/AI%20(artificial%20intelligence)/Data%20Center%20by%20Caureem%20via%20Shutterstock%20(2).jpg)

Global markets remain supported by ongoing enthusiasm for artificial intelligence (AI) and the build-out of data center infrastructure. Hyperscalers and large technology companies continue to invest heavily, with data center M&A reaching about $61 billion through 2025, topping the prior year’s record. While some strategists warn that parts of the AI trade may be stretched, demand for physical infrastructure is still driving the theme.

Within that backdrop, Vertiv (VRT) appears positioned to catch up. Barclays just upgraded the stock to “Overweight,” citing recent weakness as a more attractive entry point. The bank highlights Vertiv’s heavy exposure to data centers, which account for roughly 80% of sales, and expects 2026 earnings to come in above Street estimates.

With management known for conservative guidance, Barclays sees potential upside if data center spending remains steady into next year.

About VRT Stock

Vertiv is a critical digital infrastructure company that blends hardware, software, analytics, and services to keep data centers, telecom networks, and industrial facilities running. Its product mix spans AC/DC power systems, UPS, thermal and cooling solutions, racks and enclosures, and capabilities that make the company integral to modern AI and cloud deployments across more than 130 countries.

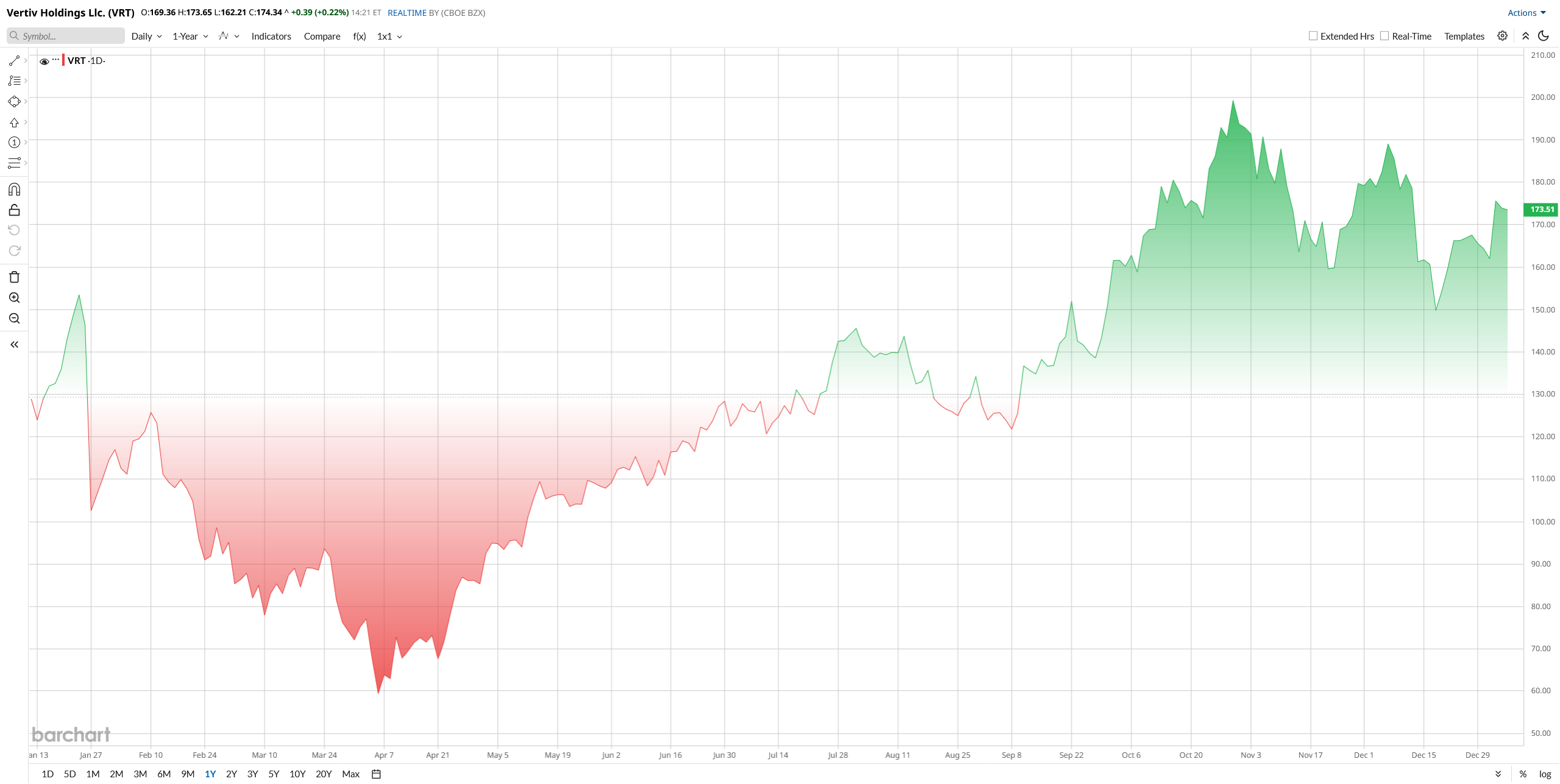

The stock had a strong 2025, more than doubling early in the year as data center demand surged and business with hyperscale AI customers expanded. Shares hit a record above $202 in late October before a year-end pullback left the price nearer $165 to $170, roughly 15% off that peak. The 50-day moving average sat above the stock in late December, while the 200-day average remained lower, signaling recent consolidation after an extended run.

Vertiv trades at a premium with price/book ratios significantly higher than the sector median, indicating an expensive stock. For instance, its forward price/book is 17.19 compared to the sector's 3.34, suggesting a price premium. Still, analysts argue that those multiples reflect expected revenue and earnings growth of roughly 25 to 30%, and Vertiv’s PEG ratio appears more attractive when growth forecasts enter the calculus.

Vertiv Tops Q3 Forecast

Vertiv posted its third-quarter 2025 earnings report on Oct. 22, showing a stronger revenue and profit beat, underscoring the robust demand for AI-driven and hyperscaler data center growth. Net sales grew by 29% year-on-year (YoY) to $2.676 billion, with North America having most of the revenues, increasing by 43%, and the Asia-Pacific region showing positive growth. That is more than offset by a small degree of softness across Europe, the Middle East, and Africa, where AI-related infrastructure expenditure is the most concentrated.

The profitability also increased drastically. Net earnings increased to $398.5 million, up from $176.6 million the previous year. Adjusting to EPS was also reported to be high at $1.24, exceeding expectations by a sufficient margin, as operating leverage and margin improvements pushed through the income statement. Operating profit grew 39% to $517 million, and adjusted operating profit increased 43%, elevating adjusted operating margins to more than 22%.

Creation of cash was also excellent. Adjusted free cash flow grew by 38% annually to $462 million, and Vertiv had almost $1.4 billion in cash left.

Management also boosted the full-year 2025 hierarchy despite the robust quarter's results and is currently estimating revenue growth of $10.16 to $10.24 billion and adjusted EPS of $4.07 to $4.13, indicating continued momentum into the last quarter.

Vertiv kept strengthening its competitiveness strategically towards the end of the year. The company completed the PurgeRite acquisition to expand its liquid-cooling and fluid-management offerings and several strategic partnerships, among others with Caterpillar (CAT), to accelerate modular power and cooling deployments. Another move strengthening the faith in the cash-generation profile was that the management increased the quarterly dividend.

What Do Analysts Say About VRT Stock

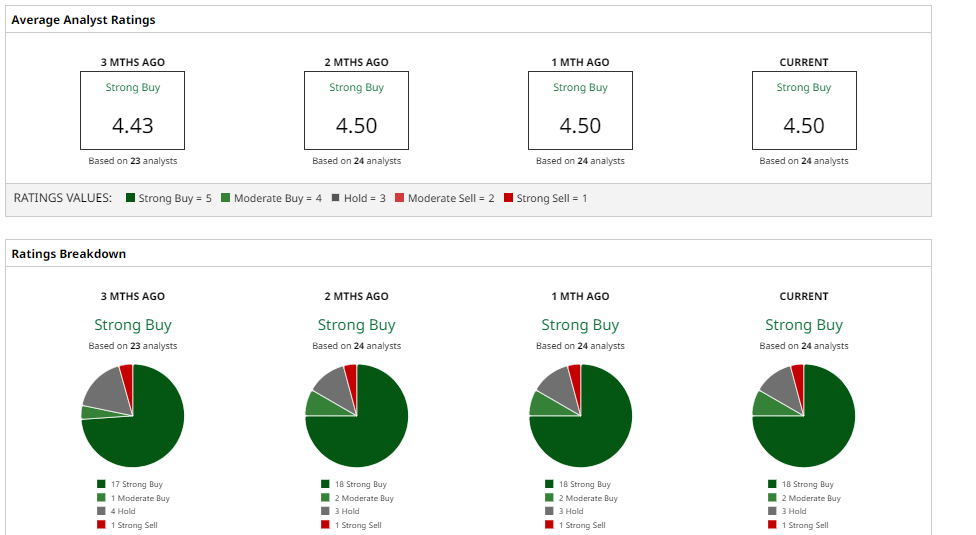

Wall Street’s view skews positive, multiple firms lifted targets, and many analysts rate the stock a “Buy,” citing record order growth, margin expansion, and a healthy backlog.

Barclays and other brokerages grew more constructive in early January 2026, lifting ratings and raising price targets to about $200, saying recent weakness creates an attractive entry point and forecasting upside if data center spending steadies. Barclays noted that Vertiv has underperformed various AI-data-center peers year-to-date and expects catch-up potential in 2026.

Similarly, Morgan Stanley in Oct. 2025 reiterated its “Overweight” rating and boosted its 12-month target to $200 from $165, citing robust demand and Vertiv’s pipeline.

On consensus, the rating is “Strong Buy” from 24 analysts in coverage with an average 12-month price target of $195, which implies an expected 12% upside potential from here.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/McDonald's%20Corp%20arches%20by-%20TonyBaggett%20via%20iStock.jpg)