Geopolitics can turn yesterday’s “watch list” into tomorrow’s “must‑own” theme in a single weekend. President Trump’s Venezuela operation, which saw Nicolás Maduro and his wife seized in a lightning operation, has drawn sharp condemnation from Beijing and Moscow (among other countries), with both capitals warning against unilateral U.S. regime‑change tactics in their strategic backyard.

That same White House is again talking openly about bringing Greenland under U.S. control, citing its Arctic location, deep‑water access, and critical minerals as reasons the island is now “non‑negotiable” for long‑term security.

European leaders and Greenland’s own allies (which, for the record, the U.S. is one of via the North Atlantic Treaty Organization) have vowed to resist any forced grab, stressing the territory’s constitutional ties to Denmark (the semi-autonomous island is sovereign Danish territory) and its importance to the broader European security architecture. Such rhetoric pulls defense planning for the Arctic and North Atlantic to the foreground and directs fresh attention toward Europe‑based defense contractors.

On trading screens, two names stand out as they offer distinctly different exposure to air defense, armor, and ammunition. Saab AB (SAABF) has climbed roughly 33% over the past month, and Rheinmetall (RNMBY) has done even more, jumping about 19% over the same period. Will these two European defense stocks become the preferred way to express this new Arctic‑Caribbean risk theme? Let's take a closer look at these two defense stocks.

Saab AB (SAABF)

Saab AB, headquartered in Sweden, is a defense company that designs advanced military aircraft, air defense, surveillance, and weapons systems, with a global government customer base.

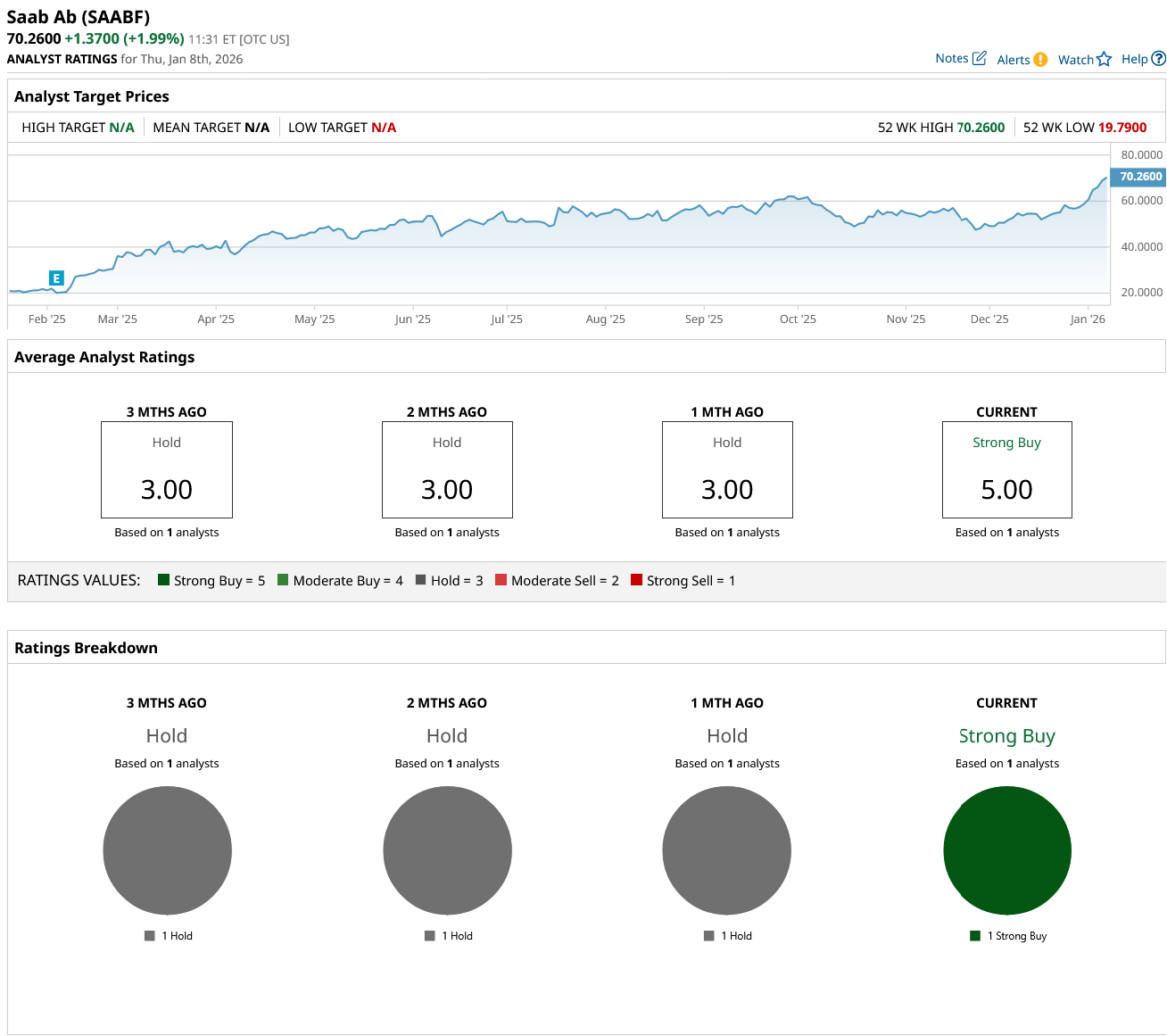

The stock trades at about $70 as of Jan. 8, up 20% year‑to‑date (YTD) and 229% over the past 52 weeks.

That still leaves the shares at roughly 2.05x price‑to‑book against a sector median near 3.33x, a discount that suggests the market has not fully priced in Saab’s order momentum or its leverage to Arctic and European security budgets.

The strategic backdrop now includes a SEK 2.6 billion contract from the Swedish Defence Materiel Administration that funds continued studies on future fighter systems through 2027, covering both manned and unmanned solutions. This agreement extends a prior framework and pulls in Swedish defense stakeholders and industry partners, just as Washington toys with the idea of locking down Greenland’s skies and resources.

The stock, however, comes with a notable financial gap, as its earnings reports, estimates, and revenue breakdowns are not readily available, which makes the stock more of a thesis‑driven call than a clean numbers story.

It is worth noting that the consensus from the small analyst pool (of just one) covering the stock sits at “Strong Buy,” even without a formal average target.

Rheinmetall AG (RNMBF)

Rheinmetall AG produces ammunition, armored vehicles, air defense systems, and other battlefield technologies and is based in Düsseldorf, Germany, with customers across NATO. This stock pays a forward dividend of $9.06 per share, giving a forward yield of 0.43% on an annual basis.

RNMBF is currently trading at $2,150 as of Jan. 8 with a YTD gain of 19% and a 52‑week return of 229%.

This profile includes a price‑to‑cash‑flow multiple of 19.69x versus a sector median of 15.02x and a price‑to‑book ratio of 1.16x against 3.33x for peers, a combination that suggests investors are paying a premium.

That setup sits on top of some very specific growth news, as the company is moving to formalize a new joint venture with MBDA in Germany that will focus entirely on naval laser technology. The entity is expected to launch in the first quarter of 2026 after years of preparatory work.

The new company will be responsible for developing and delivering high-performance laser weapon systems, initially for the German fleet but with obvious relevance for any NATO navy. Particularly relevant for hardening defenses in contested waters from the Arctic to the Caribbean.

This growth is also being driven by the bread‑and‑butter of modern land warfare, with the German Armed Forces extending a framework agreement (signed in December 2022 for 30 mm x 173 ammunition) for the Puma infantry fighting vehicle. The framework now runs through 2029 and covers several hundred thousand rounds worth around €1 billion in total volume, with a medium six-figure quantity of cartridges already delivered. The latest call-off order itself runs into the several hundred million euro range.

This stock does not have standardized public data on earnings, detailed revenue trends, or forward cash‑flow forecasts. It also leaves investors without formal earnings estimates or published analyst ratings for RNMBF, which keeps the focus squarely on its fundamentals, news flow, and the tape.

Conclusion

Trump’s Greenland talk and the Venezuela raid have simply highlighted what the tape was already hinting at for Saab and Rheinmetall. Both names look wired into a multiyear European rearmament and Arctic security story, not just a one‑headline spike. Through 2026, share prices appear more likely to drift higher with sharp news‑driven pullbacks than to settle into a sustained downtrend.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/AI%20microchip%20by%20DesignKingBD360%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)