/A%20SoFi%20logo%20on%20an%20office%20building%20by%20Tada%20Images%20via%20Shutterstock.jpg)

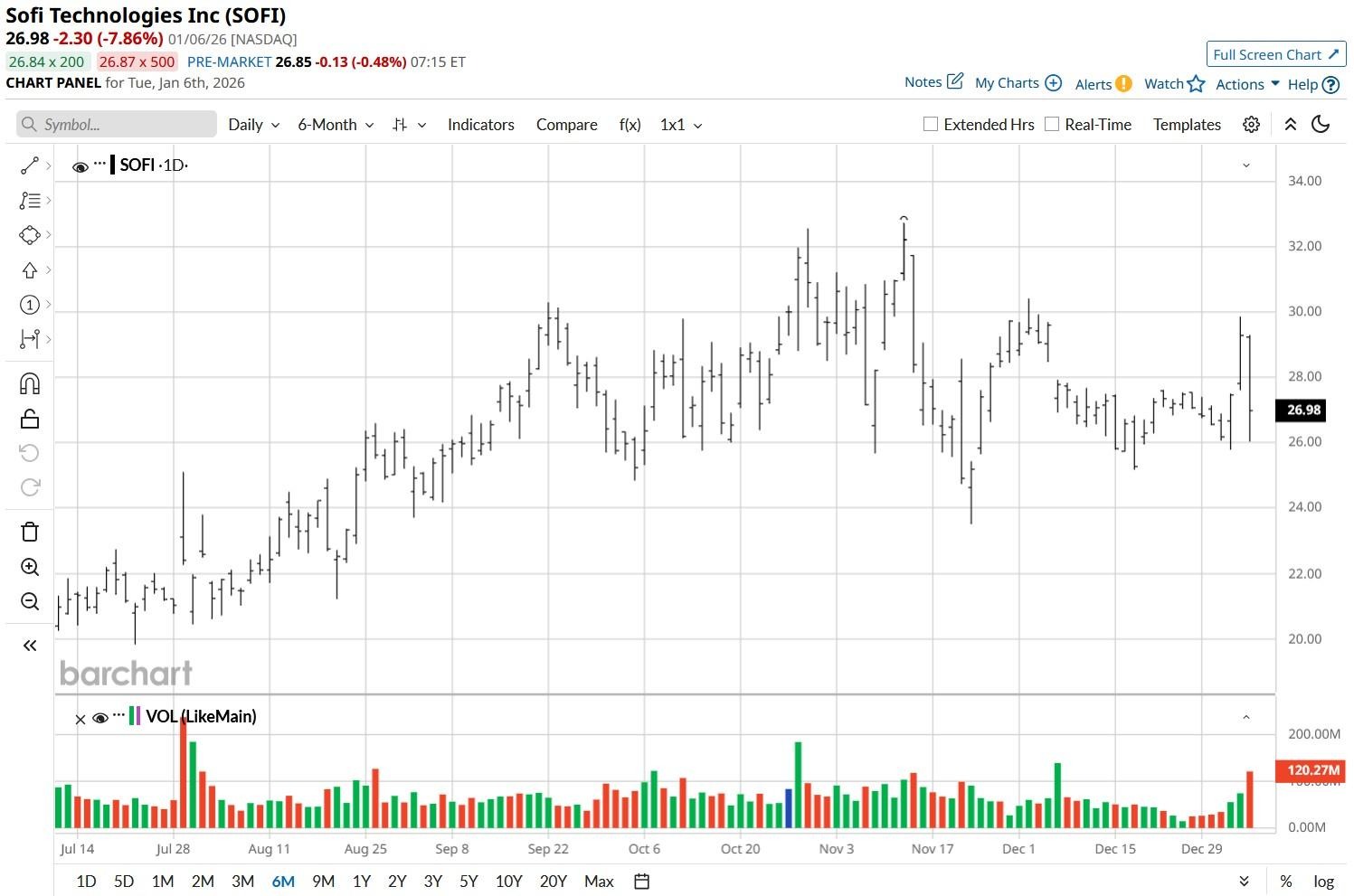

SoFi Technologies (SOFI) shares closed nearly 8% down on Jan. 6 after the financial technology company raised about $1.59 billion via an equity offering.

The selloff pushed SOFI below a major support (100-day moving average), indicating the bearish momentum may accelerate in the days ahead.

Following this recent weakness, SoFi stock is down nearly 19% versus its 52-week high.

Should You Buy SoFi Stock on the Pullback?

Investors have bailed on SOFI shares this week mostly because the announced public offering will dilute their stake in the neobank.

However, there’s reason to consider buying this fintech stock on recent weakness, especially if you are in it for the longer term.

The San Francisco-headquartered firm is scheduled to report its Q4 earnings on Jan. 26. Consensus is for it to more than double its quarterly profit on a year-over-year basis to $0.11 a share.

This could prove a near-term catalyst that helps SoFi Technologies reclaim some of its lost ground in the months ahead.

SOFI Shares Have Several Tailwinds in 2026

SoFi stock is worth owning for the company’s recent push into the cryptocurrency market and its artificial intelligence (AI)-driven personal finance tools.

Additionally, the recently launched “SoFiUSD” stablecoin has diversified its revenue stream while further strengthening its foothold in digital assets.

Meanwhile, the fintech firm’s core business stands to benefit as the Federal Reserve lowers interest rates further in 2026 as well.

These tailwinds made Needham analysts maintain a “Buy” rating on SOFI last week with a $36 price target indicating potential upside about 33% from here.

What’s also worth mentioning is that historically (over the past four years), SoFi Technologies has delivered over 20% return on average in January, reinforcing that the recent pullback could prove temporary only.

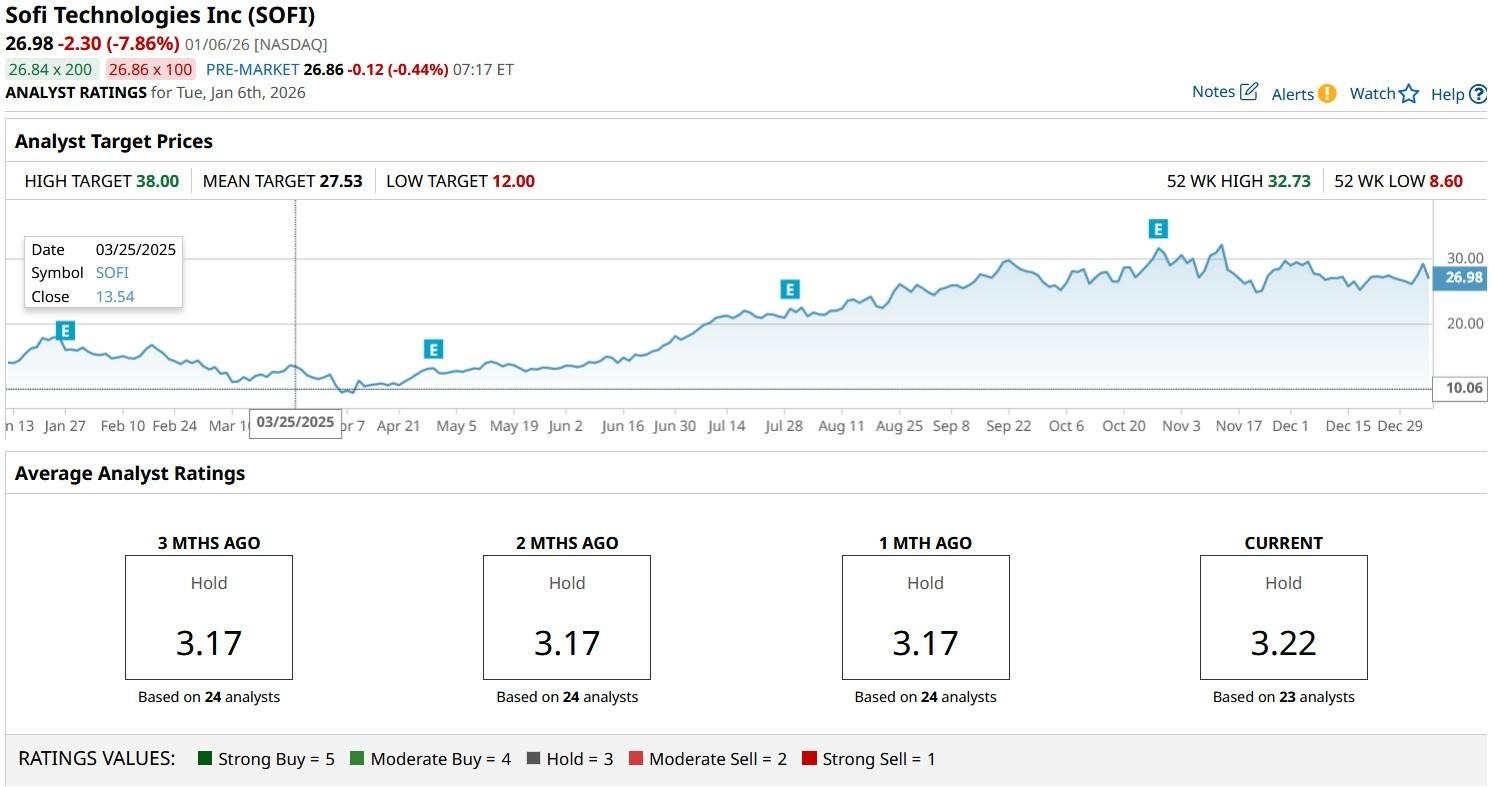

What’s the Consensus Rating on SoFi Technologies?

Despite the aforementioned tailwinds, other Wall Street analysts recommend caution in playing SOFI stock that’s already up nearly 200% versus its 52-week low.

According to Barchart, the consensus rating on SoFi shares currently sits at “Hold” only with the mean target of $27.53 signaling investors shouldn’t count on a strong rebound in them anytime soon.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)