/Lam%20Research%20Corp_%20HQ%20sign-by%20Michael%20Vi%20via%20Shutterstock.jpg)

With the new year fresh upon Wall Street, Lam Research (LRCX) stock is now skating on thin ice.

And this past Friday, one whale-sized institutional trader appears to have smartly hedged itself against the possibility of the visible cracks surrounding LRCX stock turning more destructive in 2026.

A Banner Year for Lam Research and LRCX Investors.

Lam Research was one of 2025’s strongest semiconductor performers. And it wasn’t without cause.

LRCX shares were buoyed by a trifecta of accelerating AI-driven wafer-fab equipment demand, record foundry revenue contributions, and margin expansion that pushed profitability to multi-year highs.

Investors, small and large, took notice by sending LRCX stock to record highs. Moreover, that rally has amounted to outsized gains of around 145% since last January.

2026 Brings a More Cautious Backdrop

As impressive as 2025 was, the momentum setup for 2026 looks more challenging for Lam Research investors.

LRCX now trades at a forward price-earnings (P/E) ratio of 35.93x, well above its 3- and 5-year averages. Its price-to-sales ratio of 11.56x also sits at a premium to historical norms.

Further, a price/earnings-to-growth (PEG) ratio of 2.04x signals investors are paying a steep multiple relative to Lam stock’s projected earnings growth.

In total, the stretched valuations suggest overly bullish expectations that may be running too far ahead of the share’s fundamentals. And following 2025’s aggressive capacity additions, spending from Lam’s memory and foundry customers could easily slow down.

Additionally, worries earlier this year proved in vain, but export control uncertainty continues to hang over the company’s China-linked revenue. As such, the potential for a bearish impact on future earnings shouldn’t be dismissed.

All told, the risk-reward profile for Lam Research stock investors today looks much less favorable than a purchase of LRCX shares earlier in the cycle.

That’s only half the story, though.

Lam Stock Ripe for Slaughter

Wall Street’s raging and fragile bull trade is more than a bit evident at current LRCX stock levels.

Most often, there’s a good reason to embrace the adage, “the trend is your friend.” But when across-the-board technical readings produce the kind of adamant and fist-pounding 100% uniform “Buy” ratings on shares as they are right now, I’d be skeptical.

And in lieu of all the warnings presented, I’d be much more inclined to be a contrarian and take defensive action.

The monthly chart spells out a similar message to trim exposure in LRCX stock.

Shares are poised to finish the calendar year for a fourth straight month outside the upper Bollinger Band. That’s right, monthly!

A visual inspection easily reveals Wall Street is as “all in” on Lam Research as it’s ever been. Further, the price bands are stretched and vulnerable to a bearish tightening pattern at this stage in LRCX’s bullish stock rally.

Lastly, the extremely overbought and fairly linear climbing conditions also have the stock’s RSI in extreme territory.

The current overbought reading hasn’t yet triggered a sell signal. A bullish investor might breathe a sigh of relief. Nevertheless, the lack of bearish confirmation hasn’t stopped one institutional whale from hedging and shoring up its downside exposure.

A Large Put Roll Underscores Institutional Hedging

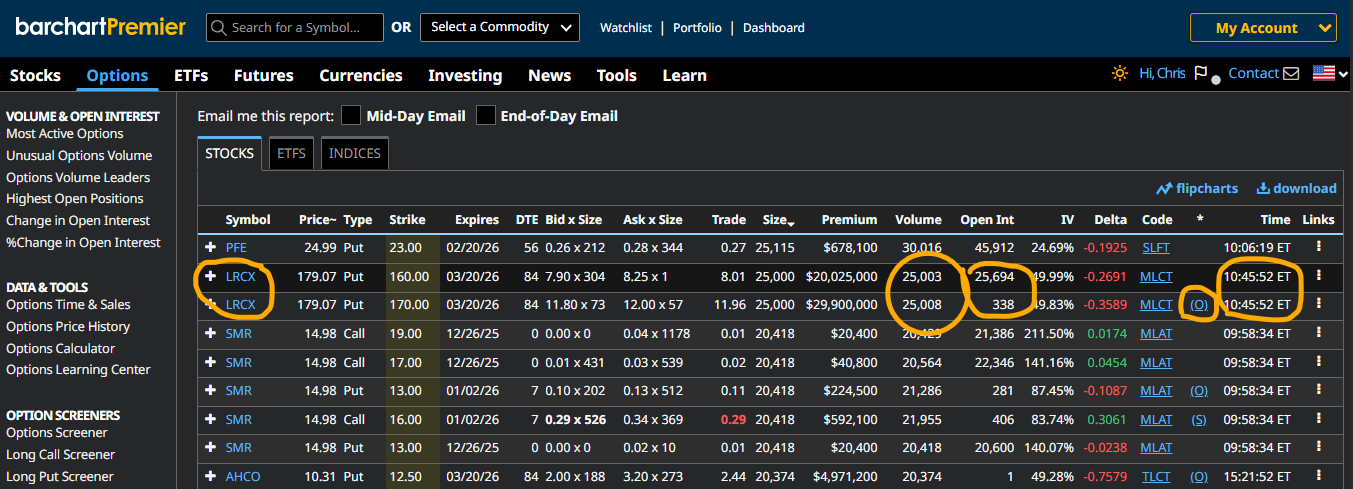

Options flow added another layer of caution on Friday, Dec. 26. A 25,000-contract March 2026 put roll traded, featuring a buy-to-open of the $170 put and a simultaneous sale of the $160 put, which absorbed nearly all of the existing open interest at the latter strike.

The defensive spread roll was executed for a $3.95 net debit.

We don’t know for certain the size and cost basis of any LCRX shares already on the books – or, for that matter, if even a single share is owned.

This trader could be rolling up a bearish, but losing, long put position that’s now closer to the money.

But one-to-one stock protection for an existing 2,500,000 share position is the most likely candidate. And that would confirm an investor that’s now re-hedged, i.e. rolled up their bullish married put spread.

If we assume that logic to be correct, the roll reduces the whale’s downside exposure to the put strike of $170 come hell or high water all the way into March expiration.

Given 2025’s generously optimistic pricing in LRCX stock, it’s not a bad idea at all. In fact, it looks downright prudent.

The tighter protection offered by this roll amounts to a fairly small 2.2% of the trader’s underlying market value in Lam shares through March expiration.

The math behind the 2.2% is as follows:

($3.95 spread debit x 100 options multiplier x 2,5000 contracts = $9,875,000) / (2.5 million LRCX shares x $178 market price Friday = $445,000,000)

And as the married put roll still allows for additional profits if a rally continues, that hefty-looking, near $10 million spent on Friday is much less costly and more reasonable than one might otherwise think.

On the date of publication, Chris Tyler did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)