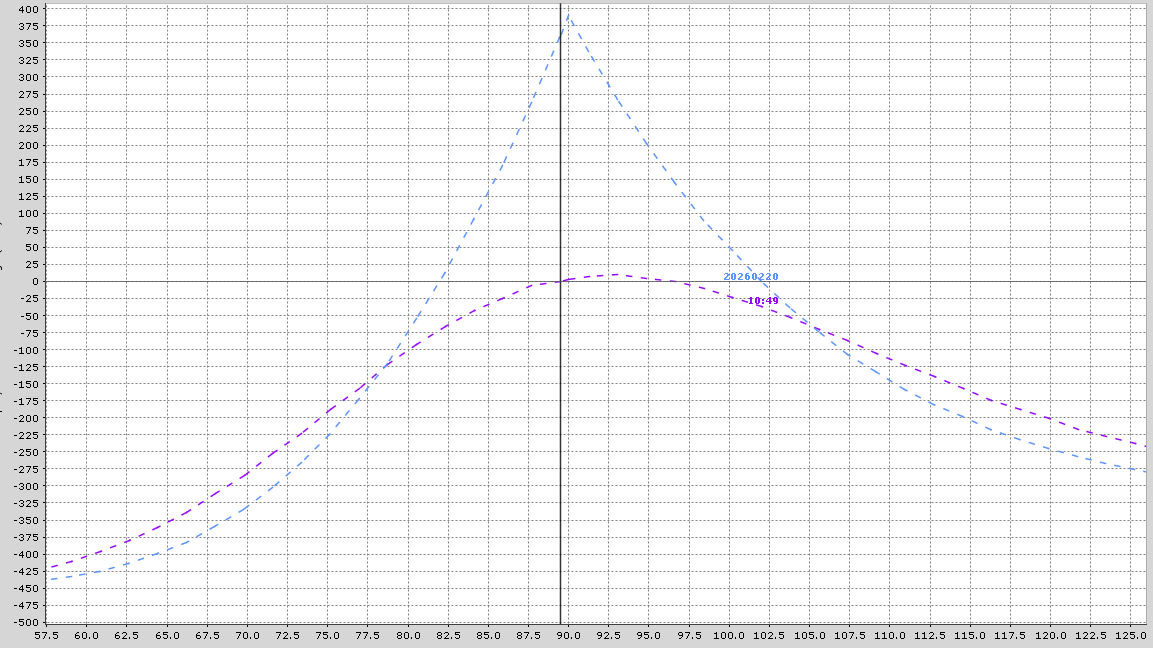

That results in a net cost for the trade of $452 per spread, and that is the most the trade can lose.

The estimated maximum profit is $390, but that could vary depending on changes in implied volatility.

The idea with the trade is that if NFLX stock remains around $90 for the next few weeks, the sold option will decay faster than the bought option allowing the trade to be closed for a profit.

The breakeven prices for the trade are estimated at around $82 and $102 but these can also change slightly depending on changes in implied volatility.

In terms of trade management if NFLX broke through either $82 or $102, I would look to adjust or close the trade.

Below is the payoff graph with the blue line representing the profit or loss at expiration and the purple line being the trade as of today.

Netflix Company Details

The Barchart Technical Opinion rating is a 100% Sell with a Strongest short term outlook on maintaining the current direction.

Long term indicators fully support a continuation of the trend.

Relative Strength is below 30%. The market is in oversold territory. Watch for a potential trend reversal.

Netflix is considered a pioneer in the streaming space.

The company evolved from a small DVD-rental provider to a dominant streaming service provider, courtesy of its wide-ranging content portfolio and a fortified international footprint.

Netflix has been spending aggressively on building its original show portfolio.

This is helping it sustain its leading position despite the launch of new services like Disney and Apple TV as well as the existing services like Amazon prime video.

Netflix streams movies, television shows and documentaries across a wide variety of genres and languages.

Subscribers, both domestic and international, can watch them on a host of internet-connected devices, including television sets, computers and mobile devices.

Netflix has kicked off 2026 with a heavy slate of new releases, including the long‑awaited Stranger Things 5 finale and the debut of several new international originals.

The company is also expanding its content portfolio with high‑profile projects like the upcoming Kennedy biopic series starring Michael Fassbender and a newly announced Season 8 of Black Mirror.

Its latest thriller, His & Hers, quickly climbed to the No. 1 spot globally, reinforcing Netflix’s continued dominance in binge‑worthy mystery content.

Mitigating Risk

Thankfully, calendar spreads are risk defined trades, so they have some build in risk management. Position sizing is crucial to ensure that minimal damage is done if the trade suffers a full loss.

One way to set a stop loss for a calendar spread is close the trade if the loss is 20-30% of the premium paid.

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/ServiceNow%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)