/AI%20(artificial%20intelligence)/Chat%20bot%20with%20AI%20Artificial%20Intelligence%20generate%20by%20MMD%20Creative%20via%20Shutterstock.jpg)

Valued at $21.2 billion, Twilio (TWLO) is a cloud communications and customer engagement platform that enables businesses to connect with their customers across different channels using software rather than traditional telecom networks. Twilio stock rose 30.4% last year, outperforming the S&P 500 Index ($SPX) gain of 16.6%. With improving margins and growing traction in high-value products, Twilio might be finally positioned for a meaningful turnaround in 2026.

Twilio Seems Ready for a 2026 Turnaround

Artificial intelligence (AI) is transforming Twilio from a low-margin messaging utility to a high-value customer engagement and AI infrastructure platform. This has enabled Twilio's revenue to grow from $1.7 billion in 2020 to an estimated $5.02 billion by 2025. In the third quarter, Twilio reported revenue of $1.3 billion, up 15% year-over-year (YoY), alongside adjusted operating income of $235 million. Adjusted earnings rose 22.5% to $1.25 per share. The company exceeded its guidance and also raised full-year targets for revenue growth, profitability, and free cash flow, sending a strong confidence signal as Twilio heads into 2026.

Twilio’s performance in Q3 was driven by strength across nearly every part of its business. Messaging revenue increased in the high teens for the second consecutive quarter, while voice revenue increased in the mid-teens, at the fastest pace in more than three years. This increase was closely connected to expanding demand for AI-driven use cases, with speech AI customer revenue increasing by over 60% YoY. Notably, income from Twilio's ten largest voice AI startup customers surged more than tenfold compared to the previous year.

Software add-ons also played a key role. Products like Twilio Verify continued to gain traction, growing more than 25% YoY, highlighting increasing demand for secure and trusted communications in a digital-first world. Meanwhile, ISV and self-service customers each saw more than a 20% YoY revenue increase, highlighting Twilio's ability to scale across several customer groups.

The company secured its largest deal ever during the quarter, a nine-figure, multi-product renewal with a leading cloud provider, alongside notable wins across financial services, retail, travel, healthcare, and software. While revenue grew, margins faced some near-term pressure. Adjusted gross margin came in at 50.1%, down YoY due largely to higher U.S. carrier pass-through fees. Management acknowledged these headwinds but highlighted ongoing price actions and efficiency initiatives aimed at stabilizing and improving margins over time. Management also underlined that higher-margin items, such as voice and software add-ons, are expanding faster, which might help with margin recovery in the long term. Free cash flow reached $248 million in the quarter, supporting $657 million in share repurchases, about 95% of year-to-date (YTD) free cash flow.

Looking ahead, Twilio raised its full-year 2025 outlook, expecting organic revenue growth to exceed 11% and adjusted operating income to reach $910 million. Free cash flow is forecasted to be near $930 million. These upward revisions indicate both sustained demand and tighter cost controls. Analysts predict a staggering 192.2% earnings growth in 2025, followed by another 37.4% increase in 2026. Twilio, trading at 25 times forward 2026 earnings, appears to be a cheap growth stock to buy now.

Is TWLO Stock a Buy on Wall Street?

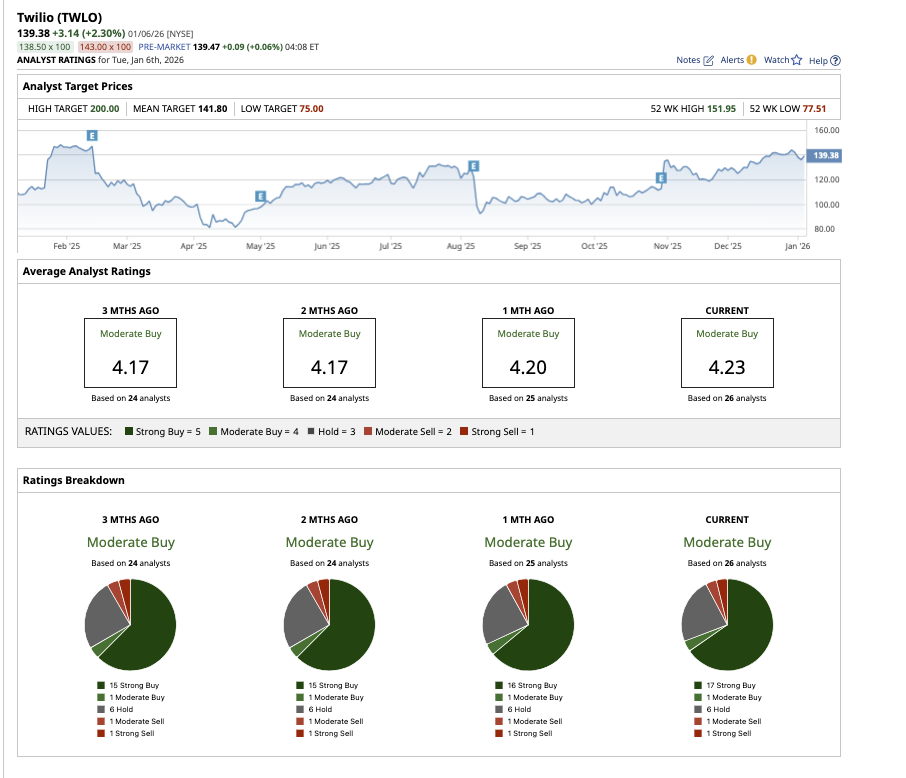

Overall, Twilio stock is a consensus “Moderate Buy” on Wall Street. Out of the 26 analysts covering the stock, 17 rate it a “Strong Buy,” one says it’s a “Moderate Buy,” six rate it a “Hold,” one says it’s a “Moderate Sell,” and one recommends a “Strong Sell.” The average target price for the stock is $141.80, which is 1.7% higher than current levels. Plus, its high price estimate of $200 implies the stock can climb 43.5% over the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)