MicroStrategy (MSTR) narrowly avoided a potentially devastating blow to its controversial Bitcoin (BTCUSD) treasury strategy when MSCI announced it would not exclude digital-asset treasury companies from its indexes after an intense review period.

The decision triggered a 2.5% surge in MSTR stock, valuing it at a market cap of $48.8 billion. The MSCI announcement offers temporary relief to investors who had watched the shares plummet by more than 50% in Q4 of 2025, as Bitcoin's value declined roughly 25% over the same period.

The MSCI USA Index tracks about 85% of the U.S. stock market and serves as a benchmark for countless institutional portfolios. So, the exclusion would have forced passive funds tracking these indexes to dump MicroStrategy shares.

That forced selling could have triggered a cascade of losses for a company whose entire business model centers on accumulating Bitcoin rather than generating traditional software revenues.

MicroStrategy vs. MSCI

MSCI's November proposal to exclude companies with more than 50% of their balance sheets allocated to digital assets directly threatened MicroStrategy's business model. Executive Chairman Michael Saylor, who transformed the software company founded in 1989 into the world's largest corporate holder of Bitcoin with 673,783 BTC, fought back aggressively.

In December, MicroStrategy submitted a letter stating that the proposal was discriminatory and arbitrary. In the letter, Saylor argued that the company operates as an active business and generates shareholder returns rather than serving as a passive investment fund.

Notably, MSCI stated it plans a broader consultation on non-operating companies as it seeks to distinguish between investment-oriented entities and those holding non-operating assets as part of core operations. The 50% digital asset threshold remains in place, and MSCI will defer any increases to MicroStrategy's weighting in indexes or allow size-segment migrations.

MSTR Stock is a High Risk Buy

MicroStrategy has evolved from a struggling software company into the world's largest corporate Bitcoin holder, amassing over 670,000 Bitcoin worth approximately $61 billion through an aggressive treasury strategy that raises capital specifically to purchase cryptocurrency.

Michael Saylor's disruptive approach aims to transform traditional corporate finance by treating Bitcoin as permanent capital rather than a speculative asset. However, this business model faces significant challenges as the company's premium to net asset value has compressed dramatically.

MicroStrategy owns more than 3% of the total Bitcoin that will ever exist. This accumulation has forced the software provider to raise close to $50 billion via equity and debt offerings over the last five years.

The strategy centers on what Saylor calls Bitcoin yield, which measures how much the company increases Bitcoin holdings per share over time. MicroStrategy targets a 30% annual Bitcoin yield, achieved by raising capital above the value of its underlying BTC holdings. The additional proceeds are then converted into additional cryptocurrency.

Last year, MicroStrategy received its first credit rating from S&P at B-minus, which provides it with access to institutional investors. However, the rating agency assigned a zero capital value to Bitcoin holdings, treating them as speculative assets rather than as permanent capital. This conservative approach limits the rating despite massive cryptocurrency collateral backing relatively modest debt and preferred equity obligations totaling just $15 billion.

Critical questions remain about sustainability when the company's market capitalization trades near or below the value of its Bitcoin holdings. MicroStrategy's premium to net asset value recently compressed to roughly 0.90 times, meaning shares trade at less than the underlying Bitcoin value, with a minimal premium for the treasury strategy.

Management maintains multiple options for funding $689 million in annual dividend and interest obligations, including selling equity derivatives, Bitcoin derivatives, or high-cost-basis Bitcoin. The company explicitly avoids selling its legacy software business to preserve the return-of-capital tax treatment of preferred dividends.

Is MSTR Stock Undervalued Right Now?

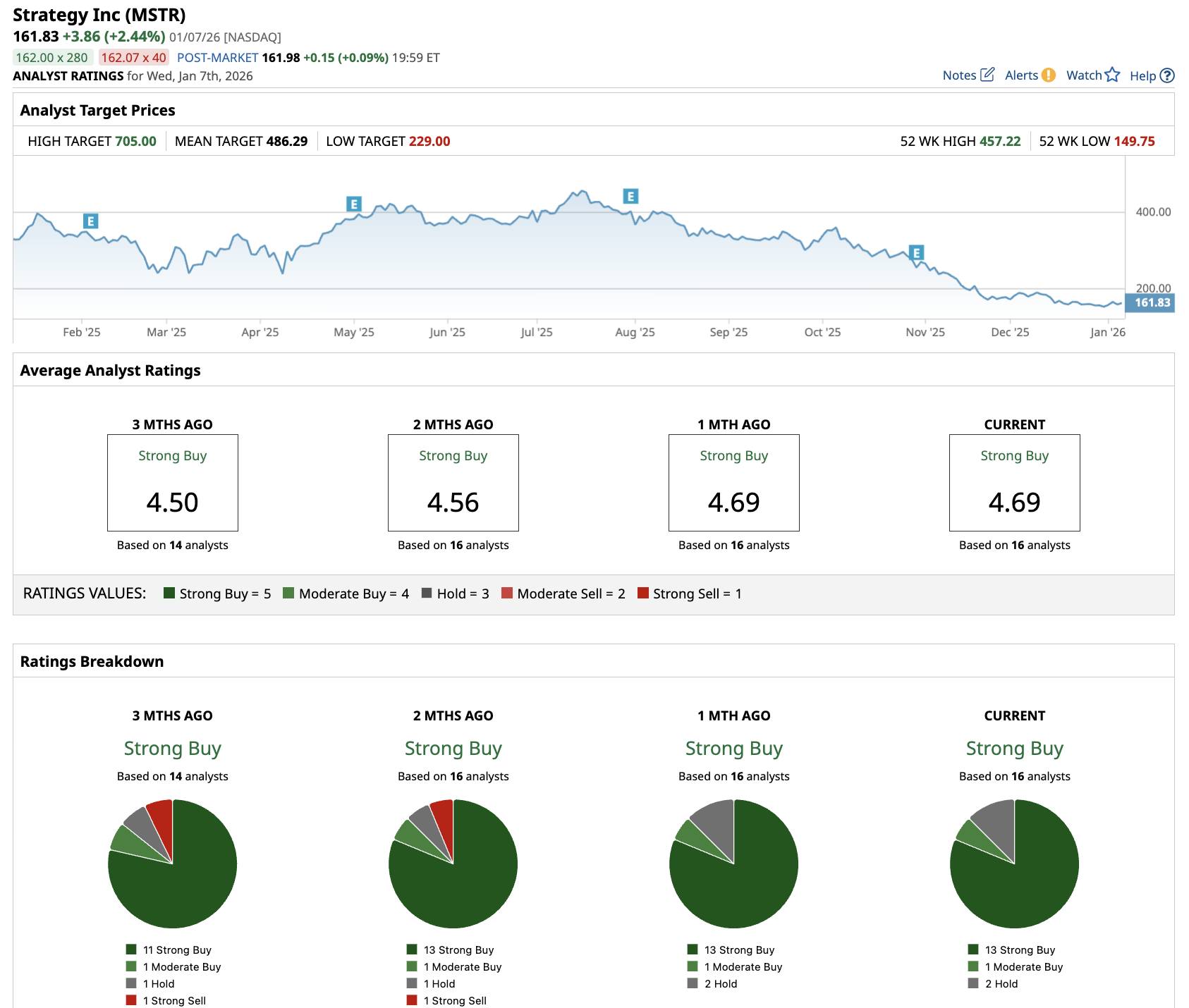

MSTR stock has more than tripled in the past five years. Despite these outsized returns, it trades 65% below all-time highs.

Out of the 16 analysts covering MSTR stock, 13 recommend “Strong Buy,” one recommends “Moderate Buy,” and two recommend “Hold.” The average MSTR stock price target is $486.29, indicating an upside potential of almost 200% from current levels.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)