/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)

Netflix, Inc. (NFLX) stock has taken a significant hit, down 27.9% from its peak in late October 2025. Investors aren't too keen on its proposed acquisition of Warner Bros. Discovery. However, one way to play it is to short out-of-the-money (OTM) put options.

NFLX closed at $89.46 on Friday, Jan. 9, 2026. That's down from $93.76 at the end of 2025, or -4.59% YTD. That's no fun.

As a result, put option premiums have soared. That makes them attractive to short-sellers.

Shorting Out-of-the-Money (OTM) NFLX Puts

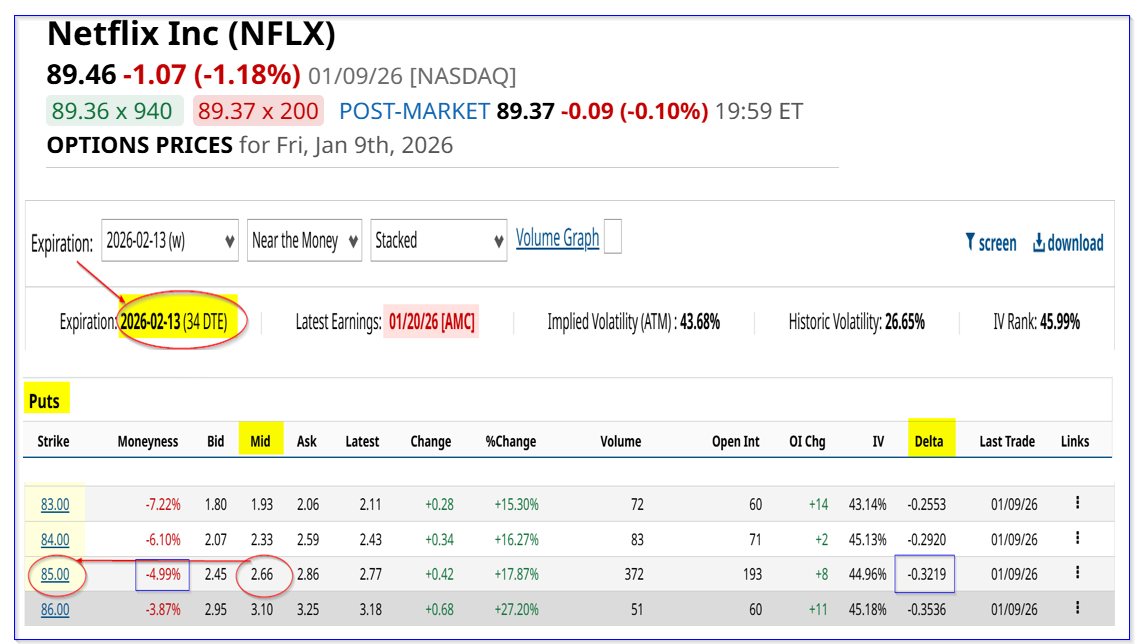

For example, the Feb. 13, 2026, expiry period shows that the $85.00 put option exercise price, 5% below today's price, has a midpoint premium of $2.66 per put contract.

That provides a short-seller an immediate income yield of 3.13% (i.e., $2.66/$85.00 = 0.03129). That is for a one-month-to-expiry put option.

That means that an investor who secures $8,500 with their brokerage firm can enter an order to “Sell to Open” a one-month away put contract at $85.00. The account will then receive $266.

As long as NFLX remains above $85.00 until the close on February 13, the account won't be assigned to buy 100 shares at $85.00 with $8,500 in collateral.

However, the delta ratio is over 0.32, implying almost a ⅓ chance that NFLX could fall to $85.00 in the next month. That is a little high.

Just to be conservative, it might make sense for more risk-averse investors to sell short the $83.00 put contract. It has a lower delta ratio of 0.2553, or a 25% chance that NFLX will fall to $83.00.

That premium is $1.93, which still provides a 2.33% one-month yield (i.e., $1.93/$83.00) to the short-seller of this put contract.

Downside Risks and How to Handle Them

This does not mean that an investor has no risk. If NFLX falls below $83.00 or lower by Feb. 13 or before, the investor could end up with an unrealized loss.

However, the breakeven point provides some downside protection:

$83.00 - $1.93 income received = $81.07 breakeven (B/E) point

That B/E is 9.8% below Friday's close at $89.46. So, NFLX would have to fall to $81.00 or lower for an investor to have an unrealized loss.

Moreover, the investor would be able to sell out-of-the-money covered calls, since they would own 100 shares. That could defray some of the loss.

In addition, at that point investor could just hold on to the newly acquired shares with the hope that NFLX would recover. So, it provides a good entry point.

Target Prices

After all, analysts still have much higher price targets (PTs) for NFLX stock. Yahoo! Finance reports that 43 analysts have an average PT of $125.71. That's over +40% higher than Friday's close.

Similarly, Barchart's mean analyst survey PT is $127.82 per share. In addition, AnaChart.com, which tracks recent analyst write-ups, shows that 29 analysts have an average PT of $113.17.

That's still 25% higher than Friday's close.

Moreover, in my Oct. 24, 2025, Barchart article, I showed that NFLX could be worth $137.40 per share. That was based on its strong Q3 free cash flow (FCF) and FCF margins.

Summary and Conclusion

The bottom line is that, despite investor fears about Netflix acquiring Warner Bros. Discovery, NFLX stock looks cheap here.

One way to play it, in case NFLX stays cheap, is to set a lower buy-in point by shorting out-of-the-money (OTM) puts.

Right now, for example, a 5% OTM put contract one month out has a 3.13% income yield, and a 7.2% OTM put play shows a 2.33% one-month yield.

The breakeven point for the latter is almost 10% lower than today's price. That provides a good risk and income benefit to short-put investors.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Alphabet%20Inc_%20and%20Google%20logos%20seen%20displayed%20on%20a%20smartphone%20by%20IgorGolovniov%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)