The main focus of international financial media was once again the US move for Venezuela's oil and the debate over how the US will take Greenland.

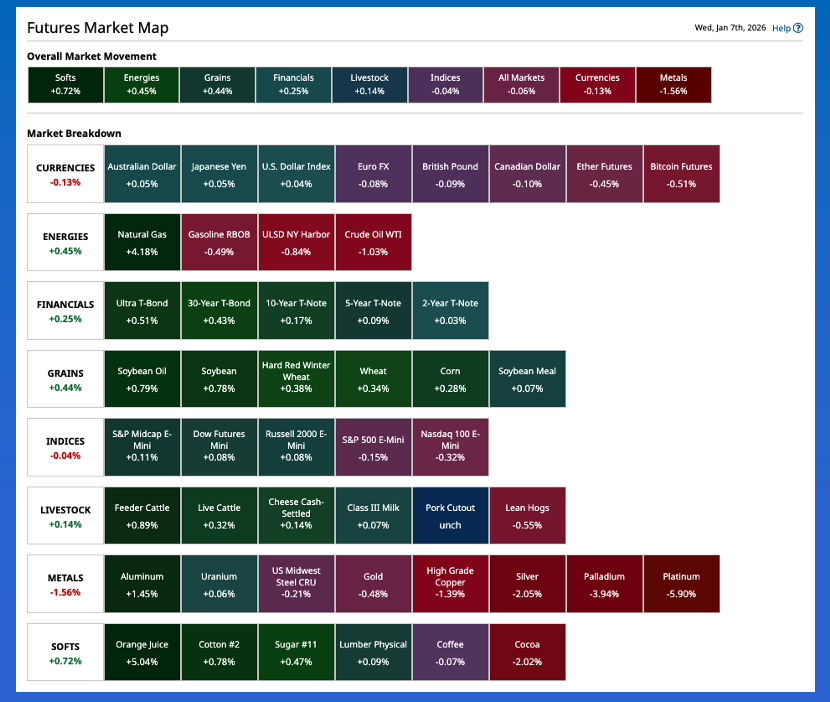

In other news, it was a wild overnight session as Metals erased some of Tuesday's strong rally.

In the Grains sector, the spotlight was on soybeans with hints of another export sale announcement to be made later Wednesday morning.

Morning Summary: Once again, the first two talking points on CNBC’s financial program Squawk Box Europe Wednesday morning were: 1) The US president said Venezuela would “give” 50 million barrels of its oil to the United States, an amount roughly valued at $3 billion. 2) The US Secretary of State stating the US administration is looking to buy Greenland rather than take it over militarily. Naturally, the US president contradicted this statement. As I said earlier this week, US activity in Venezuela wasn’t about democracy, or the latest weapons of mass destruction (aka drugs), it was about the oil. Now it seems the plan is for the US to use its ill-gotten gains from Venezuelan oil to buy Greenland. I’m sure in some corner of the Oval Office, this makes sense. (Think about that sentence for a moment.) As for markets, it was another wild night with Metals showing the largest selloff. Silver led the way down as the March futures contract (SIH26) dropped as much as $2.94 (3.8%). As for Crude Oil, the spot-month WTI contract (CLG26) slipped as much as $1.37 (2.5%) while Brent (QAH26) slid as much as $1.25 (2.1%). I’ll close this segment with a comment from the program’s co-host Karen Tso, “Unless something is for sale, it is hard to buy it.”

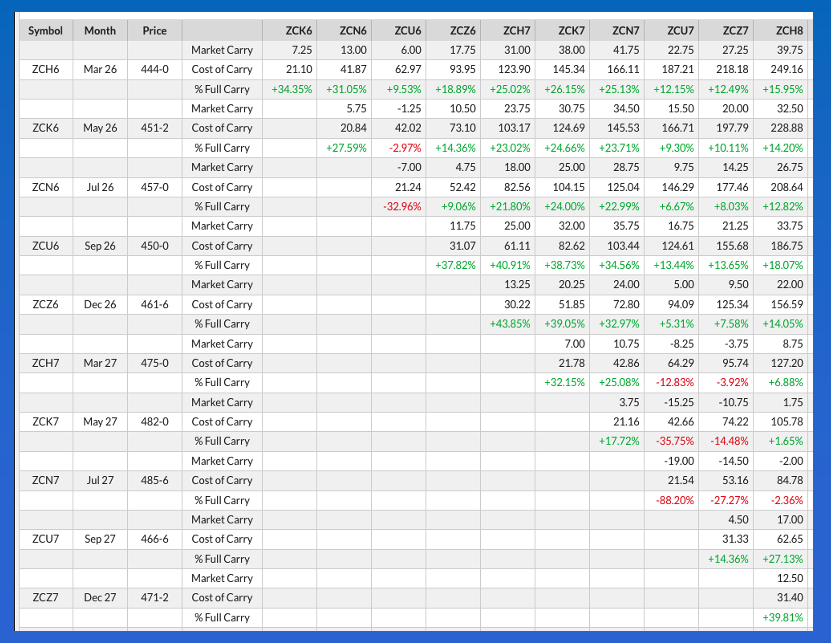

Corn: The corn market was quietly higher early Wednesday morning, though it likely had more to do with spillover buying from soybeans than anything tied to the potential double-decker “deal” of the US taking oil from Venezuela to buy Greenland. The March issue (ZCH26) posted a 1.75-cent trading range overnight, from down 0.25 cent to up 1.5 cents on trade volume of 10,000 contracts and was sitting 1.25 cents higher at this writing. Recall March closed 0.5 cent lower Tuesday after settling 7.0 cents higher to open the week. Later in the evening, the National Corn Index came in near $4.0750, basically unchanged for the day telling us national average basis firmed, as expected. The latest calculation came in at 36.5 cents under March futures as compared to last Friday’s final figure of 37.25 cents under and the previous 10-year low weekly close for the week of 35.0 cents under March. On the noncommercial side, March finished the latest positioning week, Tuesday to Tuesday, with a gain of 3.5 cents indicating the net-long futures position likely increased. Why? The May-July futures spread continues to cover a bullish level of calculated full commercial carry, possibly attractive enough to keep investors interested. For now.

Soybeans: As previously mentioned, the big story in the Grains sector overnight was the oilseed sub-sector. As of this writing the March soybean contract (ZSH26) was up 9.0 cents (0.85%) after rallying as much as 12.25 cents overnight on trade volume of nearly 15,000 contracts. This could still be considered light trade activity, raising the question of if it was actual commercial buying or continued noncommercial interest in March, with the nearby January in delivery and headed toward its last trading day on Wednesday, January 14. The latest Commitments of Traders report, as of Tuesday, December 30, showed a noncommercial net-long futures position of 121,810 contracts, a decrease of 35,970 contracts from the previous week. Tuesday’s close, with March down 5.75 cents for the day, saw the more heavily traded contract finish the positioning week with a loss of 6.0 cents indicating we should see another decrease in the net-long futures position in the next weekly update set for release Friday afternoon. That being said, I would expect another announced export sale later Wednesday morning[i]. Fundamentally, the National Soybean Index came in 5.0 cents below Monday’s calculation, meaning national average basis firmed indicating an uptick in immediate-term demand. We’ll see what subsequent weekly export sales and shipments updates show.

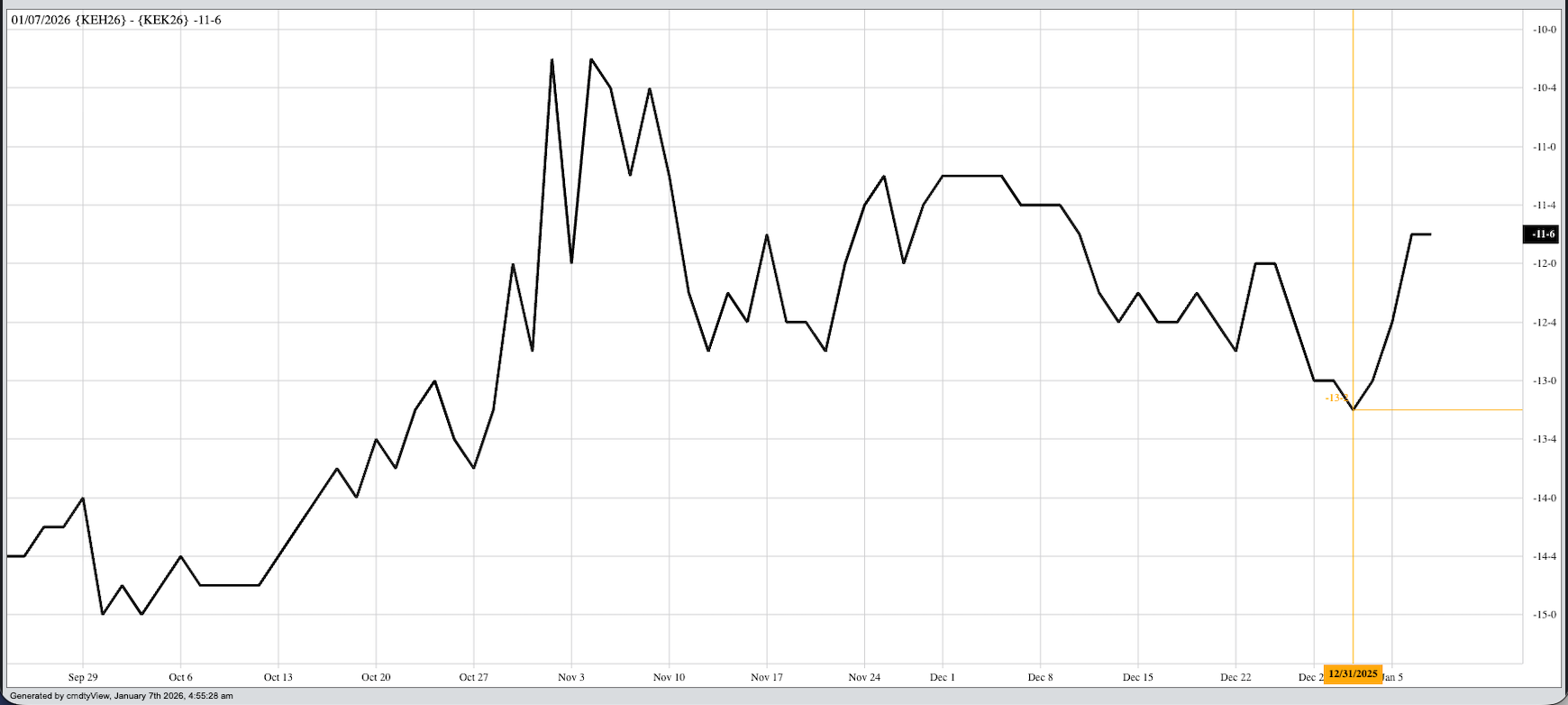

Wheat: The wheat sub-sector was quietly higher pre-dawn Wednesday. In the HRW market we see something similar to what was discussed with soybeans, where nearly all the trade occurred in the nearby March issue. March HRW (KEH26) was up 2.75 cents and one tick off its session high on trade volume of about 1,800 contracts as of this writing. Further out, the May issue could only muster 800 contracts traded while new-crop July had yet to reach 300 contracts. Well after the dust had settled on Tuesday’s close, my friend in the brokerage industry updated me with option traders were buying HRW calendar spreads. This hints at possible changes continuing to be seen in our fundamental reads. Recall last Friday’s national average basis calculation came in at 64.5 cents under March futures, as compared to 72.75 cents under the previous Friday. Yes, national average basis was still weak given the previous 5-year low weekly close was 59.0 cents under March. But that was a sizeable swing as the Krampus Countdown[ii] came to an end for another year. Additionally, the March-May spread has moved from a carry of 13.25 cents and covering 60.5% calculated full commercial carry on December 31 to 11.75 cents and 53.6% at Tuesday’s close.

[i] The announced sale from December 30, 2025, of 231,000 mt of 2025-26 soybeans to unknown destinations was changed to 136,000 mt to China and 206,700 mt to unknown destinations. Yes, I know, the numbers don’t add up. Don’t ask me to make sense of USDA announcements.

[ii] Don’t be long wheat in December.

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)