/AI%20(artificial%20intelligence)/AI%20technology%20-%20by%20Wanan%20Yossingkum%20via%20iStock.jpg)

The ancillary trade, or the “picks and shovels” trade, as many refer to it, has been a lucrative way to build wealth over the years. Here, one is not getting on the bandwagon of an exciting or transformative space. Rather, the bet is on the engine and the nuts and bolts powering this bandwagon. Whether it was the “Gold Rush” of the mid-19th century or the AI revolution now, the “picks and shovels” trade has been a rewarding bet for investors.

However, the choice of the right picks and shovels is necessary, with thoughtful discernment required to identify the right stocks in this trade. To that end, this Texas-based infrastructure services provider involved in the buildout of AI can be an option that can be looked into.

About Quanta Services

Founded in 1997, Quanta Services (PWR) is a leading U.S. infrastructure services provider focused on complex energy, utility, communications, pipeline, and renewable projects. It is widely regarded as one of the largest specialty contractors in North America. The company is a specialty contracting services firm offering design, engineering, installation, maintenance, and repair services across multiple infrastructure verticals.

Valued at a market cap of $63 billion, PWR stock increased by 33.8% in 2025, outperforming the S&P 500's ($SPX) rise of 16.7% in the same period.

However, amid a number of known and proven ways to play the AI infrastructure trade already available, how does Quanta stand out? Let's analyze.

Decent Financials

In terms of financials, nothing really screams out for Quanta. And that is mostly a good thing, with debt kept under control, which is not always the case for infrastructure companies. Over the last 10 years, Quanta has grown its revenue and earnings at CAGRs of 13.45% and 17.97%, respectively, which is, again, nothing extraordinary but steady growth.

Furthermore, the company's quarterly results have been characterized by year-over-year (YoY) growth, as well as estimates beating in the past few years. The latest Q3 2025 did not deviate from the familiar path either.

Q3 2025 saw Quanta recording revenues of $7.6 billion, up 17% from the previous year. The core electric segment, making up 81% of the total revenues, came in at $6.2 billion. This denoted an annual growth rate of 18.5%. The Underground and Infrastructure segment comprised the rest and reported sales of $1.46 billion, which marked a YoY growth of 15.9%.

Earnings for the quarter were $3.33 per share. Not only was this up by 22.4% from the previous year, but it also came in higher than the consensus estimate of an EPS of $3.25. Notably, this also marked the ninth consecutive quarter of earnings beat from the company.

Remaining Performance Obligations, or RPO, a key indicator of revenue visibility, also showed strong growth of 34.5% from the previous year.

However, net cash flow from operating activities witnessed an annual decline of 23.8% to $563.5 million. Yet, the company closed the quarter with a cash balance of $610.4 million, which was above its short-term debt levels of $204.9 million.

Overall, for 2025, Quanta expects revenue to be between $27.8 billion and $28.2 billion and earnings to be in the range of $6.53 and $7.02 per share, the midpoint of which would imply yearly growth rates of 18.3% and 12.4%, respectively. Meanwhile, analysts are expecting Quanta to report revenue and earnings growth rates ahead of the sector median at 14.84% and 20.33% versus 5.07% and 9.68%, respectively.

Quanta's Strategic Drivers

With data center power requirements set to climb steeply in the years ahead, Quanta Services finds itself in a prime spot to reap the rewards. Its ongoing collaboration with American Electric Power (AEP) could turn out to be a standout factor. AEP is already working hand in hand with top-tier hyperscalers like Meta Platforms (META) and Amazon Web Services (AWS) to fuel their data center expansions. Quanta has earned a spot as a primary contractor in AEP's $72 billion capital spending initiative, which targets upgrades to transmission networks and power delivery. Quanta's piece of the puzzle involves erecting 765 kV lines and similar high-voltage infrastructure to make sure AEP can keep up with customer loads. Arrangements like this stretch across multiple years and noticeably widen Quanta's playing field. Getting tapped for these roles also points to the company's chops, since it can tackle about 60% of what a standard data center job entails, not to mention other high-stakes builds.

Additionally, acquiring Dynamic Systems and Cupertino Electric shows Quanta's clear drive to get stronger in the data center game. Folding those teams into its existing electric-power muscle rounds out a fuller toolkit for all sorts of infrastructure work.

However, Quanta's real secret weapon is the size of its skilled labor force. The company has pulled together more than 200 subsidiaries since its foundation, creating the biggest group of craft workers anywhere in North America. That lets it have an ever-ready stream of manpower, matching the breakneck speed hyperscalers run at, a tough barrier for others to match on big, hands-on projects.

The renewables side keeps building steam too. Last year, Quanta came in 30% ahead on its CO₂ cuts by commissioning over 12 GW of new capacity. Now the sights are set on topping 100 GW by 2035, layering in another solid revenue stream.

Put it all together, and Quanta's tight connections in utilities, clean energy, and construction line it up nicely for lasting trends: overhauling the grid, adding more green power, and the data center rush. Those recent buys only sharpen the edge, setting the stage for reliable sales and profit climbs.

Analyst Opinion of PWR Stock

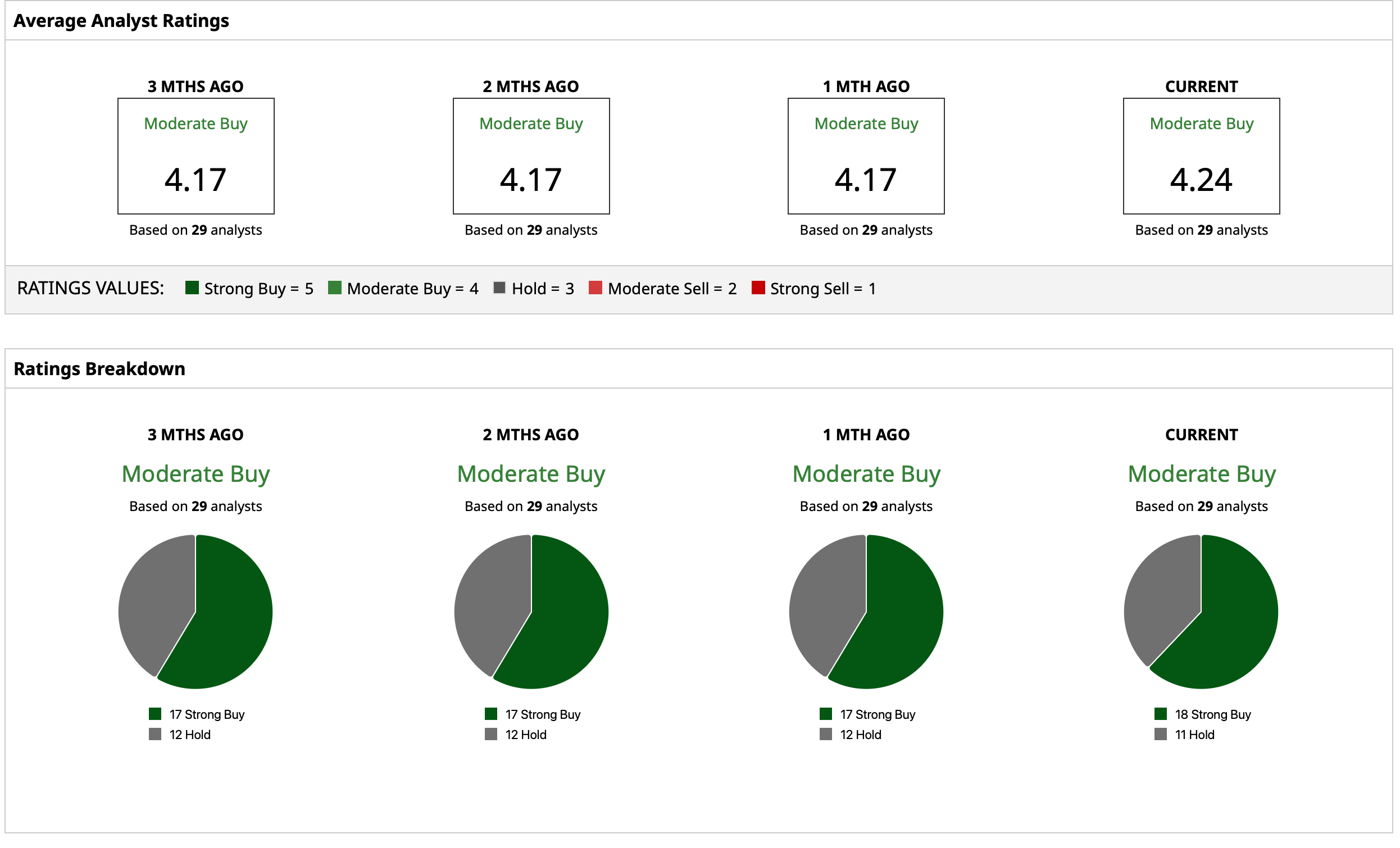

Considering this, analysts have deemed the PWR stock a “Moderate Buy,” with a mean target price of $478.64. This indicates an upside potential of about 13.4% from current levels. Out of 29 analysts covering the stock, 18 have a “Strong Buy” rating, and 11 have a “Hold” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20SoFi%20logo%20on%20an%20office%20building%20by%20Tada%20Images%20via%20Shutterstock.jpg)

/Stickers%20with%20AMD%20Radeon%20and%20Nvidia%20GeForce%20RTX%20graphics%20on%20new%20laptop%20computer%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20phone%20and%20site-by%20Majahid%20Mottakin%20via%20Shutterstock.jpg)