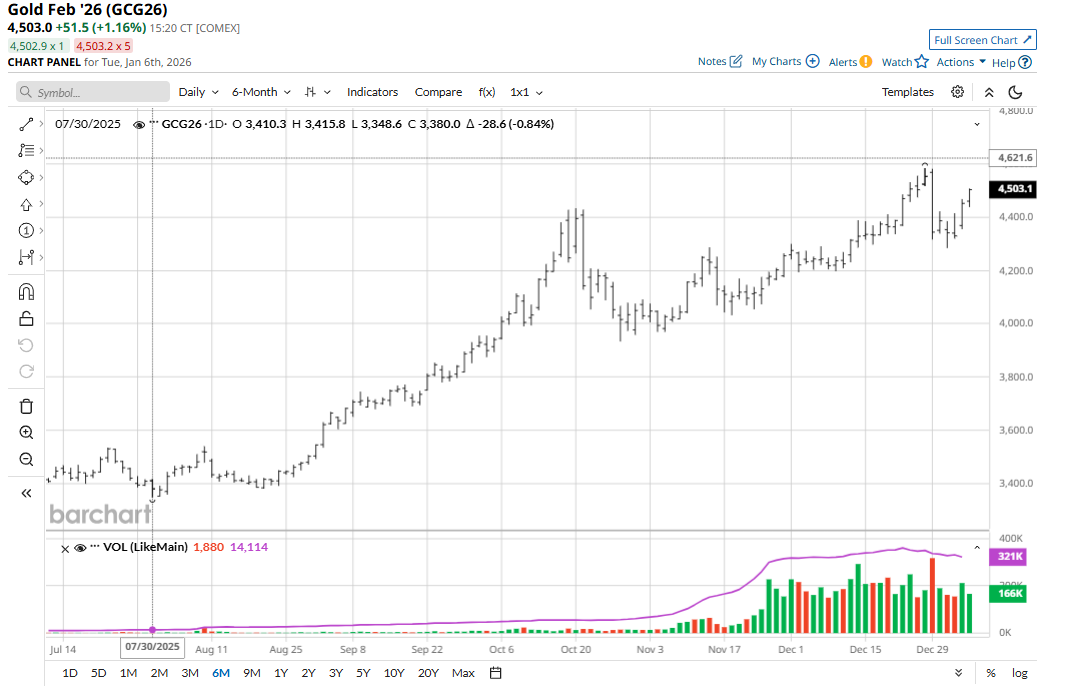

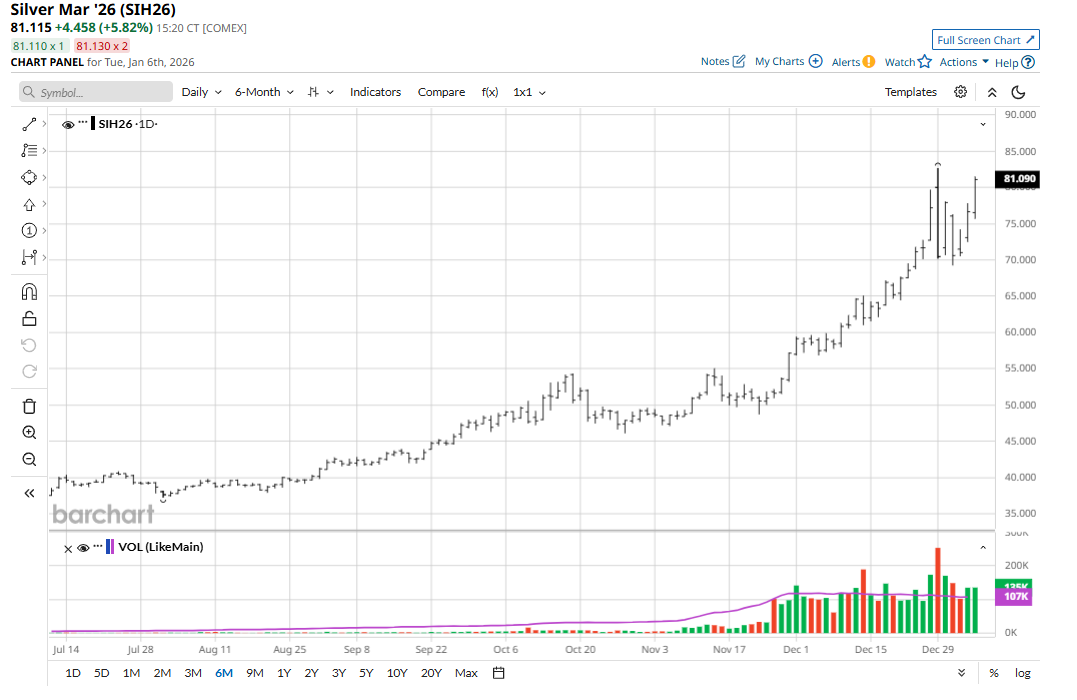

Gold (GCG26) and silver (SIH26) prices were higher again in early U.S. trading Tuesday on safe-haven demand following the weekend U.S. raid in Venezuela that captured its president and left precious metals traders pondering what lies ahead, geopolitically, in the coming months.

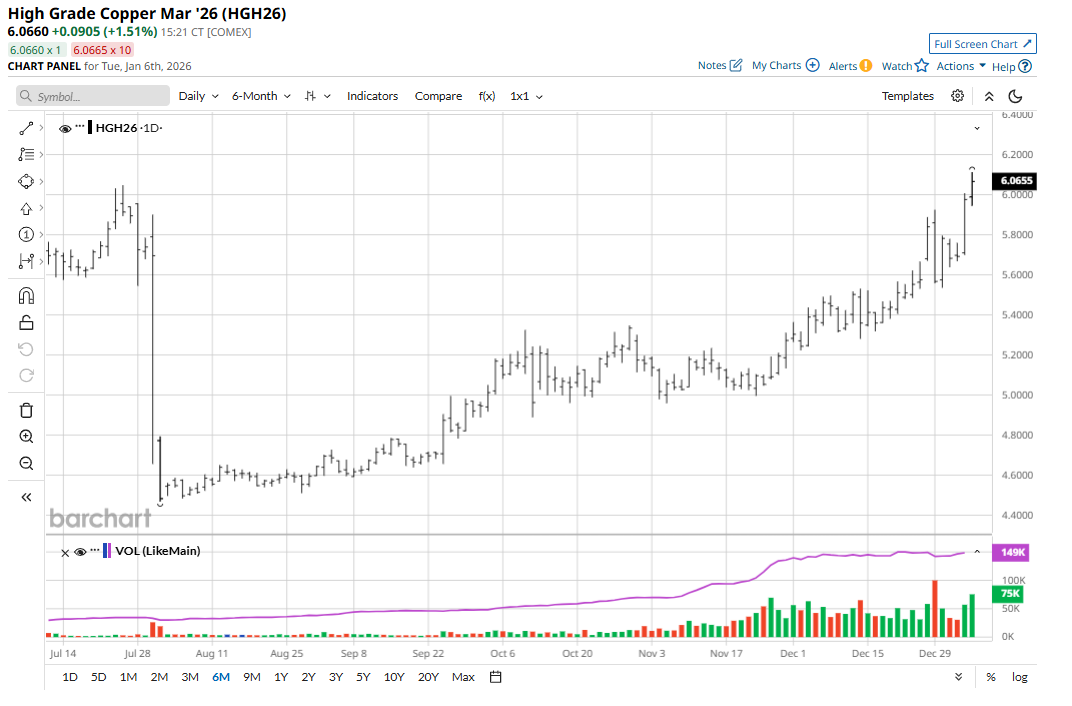

Copper (HGH26) futures climbed above $6 per pound overnight, hitting a new record high amid expectations of a further tightening in global supplies this year. “Traders are increasingly concerned that the Trump administration could introduce new tariffs on refined metals, diverting shipments into the U.S. and leaving major trading hubs such as London and Shanghai short of supply,” said TradingEconomics.com. The red industrial metal’s price has been supported by a robust global demand outlook, particularly from power grid upgrades, renewable energy projects, and data center expansion.

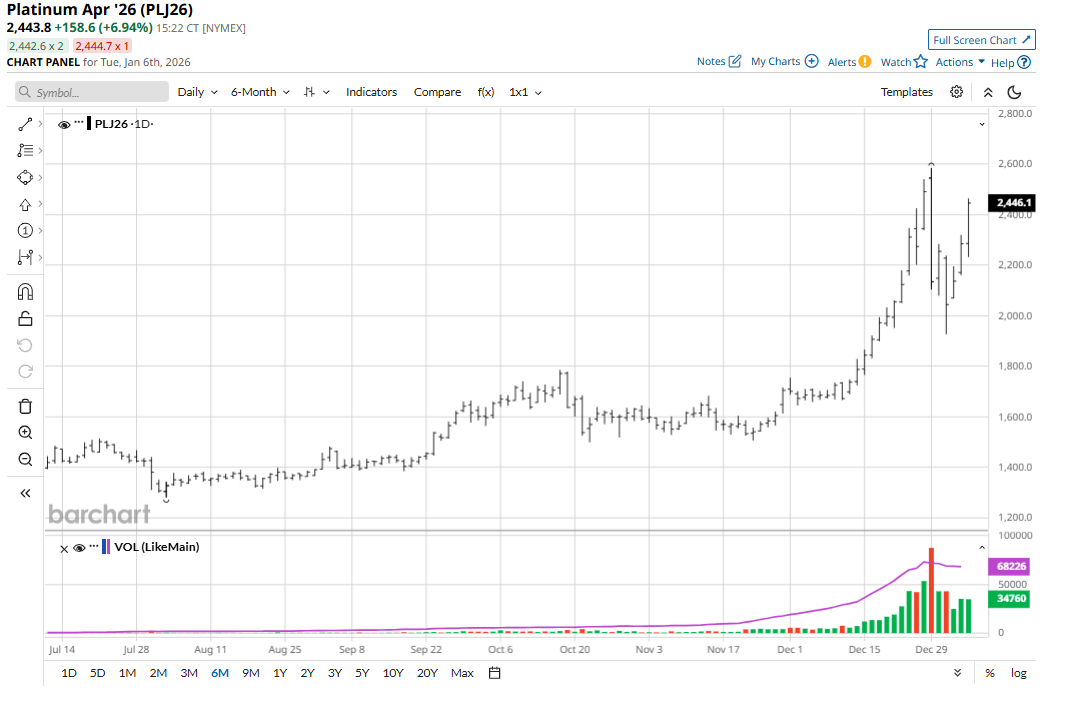

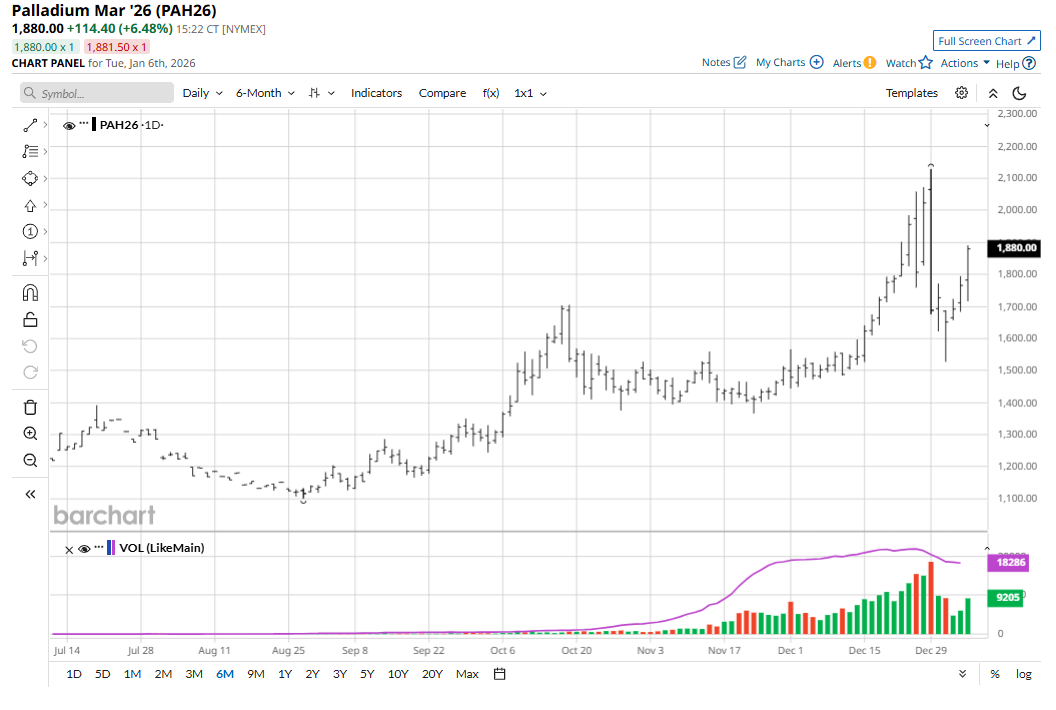

Platinum (PLJ26) futures prices in December hit a record high of $3,563.50 an ounce, while palladium (PAH26) futures prices in December hit a three-year high of $1,984.70 an ounce. These two markets have this week posted solid gains.

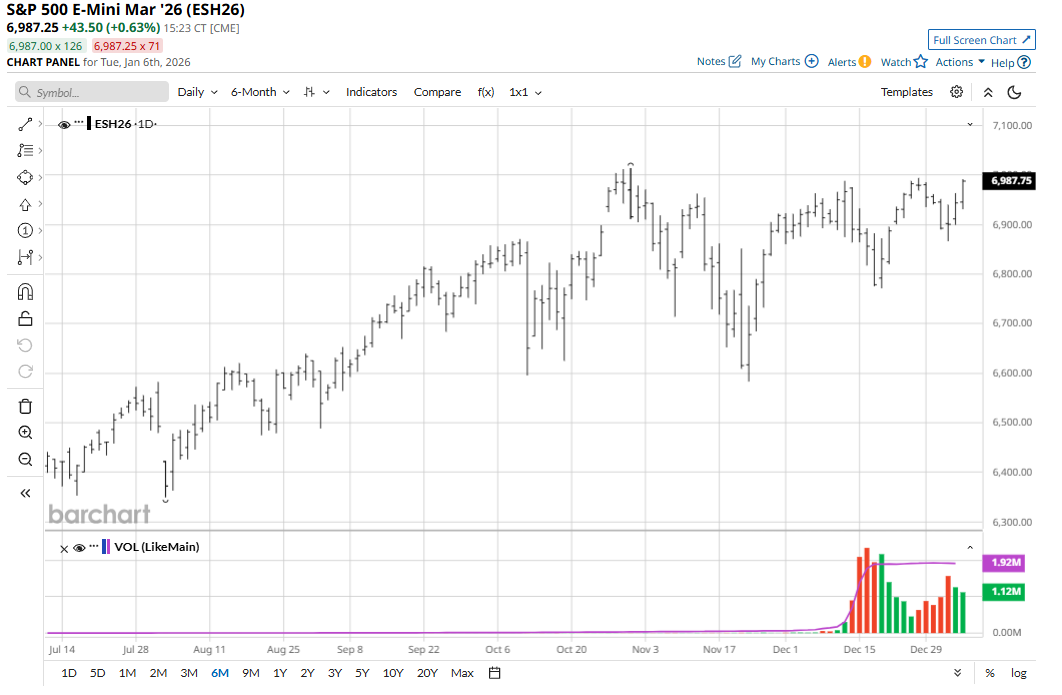

Meantime, Asian and European stock markets are on a roll. Asian stocks are having their best-ever start to a year, with some key indexes at record highs. The region’s currencies and bonds also rallying as investors seek opportunities outside the U.S. The MSCI Asia Pacific Index is up around 4% in the first four trading sessions of 2026, set for its strongest beginning in records going back to 1988. Europe’s STOXX 50 traded little changed on Tuesday but at near-record levels, while the broader STOXX 600 rose to an all-time high. The German DAX index Tuesday reached a fresh record high, as did the U.K.’s FTSE 100 stock index. U.S. stock indexes hit record highs in November and are presently trading not far below their record highs. Global bond markets took the weekend U.S. raid and capture of the Venezuelan president mostly in stride.

Yet, the gold and silver markets are in solid rally modes amid strong safe-haven demand.

Strong safe-haven buying in gold and silver generally comes amid keener risk-off sentiment. So, what gives?

Are Metals Traders Presently the Smartest People in the Room?

There’s an old market adage that says bond market traders are the smartest people in the room. That may be the case most of the time, but I’m going to argue that precious metals traders, at present, appear to be the smartest. Reason:

While stock and financial markets are taking the U.S. raid on Venezuela mostly in stride, with some global stock indexes hitting record highs this week and other markets mostly calm, it appears precious metals traders are more wisely looking over the horizon and pondering what the U.S. raid in Venezuela may mean for the geopolitical front in the coming months. Consider the following:

- President Donald Trump has warned other Central and South American countries about their illicit drug shipments to the U.S. and has said the U.S. will re-exert its influence in the Western Hemisphere.

- Trump has also expressed interest in the U.S. acquiring Greenland. A Bloomberg report today said if the U.S. takes over Greenland, the NATO defense organization would be dead.

- China, Russia, and other nations have criticized the U.S. for its raid on Venezuela, but China may have just gotten the door pushed open a little wider in its intent to reclaim Taiwan — so it can beef up its own dominance in the Eastern Hemisphere.

- After the U.S.-Israel major air strikes against Iran last summer, Iran has become more politically unstable, with civil unrest growing.

- Meantime, war-torn Russia’s President Vladimir Putin is watching everything unfold amid Russia’s own decaying economy and Putin’s only global playing card being a bulging-but-aging nuclear stockpile.

It seems precious metals traders are correctly taking all the above into account much more than the stock and financial markets — at least so far. Indeed, all the above taken together, or even in parts, is enough to more than move the needle on continued safe-haven demand for gold and silver.

Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)