The stunning U.S. military operation that toppled Venezuelan President Nicolas Maduro has thrust oil stocks into the spotlight as investors scramble to assess which energy companies stand to benefit most from accessing the world's largest proven crude reserves.

British Petroleum (BP) finds itself in an intriguing position following these geopolitical developments that could reshape global energy markets for decades to come. Venezuela has 303 billion barrels of proven oil reserves, accounting for 17% of the global total. However, it produces less than a million barrels per day after years of mismanagement, corruption, and sanctions that strangled its once-mighty petroleum industry.

President Trump immediately called for major U.S. oil companies to pour billions into rebuilding Venezuela's shattered infrastructure, with Chevron (CVX) appearing best positioned given its existing operations in the country.

However, European majors like BP and Shell (SHEL) are expected to secure entry through joint ventures with American partners, spreading investment risk across the massive capital requirements.

BP had previously won rights to exploit the Manakin-Cocuina field before Trump revoked its sanctions exemption last year, and the company is now actively lobbying to have those privileges reinstated as Venezuela's political landscape transforms overnight.

Is BP Stock a Good Buy Right Now?

In Q3, BP reported an underlying profit of $2.21 billion while upgrading production guidance and making strategic progress across its refocused oil and gas portfolio. Operating cash flow jumped to $7.8 billion as BP focused on operational excellence. The energy giant’s upstream plant reliability and refining availability stood at 97%, the best performance in two decades for the current asset base.

The British energy giant has started six new oil and gas projects in 2025, with four coming online ahead of schedule, and notched 12 exploration discoveries, including the potentially massive Bumerangue find in Brazil.

Management confirmed the discovery features a 1,000-meter hydrocarbon column with 100 meters of oil and 900 meters of rich gas condensate, the largest discovery in 25 years. BP has secured a rig to drill an appraisal well and conduct flow tests by late 2026.

The company raised its divestment guidance, expecting around $5 billion in completed and announced asset sales this year toward its $20 billion target through 2027. Recent deals include selling minority stakes in Permian and Eagle Ford pipeline assets for $1.5 billion. BP also announced an ongoing strategic review of Castrol, which has delivered nine consecutive quarters of earnings growth, as well as its Gelsenkirchen refinery and Lightsource renewable energy stake.

Downstream performance improved markedly, with the first nine-month earnings up 40% year-over-year (YoY), driven by structural cost reductions of $500 million in the customer segment and $200 million in refining.

The company's BPX Energy unit in the United States continues to exceed expectations, with 30% productivity improvements in completions and a record number of wells drilled in the Haynesville, now producing 80 million cubic feet daily from a single well. BP signed a major production-sharing agreement for Iraq's Kirkuk field, which currently produces 328,000 barrels per day and has significant upside potential.

The contract features better terms than previous deals, including price upside provisions and exploration rights. Management remains confident in delivering 20% compound annual growth in adjusted free cash flow through 2027 while maintaining capital discipline within the $13 billion to $15 billion annual guidance range.

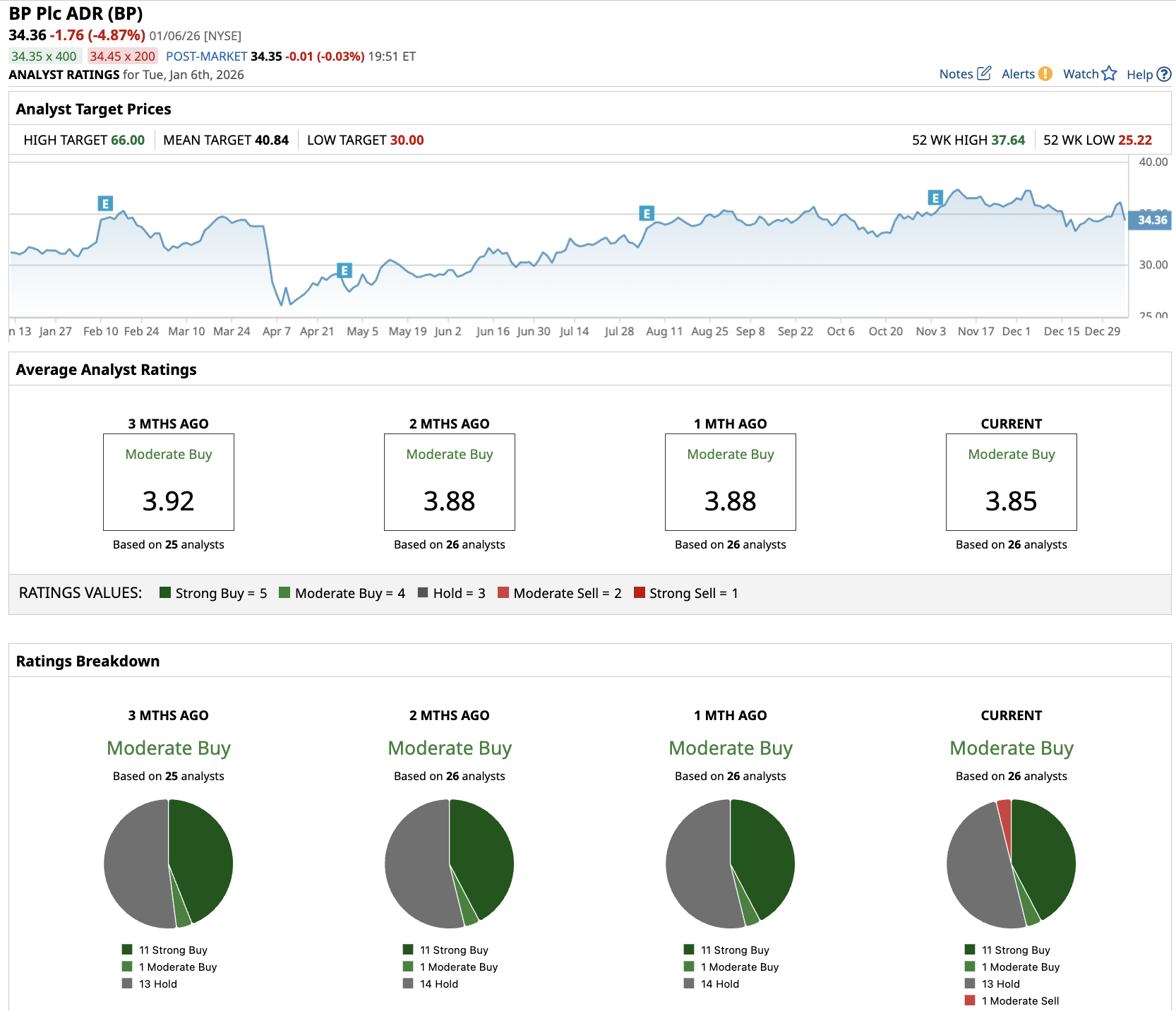

What Is the BP Stock Price Target?

Valued at a market cap of $89 billion, BP is among the largest oil and gas companies globally. In the last decade, BP stock has returned 6% to shareholders. However, if we adjust for dividends, cumulative returns are closer to 110%. Similar to other energy stocks, BP offers shareholders a dividend yield of 5.8%, making it attractive to income-seeking investors.

Out of 26 analysts covering BP stock, 11 recommend “Strong Buy,” one recommends “Moderate Buy,” 13 recommend “Hold,” and one recommends “Moderate Sell.” The average BP stock price target is $40.84, above the current price of $34.36.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/AI%20microchip%20by%20DesignKingBD360%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

/Dominos%20Pizza%20Inc%20storefront%20by-KathyDewar%20via%20iStock.jpg)