/Blackstone%20Inc%20NY%20HQ-%20by%20John%20Hanson%20Pye%20via%20Shutterstock.jpg)

Blackstone (BX) shares are in focus this morning after President Donald Trump said he plans on barring institutional investors from buying residential properties.

In his latest post on Truth Social, the U.S. president said he expects such a ban to tame prices that have spiralled out of control in recent years.

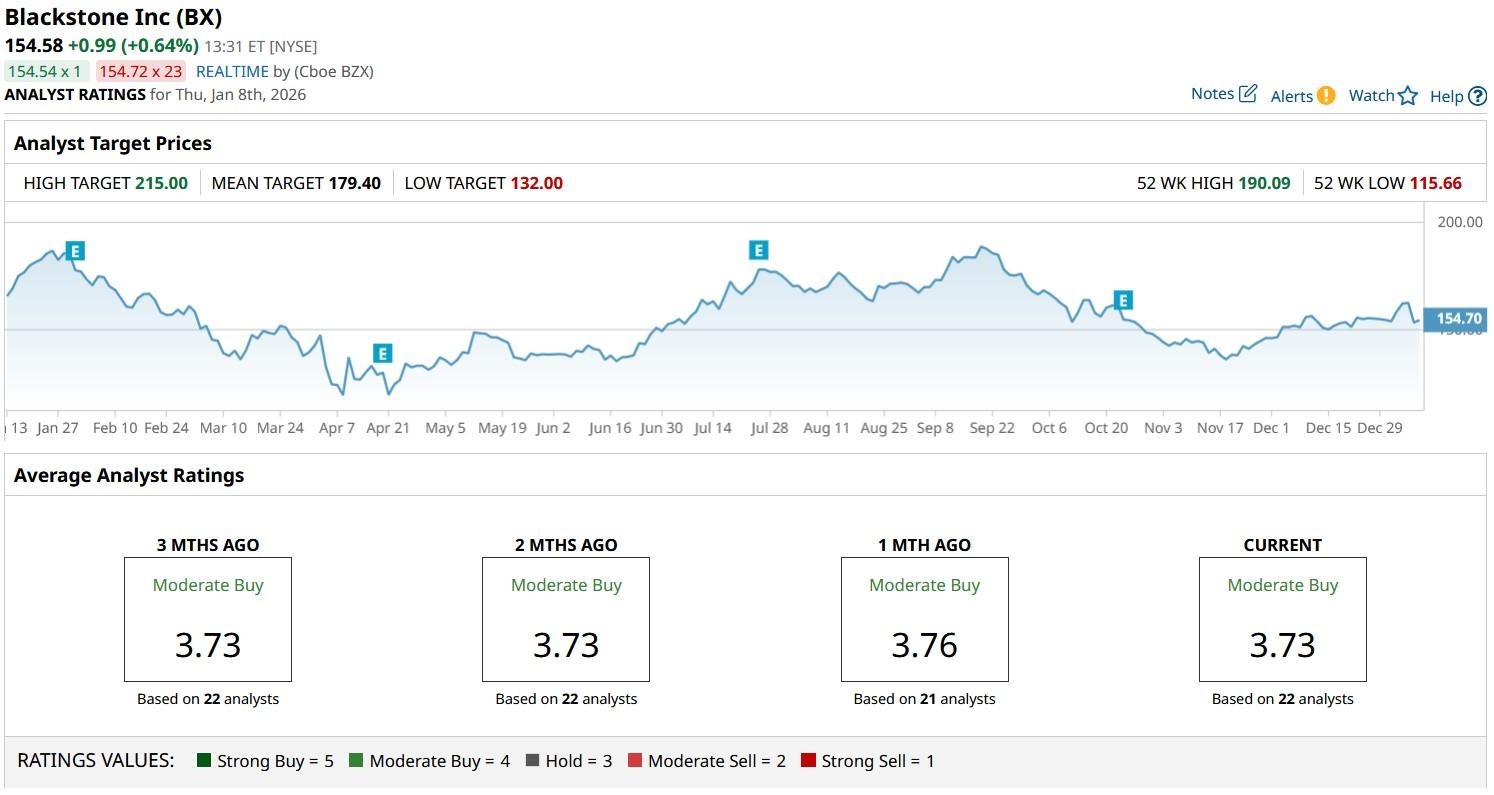

At the time of writing, Blackstone stock is already down some 18% versus its 52-week high.

Why Trump’s Post Is Super Negative for Blackstone Stock

Trump’s recent remarks are largely negative for BX stock as residential real estate has been a core growth engine for the company’s massive private equity (PE) and asset management operations.

For example, the NYSE-listed firm spent $6 billion to acquire Home Partners of America in 2021 and another $3.5 billion on Tricon Residential about a year ago.

Banning institutional investors from buying residential properties will restrict Blackstone’s ability to deploy capital into one of its most profitable asset classes, undermining both rental income and long-term appreciation strategies.

Additionally, such a move would signal heightened regulatory risk for big-cap investment firms, potentially curbing future expansion in housing markets.

All in all, investors are concerned that reduced access to residential properties could significantly hurt Blackstone’s earnings outlook over time.

But BX Shares Are Still Worth Owning in 2026

Despite this potential headwind, Blackstone shares remain attractive because the NYSE-listed titan has an exceptionally diversified portfolio spanning PE, credit, real estate, and infrastructure.

That enormous breadth ensures weakness in one single segment, such as residential housing, won’t end up derailing the firm’s overall performance.

BX’s scale and global reach bring it access to unique deal flow and resilient fee income streams.

Meanwhile, the company benefits from secular tailwinds in alternative asset management as well, with institutions and high-net-worth investors continuing to allocate capital to private markets.

A lucrative 3.34% dividend yield makes Blackstone all the more attractive for income-focused investors.

Wall Street Remains Bullish on Blackstone

With strong fundraising momentum, disciplined capital deployment, and a proven track record of navigating regulatory shifts, BX shares remain in favor with Wall Street analysts in 2026.

The consensus rating on Blackstone stock currently sits at “Moderate Buy” with the mean target of about $180 indicating potential upside of nearly 17% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/The%20sign%20for%20Marvell%20Technology%20out%20front%20of%20a%20corporate%20office%20by%20Valeriya%20Zankovych%20via%20Shutterstock.jpg)

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)